Dive Brief:

-

Dick’s Sporting Goods Tuesday reported a Q4 net sales rise of 10.9%, with profits dinged by heavy promotions over the holidays. Same-store sales rose 3.4% overall, but its Golf Galaxy stores saw same-store sales drop 7.1%, as the namesake stores saw a 3.8% increase.

-

The retailer said that inventory stuck at West Coast ports and in severe weather in some areas hurt its results. But overall the retailer handily beat expectations.

-

UPDATE: The retailer also announced a line of activewear from American Idol singer Carrie Underwood called Calia. The brand, exclusive to Dick's, officially launches Thursday, but sales of the tights, sweaters, and other items have already been brisk, with the merchandise already on shelves in recent days. The retailer is reconfiguring store space in areas where it sells merchandise from Adidas and Reebok, but, contrary to earlier press reports, that will not mean any reduction in inventory from those brands, CEO Ed Stack clarified in a conference call Wednesday morning.

Dive Insight:

Despite the struggles of its Golf Galaxy brand and a move to decrease golf inventories, Dick’s in its report reiterated its commitment to the sport. But with its venture into the “alth-leisure" space, it’s clearly also pivoting a bit toward female customers. The move continues the boom in signature alth-leisure and a greater focus on women's gear.

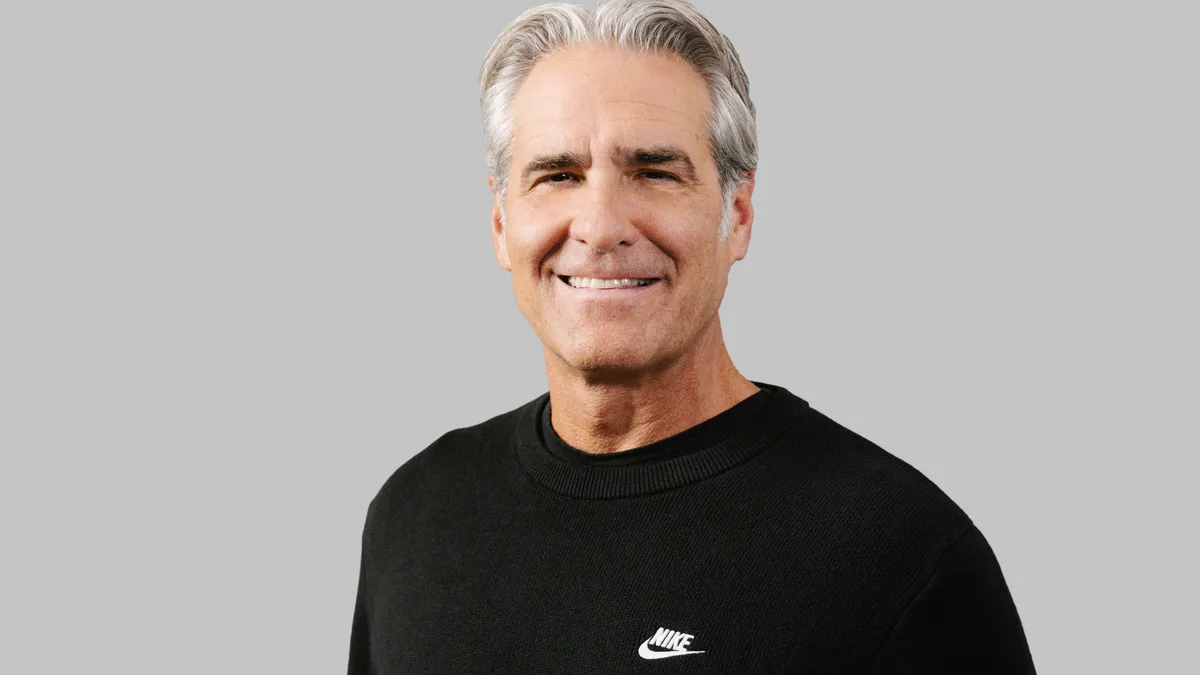

UPDATE: But chairman and CEO Ed Stack made clear on a call with reporters Wednesday morning that Adidas remains a key partner for the retailer.

"'Kicking Adidas off the shelf' couldn’t be further from the truth," Stack said, adding that he "never said or implied that we’re kicking them out. Adidas is a very large and important partner of ours, their business is continuing to grow and will continue to grow faster in the next two to three years."

On that call, Stack also said that omnichannel efforts, including ship-from-store, buy online pick up in store, and buy in store and ship home, are all paying off for the retailer. Dick's physical stores have been key to its growth both in store and online, and e-commerce grows 50% when it opens a new store. For that reason, the retailer will be opening new stores in areas where there isn't much of a Dick's presence, including in the San Francisco Bay Area, Florida, Texas, and New York's five boroughs.