Dive Brief:

-

Rent the Runway on Wednesday reported that Q4 subscription and reserve rental revenue fell 4.4% year over year to $65.4 million. Including its advertising and resale business, total revenue was essentially flat at $75.8 million.

-

Its number of active subscribers inched down 1% to 125,954, but total subscribers rose 1% to 173,247. Gross margins shrank to 39.4% from 44.2% the previous year. Operating loss widened 8.4% to $19.3 million, but net loss narrowed 5.3% to $24.8 million.

-

For the full year, subscription and reserve revenue fell 1.4% to $264.9 million; with advertising and resale, total revenue was flat at $298.2 million, according to a company press release. Net loss narrowed to $113.2 million from $138.7 million in fiscal year 2022.

Dive Insight:

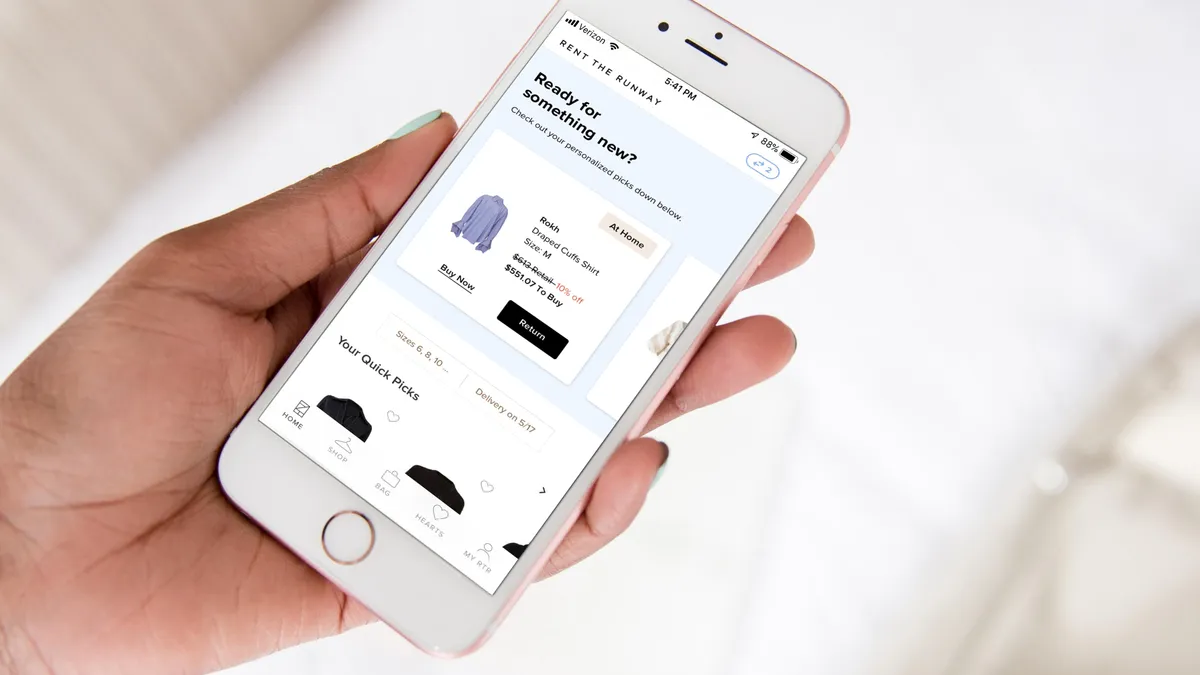

Like many would-be disruptors in retail, Rent the Runway has had to reckon with revenue declines and financial straits. The apparel rental service earlier this year landed on Retail Dive’s watchlist of digital natives that could end up in bankruptcy court.

The struggles led the company to undertake a restructuring early this year that included layoffs for 10% of its corporate workforce and elimination of the chief operations officer role. But it has also made positive moves, including the hire of a chief marketing officer and an inventory overhaul, in response to customer demand, which has brought more depth to the selection, founder and CEO Jennifer Hyman told analysts on Thursday.

Adjustments to how Rent the Runway acquires inventory — designer partnerships that produce exclusive collections for less than wholesale plus a switch to a consignment model — have also paid off at the bottom line, she said. Overall, executives struck a note of confidence on the call, and Hyman said that’s in part because the company’s restructuring “was not just about cost cutting.”

In Q4 the company beat its expectations, executives said. For this fiscal year, the company expects revenue to grow between 1% and 6% year over year, adjusted EBITDA margin to be between 15% and 16% and free cash flow to break even, per the company release.

The company has focused on its own challenges, including improvements in inventory and the customer experience, and hasn’t seen the kind of consumer reluctance that other retailers have noted in past quarters, Hyman said.

“We're not seeing any macro impacts on the business,” she said. “We feel strong momentum and feel very good about the guidance that we provided to grow this year.”

In its renewed search for growth, Rent the Runway has joined other apparel retailers in jumping on the resale bandwagon. Previously, the company partnered with off-price retailer Saks Off 5th to sell used items and is now focused on stoking its own secondhand sales. It’s early days for Rent the Runway’s advertising and resale businesses, but they are already producing results. In Q4, thanks in part to increased focus on resale that also “drove incremental cash flow and customer loyalty,” revenue from advertising and resale (“other revenue”) rose 48.6% or $3.4 million year over year, according to Chief Financial Officer Siddharth Thacker.

Moreover, these are growth areas with sales and “considerable cash generation potential,” with the ability to target subscribers and non-subscribers alike, he said.

Sales of secondhand apparel in the U.S. reached $43 billion last year and could rise to $73 billion by 2028, according to the latest research from apparel resale site ThredUp. But that expectation is tempered compared to previous reports, and some experts say that online sales of secondhand goods are unprofitable.