Dive Brief:

-

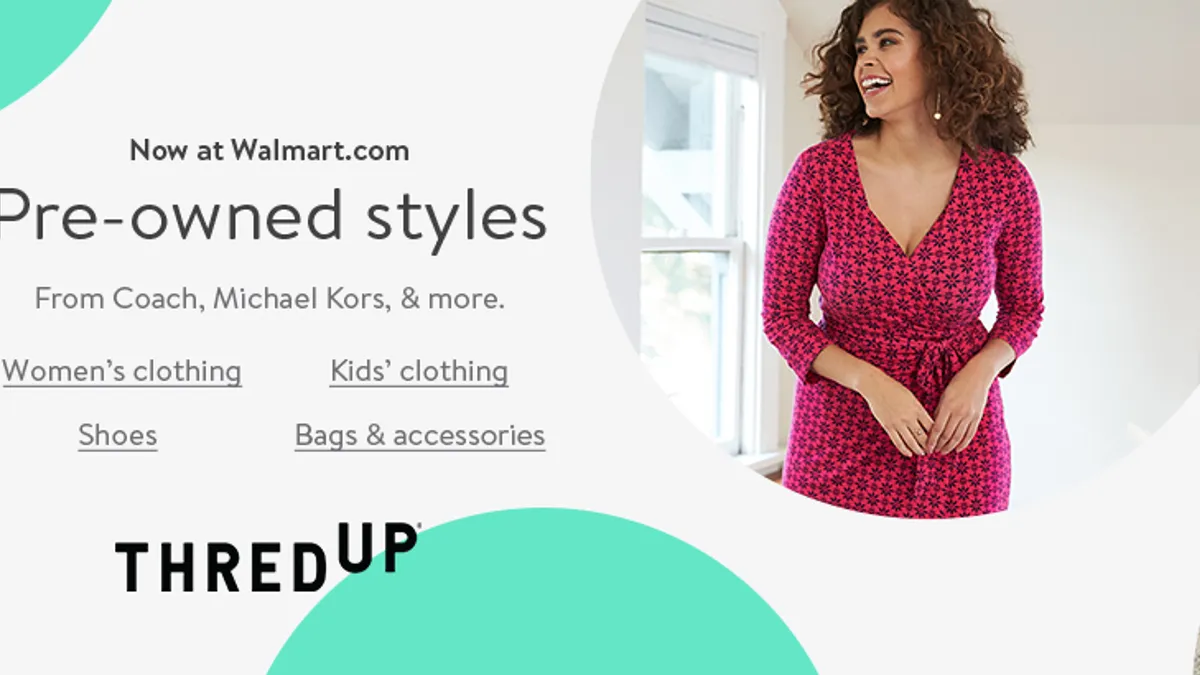

Beginning Wednesday, Walmart is offering some 750,000 pre-owned women's and children's clothing, accessories, footwear and handbags through a new partnership with resale site ThredUp.

-

Apparel and footwear deemed "new" or "like new," and accessories and handbags deemed "gently used" have been selected by ThredUp for sale through Walmart's site, according to a blog post by Walmart U.S. e-commerce fashion chief Denise Incandela.

-

ThredUp purchases through Walmart.com count toward the retail giant's free shipping on orders of $35 or more. Free returns can be made at Walmart stores as well as through ThredUp, according to the post.

Dive Insight:

ThredUp runs six of its own locations but is sold through many more stores run by legacy retailers, including Macy's, J.C. Penney, Madewell and Gap Inc.

Such partnerships are a win for both, as bringing in used apparel drives foot traffic to stores, and the established retailers provide ThredUp with new customers, Thredup CEO James Reinhart last year told Retail Dive, which gave the resale retailer its Disruptor of the Year award.

While Walmart isn't selling ThredUp's goods through stores, at least for now, the retailer is taking returns there. And its e-commerce site, which saw revenue rise 74% in the first quarter, is nothing to sneeze at. Walmart is also bringing on new customers thanks to its pick up and delivery operations during the pandemic.

In her blog post, Incandela cited ThredUp's upcoming 2020 Annual Resale Report, which found that "70% of consumers have bought or are now willing to buy secondhand."

"This partnership is our latest move to establish Walmart.com as a destination for fashion and offer customers the pre-owned items they might be looking for," she also said. "We think they'll be surprised and delighted by what they find, and we're excited to inspire customers to look and feel their best."

Despite some concerns that consumers may think twice about secondhand goods as the COVID-19 disease has spread, several analysts, including Dylan Carden at William Blair, still see it as a growth area for retail and apparel sales. In March comments emailed to Retail Dive, William Blair analysts cite ThredUp, Urban Outfitters and Trove as players in the rental and resale space with "greater utilization of inventory" as discretionary spending continues to be undermined by the consequences of the pandemic.

"We believe the importance of the value segment has only increased, though a new breed of companies involved in rental and resale are more likely to take share from legacy value players," they wrote. "In sum, we see an increasingly online world, eventually void of many of the staid brands that defined the retail landscape, with more creative paths to ownership to meet ever-stretched consumer attention."