Dive Brief:

-

Following a round of layoffs in June affecting 8% of its workforce, StockX confirmed by email that it has further downsized its corporate teams “to align with our current organizational priorities.” Those impacted received severance packages, health benefits, outplacement services, mental health support, an extended stock option window, 401K match vesting and the option to keep company laptops.

-

Fewer than 80 employees in corporate roles were let go, the company said. At the end of Oct., its employee count numbered more than 1,500, a spokesperson said.

-

Some teams are expanding in part to support what the company calls peak season. That includes the hire last month of Nike veteran Paul Foley as head of brand reputation, and plans to bring someone to lead customer support in North America and others for quantitative marketing roles, per the email.

Dive Insight:

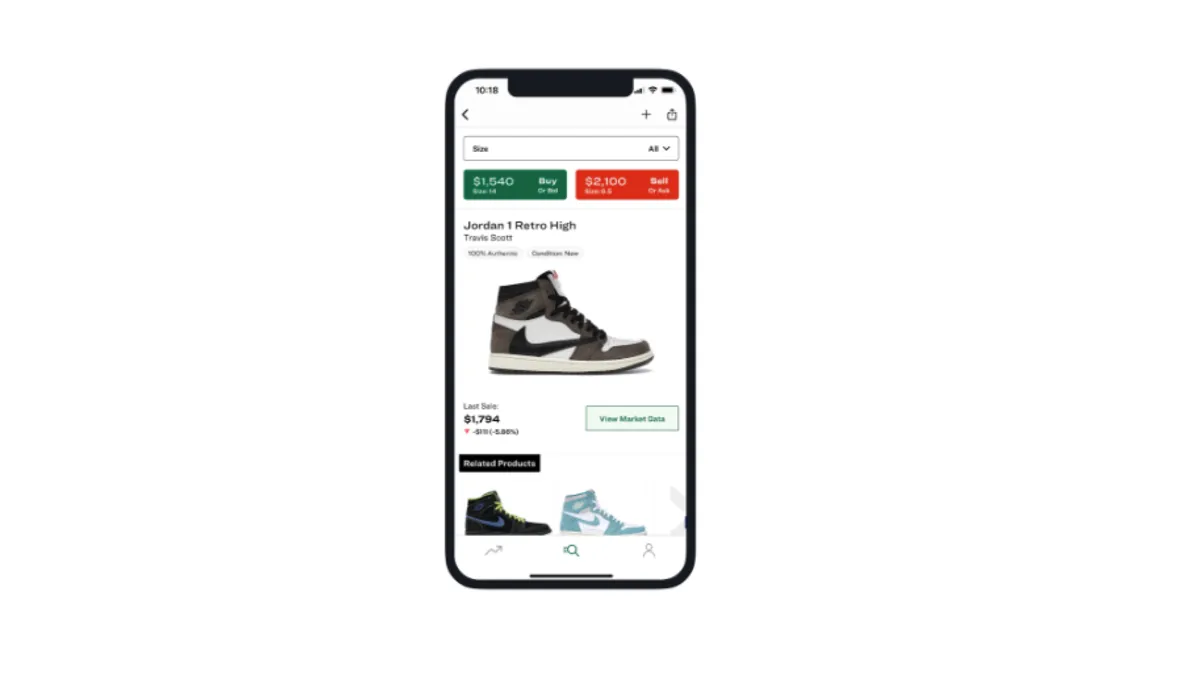

For years now sneaker resale has been a highly lucrative segment of the multi-billion apparel resale market, with some collectible shoes fetching stratospheric prices. In its statement Wednesday, the company cited the tough economy as a factor in its latest downsizing.

“Our business is multifaceted and continues to evolve, as does today’s market. We actively manage our business and regularly evaluate our strategic priorities to set StockX up for long-term success,” the company said. “We made adjustments to some of our corporate teams today to align with our current organizational priorities. While macroeconomic trends require businesses to be nimble, our vision of being the trusted global platform for consuming and trading current culture is as certain as ever. We thank the many team members who have contributed to this effort.”

But the company and the wider sneaker resale market are each contending with their own peculiar challenges as well. StockX and Nike have been sparring in court for months over counterfeit claims and other issues, for example.

More broadly, and possibly more profoundly, sneaker resellers have been roiled by Adidas’s move to cut ties with Ye over his problematic behavior and pull all its Yeezy items, from its own shelves as well as those of its retail partners.

Yeezy shoes have been a major force in sneaker resale and therefore in StockX’s fortunes. Yeezy’s resale value could be enhanced by the fact they Adidas is no longer producing or even selling the label. Then again, it may be tarnished by Ye’s downfall, which was precipitated by antisemitic and racist remarks and other troublesome behavior. So far, conflicting reports about what’s happening in the short term suggest either outcome is possible in the medium to long term.

StockX didn’t immediately respond to questions about its policy regarding Yeezy sneakers.