Jittery nerves are the name of the game in retail right now, and that may be the reason for the heavy rotation of holiday marketing that seems to start earlier each season. This year's numbers from the Black Friday-Cyber Monday weeks are mostly in — yes, these events are measured weeks now, not just days or even weekends — and it was all told, pretty much a blockbuster.

Many more Americans than anticipated — more than 174 million — shopped in stores or online from Thanksgiving Day through Cyber Monday, according to number-crunching from the National Retail Federation and Prosper Insights and Analytics, which earlier had forecast 164 million shoppers for the period. The registers just kept ringing, virtually and otherwise. Online retailers on Cyber Monday alone brought in nearly $6.6 billion, 16.8% more than last year and on track to be the largest online shopping day in history, according to Adobe.

But the reality is, the red-letter days centered about Thanksgiving are in the rear view, and now there’s something of a respite. That won’t last long — the actual holidays are around the corner so the deadlines are nigh — but it’s a chance to consider what’s in store for the remaining days. Luckily for retailers, underpinning the quirks of this season is a hefty level of consumer confidence, which promises to buoy sales even from shoppers not reaping the benefits of a record-level stock market, according to Sam Cinquegrani, CEO of digital strategy and services firm ObjectWave.

"The ease with which we can shop, compare, and buy, coupled with good economic news, is a very heady combination and that spells a strong season overall."

Sam Cinquegrani

CEO of ObjectWave

"People are feeling optimistic, regardless of what they hear in the media. We’re seeing good economic numbers and GDP growth, and people are starting to feel the wealth effect because the stock market has been so strong for so long," he said. "When consumers start feeling good about things, they spend money, even if it’s money they don’t have. So we’re going to see a continuation of this pretty solid start to the holiday season. Unless there’s some bad news, I don’t see it changing."

That's a boon to all retailers, but e-commerce in particular is a beneficiary, he said. "There are so many new benefits to shopping in this channel even over a year ago, and that further entices people," he told Retail Dive in an email. "They shop simply because they can. There are conveniences available to them are so varied, and are offered by so many different retailers. In-store pickup is no longer a novelty, free shipping is now almost a given from any retailer, flash sales and more, and so consumers are responding. The ease with which we can shop, compare, and buy, coupled with good economic news, is a very heady combination and that spells a strong season overall."

Is it all downhill from here?

Consumers do naturally hit the brakes in the aftermath of the big holiday sales events — it’s just inherent in the cadence of holiday shopping, most of our experts said. Retailers worked hard to get customers to buy things at Thanksgiving-time, culminating in the Black Friday/Cyber Monday weekend, and there’s little reason to shop much right after that, at least for a little while. For many people, this has a lot to do with their pay day, points out Marshal Cohen, chief industry analyst of The NPD Group.

"The weekend after the big weekend of Thanksgiving we tend to go into a pretty big lull, although there will be some retailers who are going to try to push sales through the door. One of the things that retailers haven’t realized is how [to] spread this out," Cohen told Retail Dive in an interview. "You’ve got to realize that consumers only have a certain amount of money. There’s only a certain amount of room in their paychecks and there’s only a certain amount on their credit cards."

Plus, it’s hard to settle for higher prices after the doorbusters of the preceding days, said Judge Graham, chief marketing officer of digital CRM agency Ansira. "Consumers are coming off of a shopping high and without these same discounts, they may be hesitant to buy in the weeks following Black Friday," he said in an email to Retail Dive. "Consumers likely will not be satisfied with the 20% discount when they have just been offered a 60% discount a few days prior."

This time between sales surges doesn't offer much of a breather, though. RSM Chief Economist Joe Brusuelas pegs it at about 10 days, saying that sales tend to pick up noticeably as the year end gets closer, and will again this year.

Neither the downtime, such as it is, nor the rosy forecast mean that retailers are off the job, of course. Matt Sargent, senior vice president of retail at Frank N. Magid Associates, agrees that post-Thanksgiving sales will slow as usual, but says that retailers must work to maintain their relationship with their customers in the meantime.

"The strong Thanksgiving weekend was powered by aggressive promotions, which began earlier in the month. Shoppers have been active all month, and they seem to be in a buying mood. All the signs are pointing to a happy holiday for retailers."

