Dive Brief:

- QVC Group ended Q4 with a nearly $1.3 billion operating loss, the company said Thursday. Total revenue for the quarter fell 6% to $2.9 billion. Overall, the company ended its 2024 fiscal year with a $1.3 billion net loss and an $809 million operating loss.

- Total revenue for the year fell 8% to $10 billion, down from $10.9 billion the prior year. The company cited second-half business challenges that included competing with the Olympics and the election for viewership. A “conservative consumer environment” also pressured top-line performance.

- QVC Group said Friday the company will extend CEO David Rawlinson’s leadership term through the end of 2027 with an option to stay on through 2028. Rawlinson’s compensation package includes a retention bonus of $2.25 million, a base salary of $1.75 million and eligibility for an annual cash bonus and stock options, according to a U.S. Securities and Exchange Commission filing.

Dive Insight:

Rawlinson has led the company through big decisions and challenges since taking over in 2021.

Those include a 2021 North Carolina fulfillment center fire that resulted in an employee’s death and cost the company $500 million in revenue; 400 corporate job cuts in 2023; and later that year, the sale of Zulily.

More business challenges are likely ahead, as the company said consumer cord cutting is affecting its video commerce business.

Rawlinson alluded to some of those setbacks in a statement on his contract extension, but said despite them, “as shopping grows quickly on social and streaming platforms, we are well positioned to use our exceptional content creation and selling capabilities to capture market share. We still believe retail can be joyful and human.”

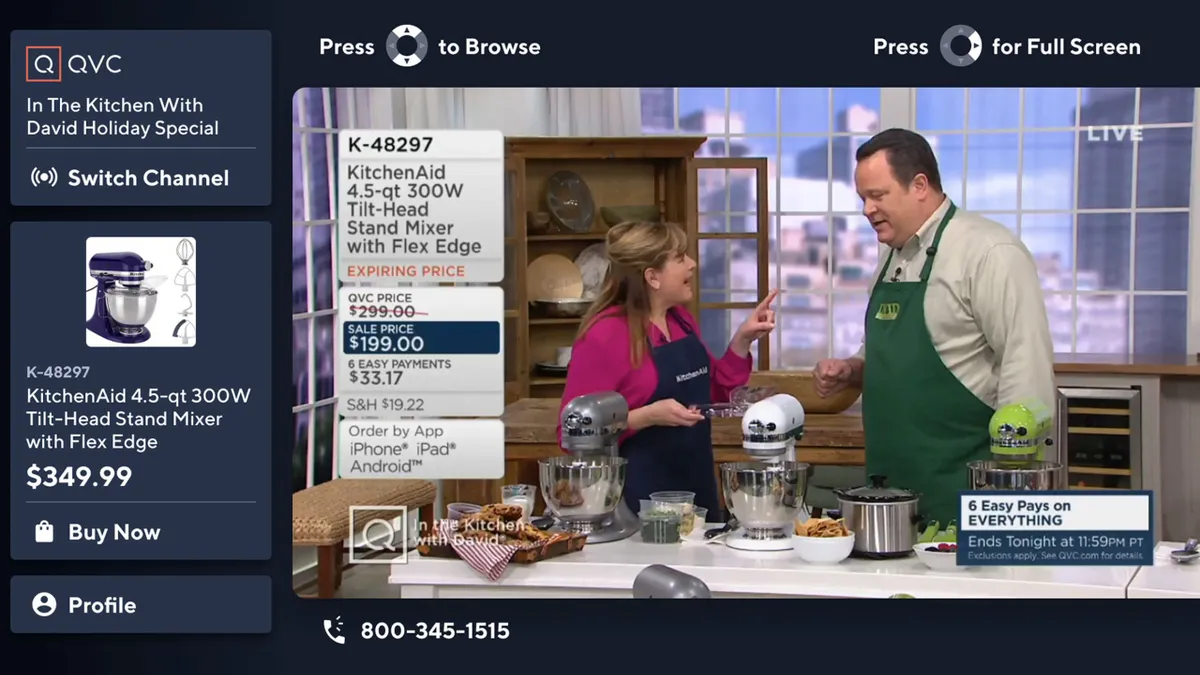

The company began a three-part growth and turnaround strategy in November. It includes offering live shopping content anytime and anywhere; creating what the company describes as “the leading live social shopping content engine;” and leveraging technology to grow with emerging platforms and audiences.

However, the company’s broadcast and streaming-based model faced several challenges during the holiday quarter, including hurricanes and the presidential election cycle. “These events affect our sales far more than other retailers as a video-driven commerce platform with the need for people to tune into our programming in order to drive sales,” Rawlinson said during a Thursday earnings call.

Also during the quarter, Rawlinson said QxH, which comprises the U.S.-based QVC and HSN business units, saw TV minutes viewed decline 4%. In contrast, the number of TV minutes viewed for news and information programming rose 11%. QxH has a combined 7 million followers across Instagram, Facebook, TikTok and YouTube, Rawlinson said.

Consumers engage with social content and QVC content in similar ways. “In short, social scrolling is the new channel surfing and we believe this behavior is very relevant for today’s consumer,” Rawlinson said. He also shared during the call that the company has recruited a chief growth officer.

That person, who he did not identify, will lead social streaming, digital, new business development and platform distribution for QVC U.S. and HSN.

QVC Group has taken other actions to drive its growth and turnaround. It revamped its leadership team in January and announced it will close its Florida-based HSN campus, consolidating its QVC U.S. and HSN operations in Pennsylvania.