Dive Brief:

- Mobile and social commerce drove holiday sales that beat forecasts, according to a Salesforce report released Monday. The data indicates holiday retail sales reached $282 billion in the U.S., up 4% year over year, and $1.2 trillion globally, a 3% rise from last year.

- Both retailers and consumers used AI to enhance the shopping experience with elements like product recommendations, targeted offers and personalized customer order support. AI and agents influenced 19%, or $229 billion, of all online holiday season orders, per the report.

- However, the rate of returns for online purchases also rose by 28% to $122 billion globally from last year. Consumer behaviors like bracketing and try-on-hauls may affect profit margins as the total figure for returns may rise to $133 billion, Salesforce said.

Dive Insight:

Artificial intelligence — and a rising rate of returns — are increasingly influencing retail for consumers and businesses.

“Retailers had a robust holiday season, but a 28% rise in the rate of returns compared to last year is a cause for some concern,” Caila Schwartz, Salesforce’s director of consumer insights, said in a statement. “Retailers who have embraced AI and agents are already seeing the benefits, but these tools will be even more critical in the new year as retailers aim to minimize revenue losses on returns and reengage with shoppers.”

Analysis from other industry groups appear to confirm trends on returns. In December, the National Retail Federation forecast that shoppers would return $890 billion worth of merchandise in 2024. And a more recent report late last month from Appriss Retail and Deloitte found that retailers lost $103 billion in 2024 due to fraudulent returns and claims.

Meanwhile, use of generative AI features in retail increased 25% between Nov. 1 and Dec. 31 compared to September and October in 2024, according to Salesforce’s data, which is based on an analysis of 1.5 billion shoppers and 1.6 trillion page views across its platform.

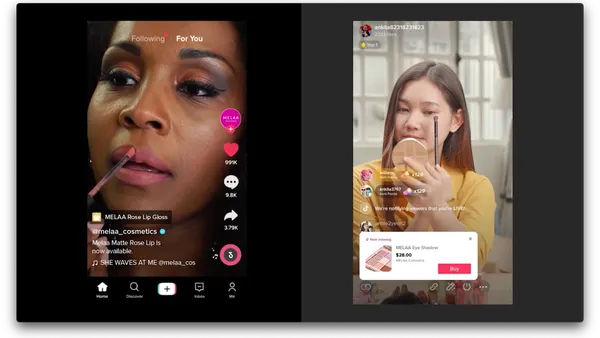

Mobile and social commerce also shaped the holiday shopping season, Salesforce’s data found.

Although the share of global mobile traffic held steady, the percentage of orders placed on mobile rose to nearly 70%, up from 67% the prior year. The analysis also found that mobile buying reached its peak on Christmas Day, comprising 79% of all orders. That’s up from 77% in 2023. Overall, Salesforce said mobile devices accounted for $842 billion in global sales and $195 billion in the U.S. in November and December.

Social media drove 14% of traffic to e-commerce sites during the holidays, an 8% uptick from last year, while social commerce strategies drove 20% holiday sales on platforms like Instagram and TikTok Shop.

And while Salesforce characterized discount offers as “lackluster for consumers this holiday season” it noted that loyalty programs appear to be driving customer retention. Seventy-two percent of U.S. shoppers surveyed said a loyalty program increases the likelihood that they’ll keep shopping with a brand.

Salesforce in August had forecast $1.19 trillion in global sales and $277 billion in the U.S. for Nov. 1 through Dec. 31. Salesforce’s forecast contrasts slightly with the National Retail Federation’s October prediction of holiday season e-commerce spending ranging from $295.1 billion to $297.9 billion.