Last week, off-price retailer Burlington told analysts that it's pulling the plug on e-commerce sales, saying that it's too expensive for its "moderate" business and less fun for its customers.

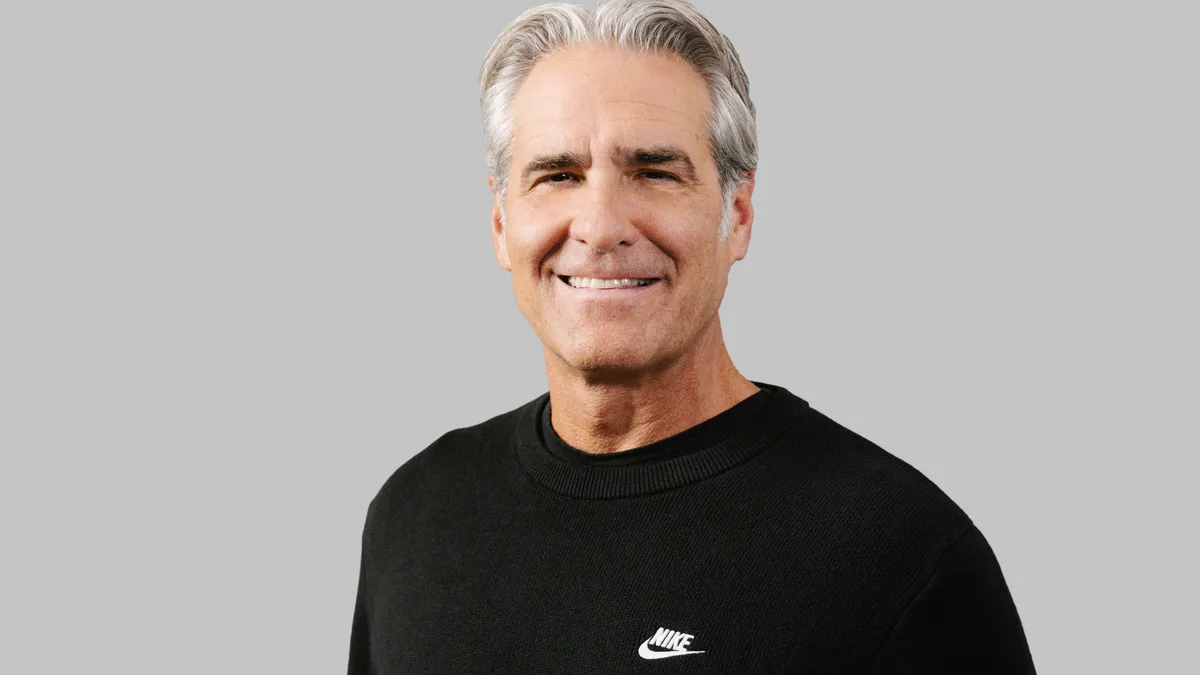

Burlington CEO Michael O'Sullivan said that for a company whose average unit retail is "about $12," the sales channel makes little sense.

"E-commerce when you fully account for the cost of merchandising, processing, shipping, accepting returns. It's very difficult, impossible to make at those price points in the businesses that we compete in," he told analysts, according to a Seeking Alpha transcript.

It may seem like an odd position at a time when apparel retailers at all price points are under pressure to boost their online sales. But O'Sullivan's words were remarkably similar to those of Michael Hartshorn, chief operating officer at off-price rival Ross, speaking to analysts in November. "We think that the moderate off price business, which is what we're in, would not work in an online environment with a $10 to $11 [Average Unit Retail]," he said, per a Motley Fool transcript, noting that "the economics with free shipping and returns are just not financially sustainable and we don't see any way that business would be accretive to our profit."

O'Sullivan is confident about leaving online behind in part because Burlington's own numbers demonstrate that it's just fine without it. Even as e-commerce more widely has grown, the off-price segment, where all players focus on physical retail (TJX's Marshalls added e-commerce only last year, with its TJ Maxx banner online since 2013), has continued to gain share, taking mostly from department stores. Burlington's topline growth has averaged some 8% annually, driven by stores, he said, adding he expects that to continue. "[T]his isn't just a conceptual argument," he told analysts.

Apparel discounter Primark, relatively new to the U.S., has also eschewed e-commerce from the get-go. All three of these retailers plan to add brick-and-mortar stores to their fleets this year, instead. In fact, Ross, which has never sold online, this week reiterated its plans to add 100 stores just this fiscal year, after adding about 100 for each of the past two years.

That's a trend for discounters in categories beyond apparel, too, according to a recent report from Coresight Research. "[T]he economics of e-commerce remain a challenge, and we expect discount formats to continue focusing on bringing shoppers into physical stores, as brick-and-mortar remains the only channel for no-frills retailing that has been proven profitable," per the Feb. 23 report, which was emailed to Retail Dive.

However, while these retailers say they can't make the money work online, some experts say that, when it comes to apparel, it's not just the economics.

Inventory uncertainties

Apparel e-commerce may also be confounding retailers when it comes to inventory, in part because of the way shoppers treat their own homes as a dressing room of sorts, ordering several items but often keeping only some, if any.

