Dive Brief:

-

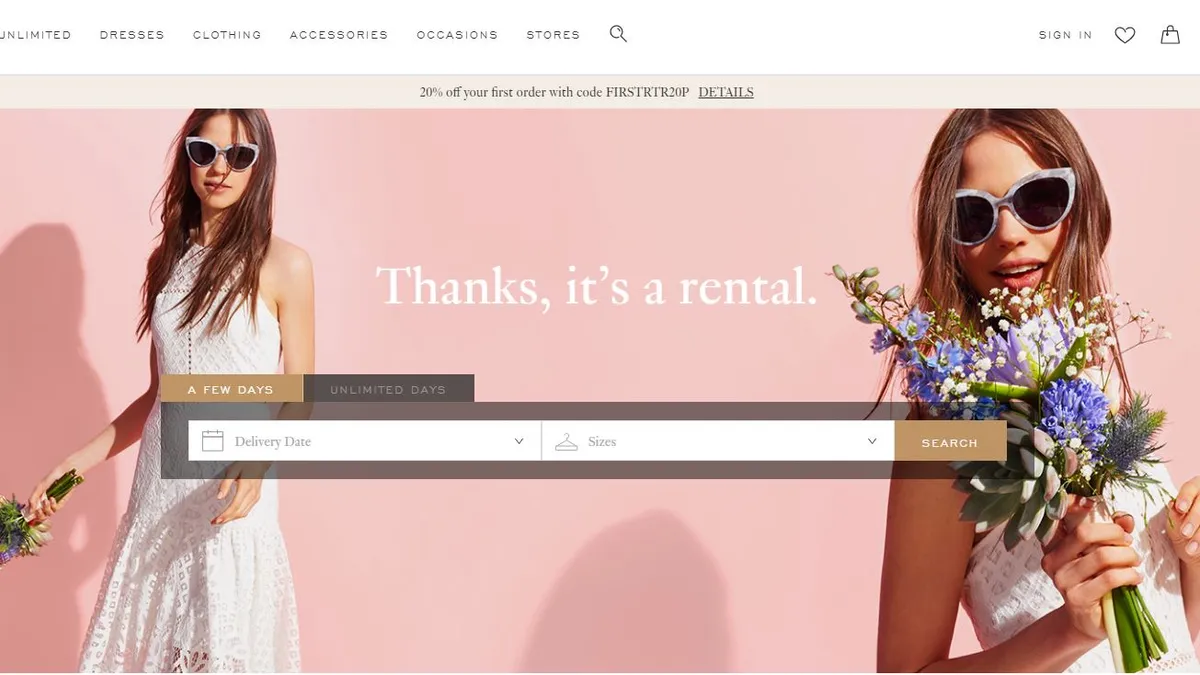

Struggling department store chain Neiman Marcus is partnering with haute couture rental startup Rent the Runway, according to multiple news outlets including The Washington Post.

-

A 3,000-square-foot Rent the Runway boutique will open Friday in Neiman Marcus' San Francisco store, featuring rentable clothes and accessories as well as some items for sale from Neiman Marcus, Bloomberg reports.

- More Rent the Runway boutiques are slated to open in Neiman Marcus locations next year, Neiman Marcus CEO Karen Katz told Bloomberg, explaining that the effort is part of a strategy to attract new customers, including younger ones. The average age of the upscale department store’s customer: 51.

Dive Insight:

Rent the Runway has been experiencing growing pains while Neiman Marcus has suffered growing-old pains, and this tie-up is a bold move for each of them.

Rent the Runway loaned its customers an estimated $1.35 billion of couture and other high-end clothing last year, also adding designer sportswear to its offerings and brick-and-mortar showrooms. The company expects some $100 million in revenues by year's end and enjoys a valuation of between $400 million and $600 million.

Rent the Runway has a strong millennial following, especially given how consumers' growing environmental concerns fit with the retailer's model of reusing the kind of apparel customers would otherwise likely wear only once, at weddings and other milestone social events. A study from Nielsen last year showed that 66% consumers are willing to pay more for a product if it came from a company that's committed to making a positive environmental impact, up from 50% in 2013.

In addition to incorporating brick-and-mortar showrooms into its strategy, Rent the Runway has played with its model, launching an unlimited subscription service in April: For a fixed monthly price of $139, women can rent out three articles of designer clothing, rotating them for three new pieces once they're finished. But subscription services aren't what they used to be. While it once seemed an unstoppable model, innovators like online beauty subscription service Birchbox are struggling.

Neiman Marcus, meanwhile, appears to be suffering from the general malaise affecting department stores, as well as its own particular difficulties. The company has lost top executives, include its CFO (after just 17 months), amid a 4.1% decrease in its Q4 and fiscal year same-store sales, its fourth straight quarter of declines. The department store chain also reported a Q4 loss of $407.2 million compared to a loss of $32.9 million in the year-ago period, dragged down by $466.2 million in write-downs tied to the value of assets, including trade names and real estate.

Neiman Marcus' problems are fomenting talk that it may soon be for sale, with speculation that it will be bought up by Saks Fifth Avenue parent Hudson’s Bay Co. Neiman Marcus, which was taken private in 2005 to accomplish a turnaround, filed for an initial public offering last year, but pulled back amid a bleak outlook for luxury retail: Its results in recent quarters make a second IPO attempt unlikely.

Neiman Marcus chief Katz and Rent the Runway co-founder Jennifer Hyman emphasized to news outlets the overlap of the two companies, which are both focused on fashion-forward women with money to spend. But where they part ways could be a problem. If customers are more willing to rent than to buy, for example, how does that help Neiman Marcus? Meanwhile, the promotional environment endemic to department stores these days — Neiman Marcus’s expensive collard greens notwithstanding — could clue in Rent the Runway’s customers that buying something could be a better investment than renting it.

Finally, department stores haven’t fared that well in getting distracted by shiny e-commerce startups. Nordstrom recently took a $197 million write-down on its unprofitable Trunk Club online fashion concierge service, and Hudson’s Bay Co. in its most recent quarter reported that its Gilt Groupe flash-sales unit was a drag on its off-price sales.