Dive Brief:

-

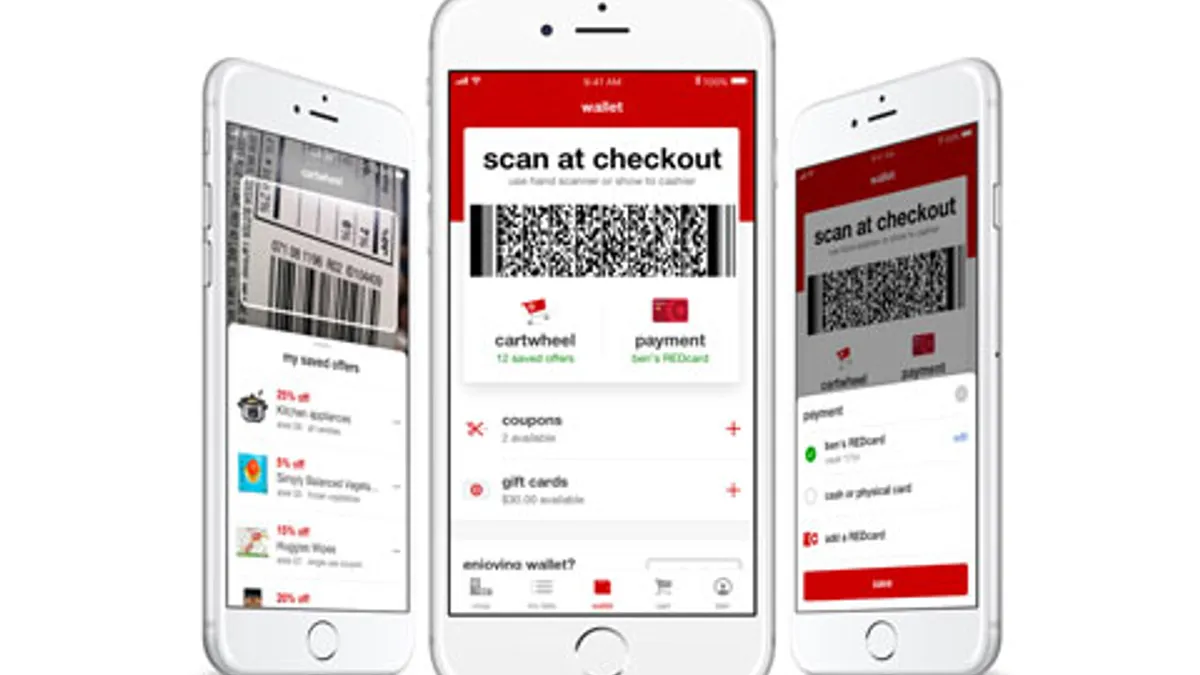

Target on Monday said that its REDcard loyalty members, who enjoy 5% off all purchases and free online shipping (but unlike Costco or Amazon Prime don’t pay a membership fee) will be able to pay via mobile starting in November, according to a press release.

-

As part of its holiday plans, Target is also touting the eight new private label apparel and home goods brands its launched within the last year (including Project 62, A New Day, Goodfellow and Co, JoyLab and Hearth & Hand with Magnolia) and a "gift hub" service allowing gift recipients to choose the color or size of a gift or exchange it for something else before the giver’s item ships, according to a company blog post.

-

After a lukewarm holiday season last year, Target is reducing the amount of promotions it will have and doubling down on differentiated merchandise, according to the Minneapolis Star Tribune.

Dive Insight:

Target is once again turning to its well established merchandise differentiation to offset price competition in the less dazzling consumer product category. That's been a key Target strategy since it lost a bruising price war with Walmart in the 1980s. In addition to partnerships with designers and brands, Target is working hard to bolster its own brands. The new private label lines have been developed using the same research and design approach applied to developing its successful Pillowfort and Cat & Jack kids lines.

Apparel and home decor are where the big-box retailer has been leveraging its efforts most, which makes sense considering earlier this year outgoing CFO John Mulligan said the categories account for about $26 billion in sales. In addition to the private labels, apparel collections touting celebrity partnerships have also helped differentiate the retailer’s merchandise of late. It’s tie-up with British singer Victoria Beckham in April broke online sales records for the retailer’s design partnerships without the attendant frenzy that irritated customers in past collaborations, notably its 2015 Lilly Pulitzer effort. Home decor, and to a lesser degree smart home products, have also become winning categories.

"I think their goal is to build their in-house brands more," Maya Mikhailov, chief marketing officer and co-founder of GPShopper, told Retail Dive earlier this year. "Target was always known for design, earning the moniker 'Tar-zhay.' Their new streak appears to be focused on re-energizing that. It seems to be a natural extension of what their original brand promise was."

Target's hopes are well founded. Sales from such merchandise have been able to bolster margins amid an emerging price war in consumables and grocery. Last month, Target announced a series of price cuts to those goods, an effort to get the word out that it's willing to play on that field. While Target has a reputation for being higher priced than Walmart, that’s not quite true, Keith Anderson, Profitero vice president of strategy and insights, told Retail Dive.

"I don’t know that they really struggle to compete on price the way some people perceive them to," Anderson said. "Target does carry items closer to the 'better' and 'best' category, but on exactly the same item, Target really is competitive. People walk into Walmart and walk out pleased about the prices, and people walk into Target and walk out with things they hadn’t planned on buying, so they perceive Target as more expensive.”

This story is part of our ongoing coverage of the 2017 holiday shopping season. You can browse our holiday page and sign up for our holiday newsletter for more stories.