Michael Brown

Partner, A.T. Kearney

"The old rules were, you really wanted to drag customers in physically on Black Friday and get them to think about the rest of the holiday," he told Retail Dive in an interview. "That doesn’t really apply any more because people are online. I think that’s going to mean that we’re going to continue seeing strong sales. We’re seeing overall strong consumer growth — we have optimism, and that’s going to feed into the rest of the season."

Indeed, retailers should be prepared for a pick-up this weekend, said Michael Brown, partner in the retail practice of global strategy and management consulting firm A.T. Kearney.

"In the short-term, sales will drop off for the balance of this week as they traditionally do, but they will begin to slowly increase beginning this weekend through the holidays," he told Retail Dive in an email. "The strong Thanksgiving weekend was powered by aggressive promotions, which began earlier in the month. Shoppers have been active all month, and they seem to be in a buying mood. All the signs are pointing to a happy holiday for retailers."

How hot do the deals have to be?

Pretty hot, especially for retailers whose customers are especially budget-minded, our experts said. "Retailers are under tremendous pressure to feed today’s discount-driven consumer," said Ansira's Graham, noting that research shows that more than 60% of holiday shoppers are motivated by discounts and that retailers have already discounted their goods 10% more this year than last. "These major discounts early in the holiday season lead consumers to believe that deeper discounts will be coming," he said. "It seems like retailers have no choice — give consumers what they want or see sales fall."

"These major discounts early in the holiday season lead consumers to believe that deeper discounts will be coming," he said. "It seems like retailers have no choice — give consumers what they want or see sales fall."

Judge Graham

CMO of Ansira

Retailers catering to wealthier customers are off that hook, though. The high levels of consumer confidence that drove healthy sales over the red-letter sales weekend is especially easy to find among higher-income customers, says RSM’s Brusuelas.

"My sense is that the higher-end luxury products across the spectrum from Tiffany to Sonos are poised to do quite well, because wealthy consumers are likely receiving larger year-end bonuses and benefiting from a wealth effect linked to a turbocharged equity market," he said. (The stock market is surging mightily at the moment, though, and Jim Fosina, CEO of Fosina Marketing Group warned that a significant correction in the midst of the holidays could crimp everyone's style by making all consumers nervous.)

But differentiating product and curating holiday merchandise can help even retailers with less flush customers take at least some of the focus off prices, experts say. And the time just after Thanksgiving can be critical. "This period is the definition of real time marketing," Fosina told Retail Dive in an email. "The retailers who do the best job in out-thinking and out marketing the competition will be the winners. This is the period that everyone including Amazon is doing battle. If you are going to beat Amazon to the punch, now would be the time to take your best shot."

