Dive Brief:

-

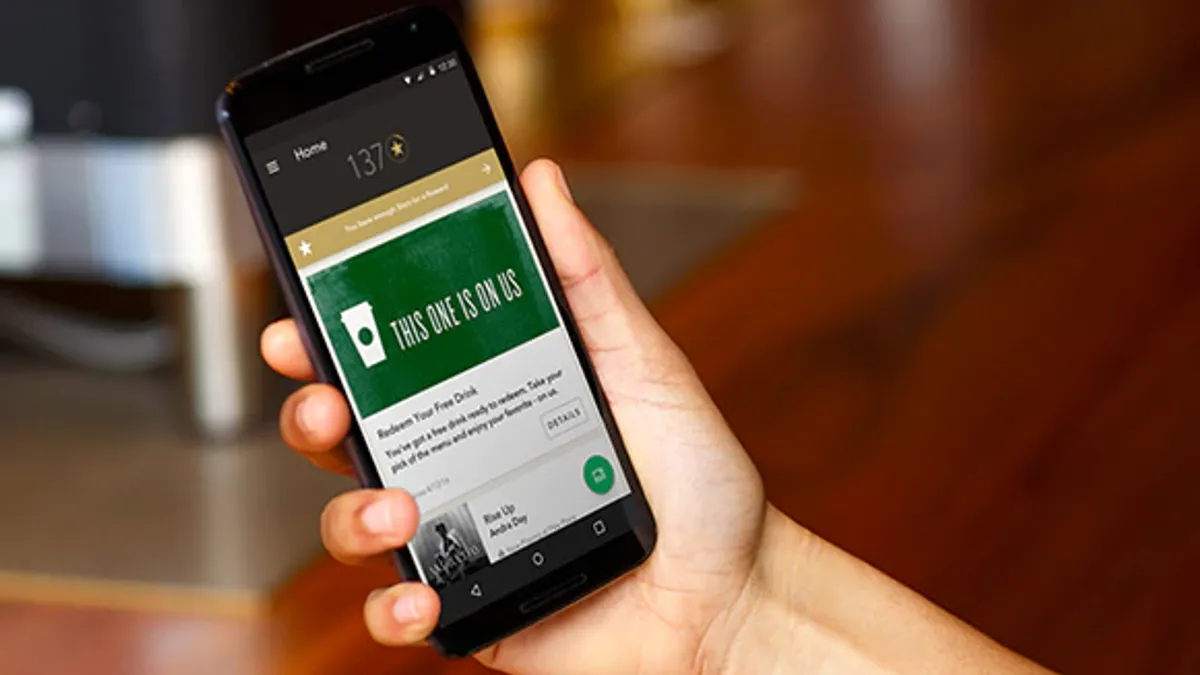

Starbucks is testing out cashless checkout in stores nationwide, according to several news reports. As of Tuesday, for example, one downtown Seattle store accepts only cards or mobile payments, according to a report from KIRO-7.

-

That received mixed reviews from customers, with some saying they like the convenience and speed or don't like carrying cash, but with others worrying about privacy issues with trackable payments, according to the report.

-

Just last month, former Starbucks CEO Howard Schultz, told CNBC that Starbucks would soon be a cashless retailer. "That time is nearer than you think," he said, but also added that people would continue to brew and pour coffee. "I don't see a day where artificial intelligence or robotics is going to replace the humanity of Starbucks," he said.

Dive Insight:

Starbucks' rollout of cash-free checkout has been markedly quieter than the big deal it's made of its new "blonde espresso." But the retailer is joining Amazon, Walmart and others in toying with something that most gas stations pioneered long ago.

Walmart is offering a Scan & Go capability in several stores that allows shoppers to use a mobile app to scan barcodes of items they want to buy, pay for them in-app with and show the in-app receipt to a greeter as they leave the store — entirely avoiding checkout lines and physical payment terminals. The "Amazon Go" store, meanwhile, goes well beyond that, with not just cashless checkout but also a dearth of humans in sight — though that project appears to be stalled at just one store a year after launch.

The cashless store is positioned as a convenience play, but cash-free payments, especially through a retailer's mobile app, could siphon up a lot of customer data. Starbucks is looking for feedback on its new effort, and the privacy concerns expressed to the Seattle news channel aren't likely relegated to just one store.

In fact, as mobile use increases, such issues remain top of mind for consumers. New research from SAP Hybris emailed to Retail Dive this week found that a vast majority — 71% — of 20,000 global consumers surveyed said they're willing to part with information like e-mail addresses and shopping history, but are less likely to provide their mobile number, real-time location or monthly income. Plus, when they do share data, consumers expect retailers to protect their interests (72%), be transparent in how they use personal data (6%) and protect their privacy in the event of criminal investigations (60%). A whopping 79% said they would leave a brand if their personal data was used without their knowledge.