Dive Brief:

-

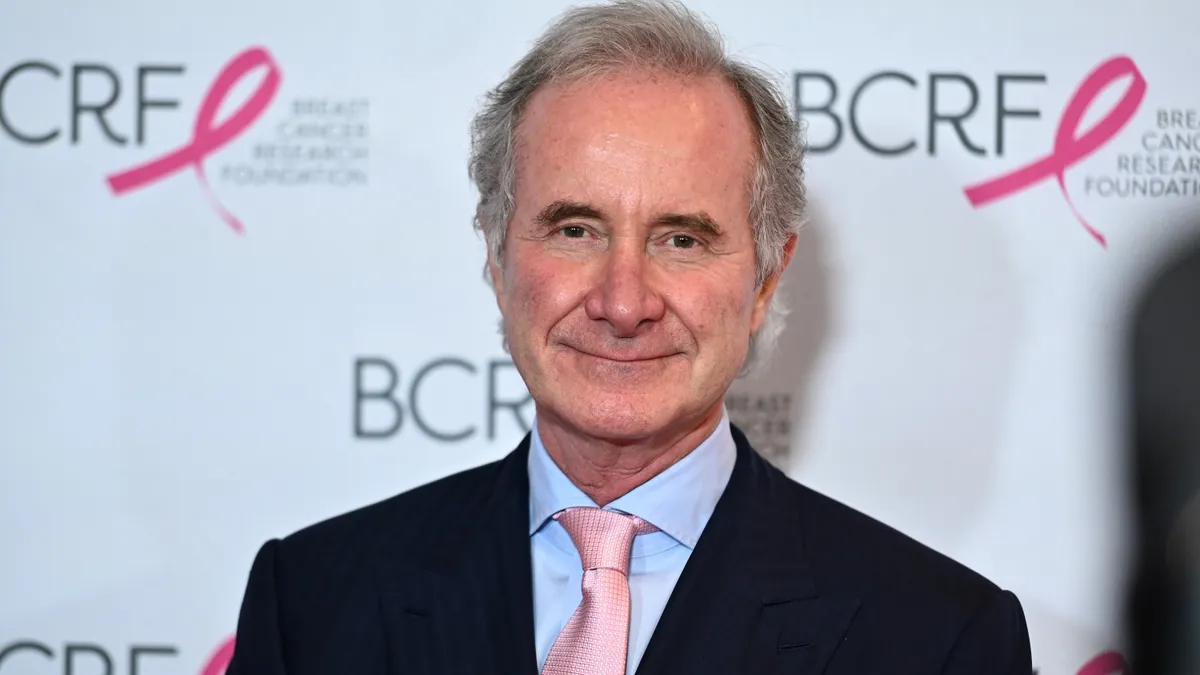

Estée Lauder Companies CEO Fabrizio Freda has informed the board of directors that he will step down at the end of the fiscal year, which began July 1, after 16 years at the helm.

-

The board is “well advanced in its long-established CEO succession planning process” and has already considered candidates to replace him, per a company press release.

-

The news was accompanied by the report that, for the fiscal year ended June 30, net sales dropped 1.9% to $15.6 billion and net earnings shrank by more than half, from about $1 billion to $409 million.

Dive Insight:

Freda is preparing to leave Estée Lauder in the midst of a turnaround — which so far this year has entailed laying off 5% of its workforce and promoting an executive to CFO — and suggested in a statement that the moment is right.

“I will continue to be fully focused on the execution of our strategic reset and the Profit Recovery and Growth Plan, as we continue to address the current challenges,” he said. “As we manage for the long term, now is the right time to look ahead to the next generation of leadership for this great company. I look forward to continuing to work closely with our Board of Directors in the selection of my successor and ensuring a seamless transition.”

Freda will stay on after his successor has been named and then continue in fiscal year 2026 as an adviser, per the release.

The conglomerate runs various beauty, fragrance and fashion brands, including Estée Lauder, Aramis, Clinique, Tom Ford, Smashbox, Aerin Beauty and The Ordinary, among many others.

Last month, Morningstar analysts surmised that the company is looking to exit unprofitable brands.

Soft demand in China is complicating Estée Lauder’s recovery. The company said it expects ongoing declines in mainland China, but also predicted that global prestige beauty will “re-accelerate to historical mid-single-digit growth in fiscal 2026, assuming China progressively stabilizes and then returns to growth.”

Goals of the Profit Recovery and Growth Plan, previously known as the “Profit Recovery Plan,” include boosting gross margin and trimming costs, while investing in “key consumer-facing activities to accelerate growth” and “increase agility and speed-to-market.” The new name “better reflects the plan’s vision from the outset of both sales growth acceleration and profit margin recovery,” per the release.

Wells Fargo analysts led by Chris Carey questioned whether much had changed, however.

“Still the same as before?” Carey wrote in a Monday client note. “Maybe...language is squishier though.”

The change at the top is, by contrast, a concrete move.

“Given multi-year challenges, we think investors are ready for fresh [management], so visibility on change seems a positive, at a minimum,” Carey said.