The practice is especially prevalent among coveted younger shoppers, according to a report from supply chain reverse logistics provider goTRG, which found that nearly half (47%) of consumers 18 to 29 years old say they buy multiple items with the intention of returning most, and that almost a third of those say they're doing so more often than they did a year ago.

In that scenario, it's more difficult to draw a bead on supply and demand, according to MKM Partners Managing Director Roxanne Meyer. "E-commerce is a much tougher model to execute on, in terms of getting your inventory right," she told Retail Dive in an interview. "In a brick-and-mortar store, your return rates are likely within a narrower range."

In fact, the return rate for physical apparel retailer is probably around 2%, compared to more like 20% for e-commerce, according to Kate Klemmer Terry, chief revenue officer at Quiet Logistics, who previously worked in e-commerce operations at Tommy Hilfiger, Kate Spade and Ralph Lauren.

Online shoppers return more due to uncertainties about size or differences between what they find in pictures of items versus real life, she said in a phone interview. They depend on images, reviews and, in some cases, videos of products online. In a store, by contrast, a salesperson can be extremely helpful to a customer in finding what they like in their size.

"Online, I'm going to get 10 things knowing I will maybe buy four or five," she said. "That behavior has existed from the beginning of time with e-commerce."

Customer acquisition

Then there's the difficulty of marketing online. Turns out that stores are a strong marketing tool, which has led some retailers to revamp their brick-and-mortar operations and even some digital natives to open them. Retailers as diverse as Target, Nordstrom and Nike have improved their physical stores, cleaning them up with better interiors and displays, elevating customer service and creating over-the-top experiences.

"Stores are the new channel for retail."

Doug Stephens

Author, "Reengineering Retail: The Future of Selling in a Post-Digital World"

Store experience is extremely valuable for touch-and-feel opportunities like trying on apparel, and it also provides marketing that so far online search or sites have not been able to match, several retail analysts and executives also said during the National Retail Federation's Big Show earlier this year.

That has brought some advantage back to brick and mortar, which already accounts for most retail. At the same time, online marketing has grown noisier, amid a barrage of social media posts and emails, according to Doug Stephens, retail consultant and author of "Reengineering Retail: The Future of Selling in a Post-Digital World."

"Digital advertising has become marginalized," Stephens said at an event during the NRF annual conference. "We are swimming in a sea of media and communication from brands. Stores are the new channel for retail. Stores are an incredibly powerful means of bringing people together."

Where's the fun?

Consumers still tend to shop online for things they already know they want or need. Hunting for clothes, meanwhile, is often about finding something to wear to express oneself.

That means that apparel shoppers, in addition to being concerned about how something fits or how good the quality is, are in search of something ineffable. That makes shopping for clothes online a little less fun.

"There are also very significant constraints on recreating the off-price treasure hunt in an online environment, so that's a reason number one," is how O'Sullivan put it last week.

There are ways to cut down on the returns that make apparel e-commerce so unwieldy, according to Quiet Logistic's Terry. That includes providing the best possible information about size and fit, with accurate charts, size suggestions based on preferences and past purchases, honest reviews and videos that show how the garments fit and drape. She pointed to Zappos as an e-retailer that does this well.

But Zappos, like Nordstrom and others, also makes returns free and easy. And that is a requirement of selling apparel and footwear online, she said. "When you make the return process easy and forgiving, you get more conversion and more sales — you're still netting out with more sales in the long run," she said. "Plus, I'm encouraging you to return because in essence I think you will keep more if you try more."

Online returns are made more difficult by their original packaging requirements like stuffing and collar tabs dismantled by the customer, Terry noted. The difficulties of mitigating that and of demand planning in general are sending more goods from apparel e-commerce into off-price stores, according to Meyer.

A smooth, swift reverse supply chain helps with that, and enables a retailer's ability to sell a returned item at full price, according to Terry. That's a logistical answer to bolstering the efficiency of the online cart that only goes so far, however. And it doesn't address the increasing concerns about the sustainability of the practice, according to Thomai Serdari, a professor of luxury marketing and branding at New York University's Stern School of Business.

"With a few years of experience in buying online and several painful experiences of having to return the product, consumers realize that e-commerce is not a guarantee of seamless shopping," she told Retail Dive in an email. "It isn't just the pain of the returns that is finally sinking in. A lot of consumers are concerned about the burden of packaging on the environment and the carbon emissions of delivery trucks — not to mention their contribution to the daily traffic. I think that e-commerce and physical sales are reaching a balance at least in urban environments. There has been significant investment in upgrading the store environment and maybe this is the type of novelty that was needed for the consumer to stop clicking on the e-commerce site."

E-commerce is hardly going to disappear, not even for apparel. In fact, more clothes will likely be sold online because that's where the growth is, according to MKM's Meyer. But these retailers will continue to have to grapple with its downsides, she also warned. "E-commerce has not proven to be a better model," she said of apparel sales. "I think time will tell what the ideal hybrid is. I think it's pretty clear you need both."