Jennifer Rockwell was working in her secondhand apparel shop in downtown Portland, Maine, last week, scrambling to figure out how she could sell online after closing down just days before. The store, Material Objects, is all set for the spring fashion season and normally bustling with shoppers who come in frequently to discover her most recent finds. On Friday, it was empty save for her two huskies.

"I think we were naively thinking we were going to continue with business as usual as recently as last Friday," she told Retail Dive in an interview. "We were letting people know that we were being diligent about wiping surfaces, but by the time Sunday came around, at least one of my employees said they were uncomfortable being around the public. It was almost easier to make the decision to close than to try to manage it on a day-to-day basis."

While larger U.S. chains have the financial cushion to pay their workers for at least a few weeks, Rockwell does not. She feels lucky that she and her business partner years ago bought the building they're in. She paid her employees for the first week of closure, and then they will access the unemployment system. She's also contemplating e-commerce, not something she thought she would ever do.

"I'm so ingrained in brick and mortar that I can't make that switch so quickly, and that's not how my customers shop either," she said. "I instantly got overwhelmed, trying to take photos, trying not to go crazy. I'm seeing some of my other business friends trying too and I can tell it's tricky."

She remains hopeful, in light of the store's ability to weather the Great Recession and other downturns, but feels like it's uncharted territory. "Just understand that everybody, especially one- or two-person operations, we all live on incredibly small margins," she said. "Their income is over for now, but they're still paying bills. I bought stuff on my credit card thinking we would be selling into the summer. And we're coming out of our slowest time of the year after the holiday."

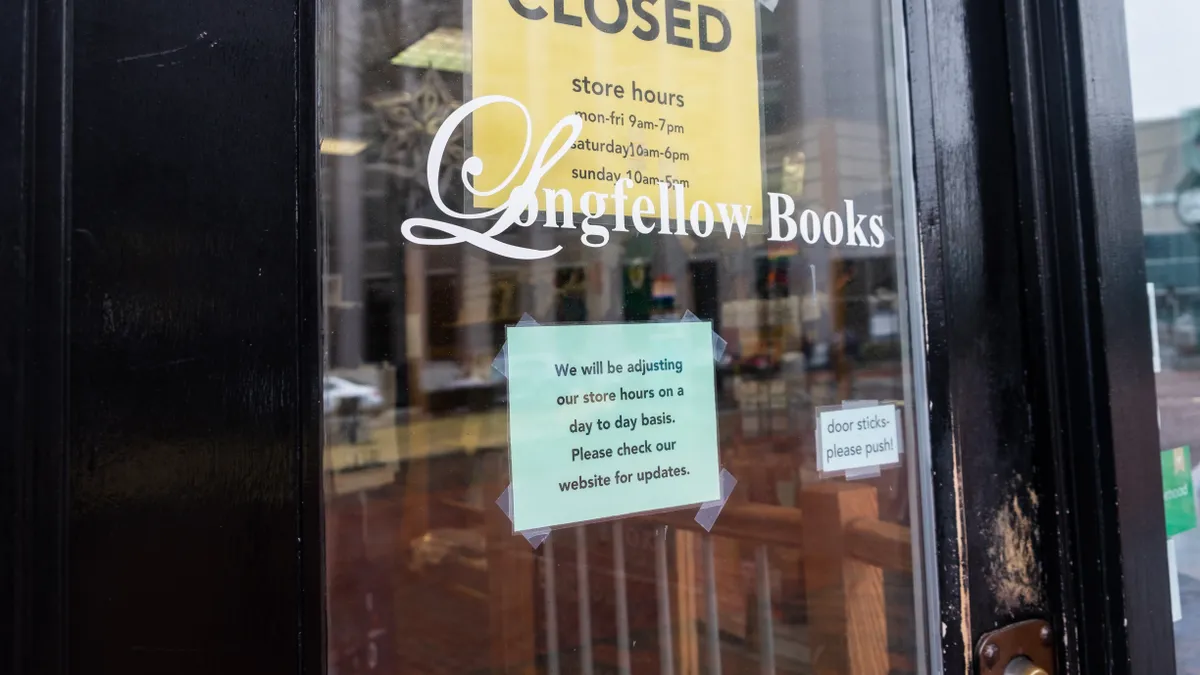

Rockwell's store is one of many nationwide voluntarily shuttering in the face of the COVID-19 pandemic. Sales from small retailers were hovering around 5% to 10% above last year, with a small surge before last week, but that has flattened out, according to data from small-business tech and data platform Womply.

In general, local retailers may benefit, at least to some extent, from strong loyalty in a time of crisis, according to Neil Saunders, managing director at GlobalData Retail.

"I think this is definitely a time when local business can shine," he told Retail Dive by phone. "Local businesses are part of communities, and there's an opportunity for local to really revive out of this by providing local deliveries for older people. People remember that kind of thing and they will respond kindly to businesses that step up."

Indeed, some small retailers like grocers and hardware stores have actually experienced a demand increase in recent days, but others, like apparel stores and antique shops, have lost, according to Womply VP of Corporate Marketing and Communications Brad Plothow.

"We're seeing mass carnage basically," he told Retail Dive in an interview. "It's a unique situation, the spread of a virus, and it's especially hard for businesses that depend on a physical presence, they're disproportionately affected, obviously. We need lawmakers to take action on their behalf, and what really needs to happen is a direct stimulus for small businesses."

Peter Temin, a professor of economics at the Massachusetts Institute of Technology, advocates government-backed, interest-free loans to small businesses so they can stay afloat and remain focused on the future. "Think if your plant burned down, how would you rebuild," he told Retail Dive in a phone interview. "Thousand-dollar checks to everybody isn't really a good idea, it's just the simplest thing to do."

Plothow agrees that the quick checks being contemplated by Congress won't help many smaller retailers much. "The stimulus for individual consumers may make them more willing to spend, that does benefit the whole economy," he said by phone. "But if you are stuck at home you're not going to use that money on a physical local business. You're probably going to spend it on Amazon, and they don't need the help right now."

That has consequences not just for those retailers, but for the economy as a whole. The Small Business Administration estimates that those enterprises drive some 44% of the economy.

"If one mom-and-pop shuts down, it's sad for those people who have a job there or have it in their neighborhood, but it's not just a problem for these communities and employees — it's also a problem for the country," Plothow said. "U.S. employment is tied to small businesses as well."

While small retailers have benefited from the "buy local" movement and consumers' desire for unique experiences, that affinity could be undermined as new habits form during this unusual time, he said. "All this momentum around consumer behavior around small businesses, you get into these rhythms," he said. "If your muscle memory changes because I go to Target or Amazon or get pizza from Domino's, it could take a while for people to rediscover their local businesses, even if they're still around, and that is a real threat."

Material Objects' Rockwell is staying in touch with her customers on Instagram in order to stay top of mind. Although, she says, her customers aren't shopping much for fun right now, even if they could. "I do feel like things will return to normal and I'm trying not to get panicked about it," she said. "And I'll use some of this downtime to get more familiar with using the computer."