Dive Brief:

-

Surprising some analysts, Rent the Runway doubled its revenue in Q1, from $33.5 million last year to $67.1 million, according to a company press release.

-

Its active subscriber base rose 82% to 134,998 by quarter’s end, a 17% increase from the previous quarter and its highest end-of-quarter count.

-

Gross profit rose 178% to $22.5 million, as gross margin expanded to 33.5% from 24.2% a year ago. The company’s net loss widened from $42.3 million last year to $42.5 million.

Dive Insight:

Before the pandemic, Rent the Runway had begun to expand its market by offering more office-appropriate options, but its momentum right now is being driven by special occasion dressing.

“Rent the Runway is benefiting from the fact that women are using fashion for self-expression as they emerge from COVID,” co-founder and CEO Jenn Hyman told analysts, according to a Seeking Alpha transcript. “In other words, fashion is bolder than ever. The shorter hemlines, cutout, new trends and colorful clothing women are wearing right now translates into highly cost-efficient customer acquisition for us.”

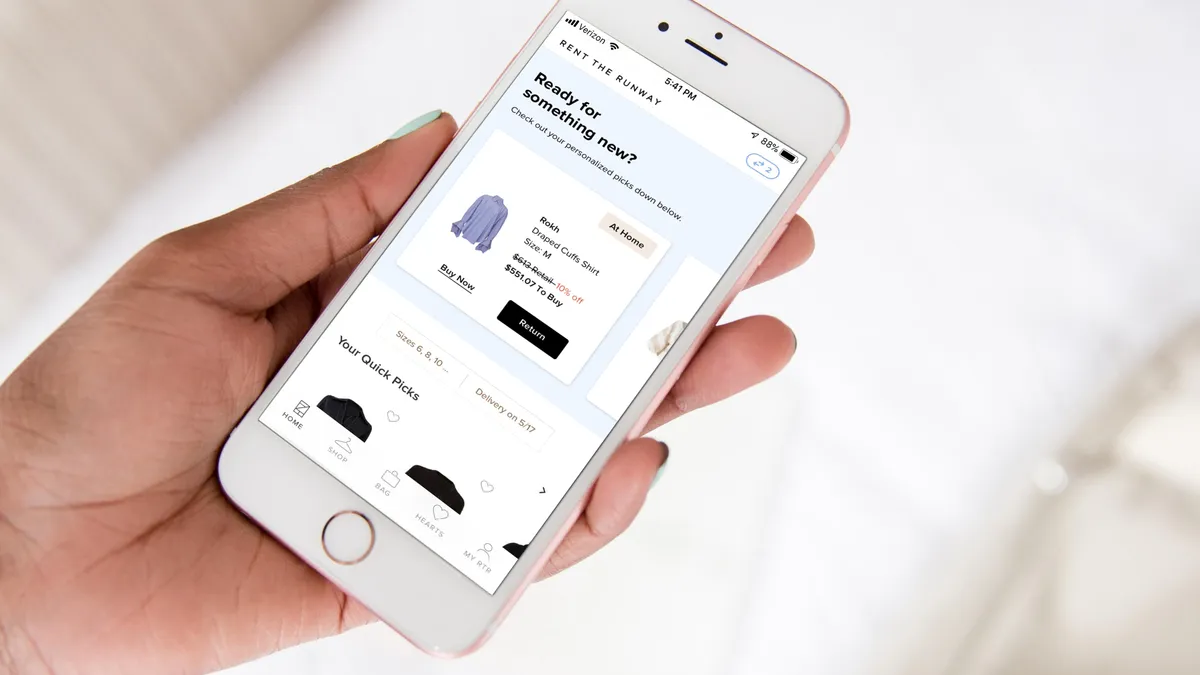

The recently unveiled at-home pickup offer, available in 20 cities to more than a third of the subscriber base, is proving to be not only more convenient to customers but also less expensive for the company, Hyman also said. “We are well on our way to bringing this offering to more than half of our subscriber base by year-end,” she said.

During the quarter, Rent the Runway launched six new exclusive collections, with plans for almost 20 such partnerships this year — on track to becoming 60% of the company’s product acquisition mix this year. The company is aiming for those exclusive to become two thirds of its assortment, part of its plan toward free cash flow profitability.

The late-pandemic penchant for rescheduling events like weddings and dressing up for other reasons is helping Rent the Runway escape the worst effects of what is becoming a challenging environment for other e-commerce players, according to Wells Fargo analysts led by Ike Boruchow, who expressed surprise at the company’s strong revenue performance.

The company still has to prove itself, but is tapping into the market forces that are stoking the rapidly growing secondhand apparel market, according to those analysts. Globally, that market is expected to grow by 24% this year, according to the latest study from ThredUp and GlobalData. In the U.S., the secondhand market is poised to more than double by 2026, reaching $82 billion, those researchers found.