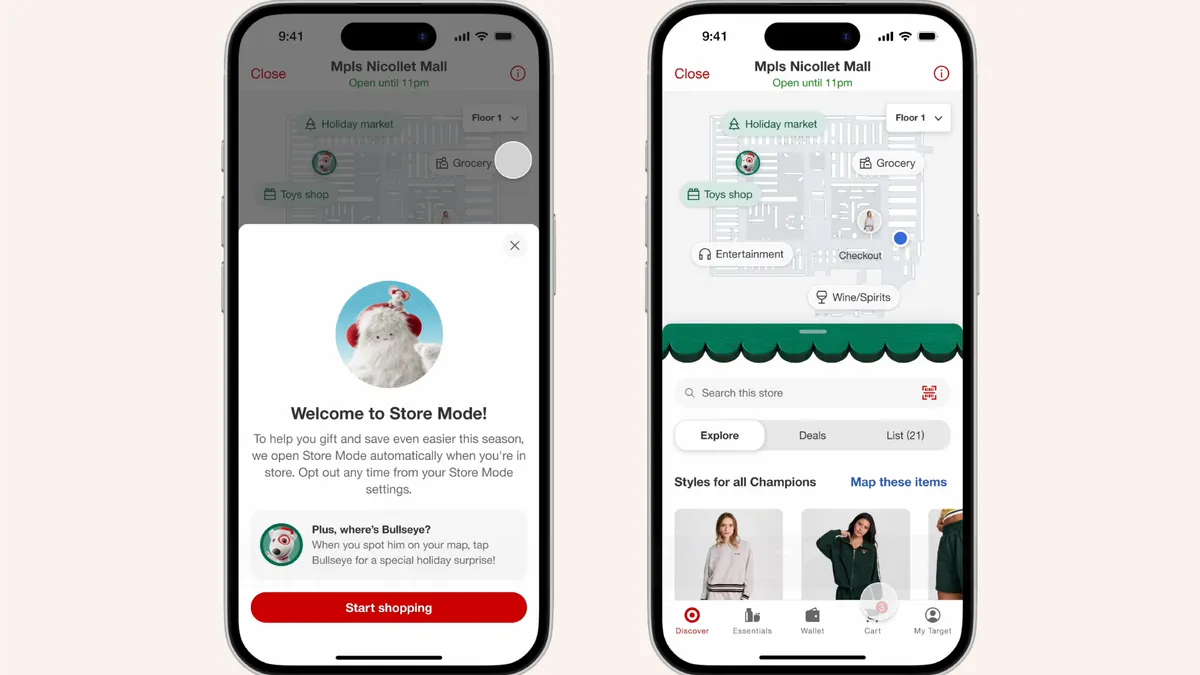

Retailers in general are stretching out the holidays and the deals, but some, like Target and Nordstrom, are using their websites and apps to help stoke emotional reasons to turn to their stores or sites for holiday shopping, while Macy’s, J.C. Penney and Kohl’s have kept the spotlight on discounts, according to Magid’s Sargent. This helps in the wake of the Black Friday madness.

"In Penney’s and Macy’s defense — their customers are more promotionaly driven and less research driven," he said, saying that the curation, gift guide, inspirational approach from Target, Nordstrom, Gap and others demonstrates new-found comfort in reaching customers online. "You’re seeing that these retailers are approaching online with a lack of fear. Before you saw a fear that online would cannibalize their sales, but there’s a decided shift."

Magic Monday?

There’s a quirk in the calendar this year that could fuel a weekend shopping frenzy that might rival the Thanksgiving-Black Friday-Cyber Monday juggernaut — Christmas Day falls on a Monday. Then again, many people will be traveling that weekend, so sales in the final days could be depressed. "It’s an interesting point," said NPD’s Cohen. "Usually the weekend before Christmas, that Saturday, is always the biggest day. Last year 'Super Saturday' was a very big day," he said. "But Saturday and Sunday this year are are getaway days, so they’re not necessarily shopping days."

Like last year, when Christmas fell on a Sunday, this year’s Monday Christmas does provide retailers with two potential "Super Saturdays," however, according to ObjectWave's Cinquegrani. That’s "two days to make the last-minute dash," he said. "That further bodes well for retailers."

In fact, expect retailers to be working really hard in the final run-up, said A.T. Kearney’s Brown, who called the weekend a potential second blockbuster. "Look for stores to be open from Friday morning straight through to Sunday night," he said. "Look for a sleepless weekend for retailers promoting heavily to get the consumer’s last dollars, and consumers looking for aggressive pricing as retailers look to maximize the holiday season," he said.

But the timing could really work against online retailers (except, as Fosina points out, those selling subscriptions or downloadable items like gift cards). "From an e-commerce standpoint, Christmas falling on a Monday poses some additional logistical challenges, particularly around shipping," Rachael Genson, public relations manager at e-commerce platform BigCommerce, told Retail Dive in an email. "For many shipping providers, Saturday and Sunday are not considered business days, so retailers are losing two vital days to get packages to their consumers."

And retailers aren’t likely to make up for it with the enticement of last-minute fast-and-free shipping deals because that experiment of holidays past proved to be very expensive, said NPD’s Cohen. "Don’t expect that again," he said. "That means that online will fizzle out much earlier than in store. Ten to 12 days before Christmas is the magic shipping date when you can have free shipping."

Tight control of inventory and logistics are mandatory in these final weeks, experts told us. "It is even more important that retailers know exactly how long it takes to process and ship orders, and clearly display the final 'purchase by' date on their website to help ensure that all packages arrive to their destinations on time," Genson said.

Really, though, that applies to retailers across all channels, Cohen said, noting that the abundant holiday sales results so far could themselves present inventory problems. "'Be careful what you wish for,'" he said. "The real key is, retailers have to learn how to continually replenish their inventory levels. If you have a great Black Friday weekend, you better be able to re-stock those shelves or you’re going to lose momentum."

This story is part of our ongoing coverage of the 2017 holiday shopping season. You can browse our holiday page and sign up for our holiday newsletter for more stories.