Dive Brief:

-

Amazon’s Prime membership program now boasts some 49.5 million Prime members across the United States, a 23% increase from last year’s estimate of 40 million and up from 47 million in the third quarter of 2016, according to data from financial services firm Cowen & Co. cited by Barron's.

-

Cowen retail analyst John Blackledge found that 83% of Prime members made a purchase from Amazon last month, compared to 49% of U.S. consumers without a membership. On average, Prime members also bought across 3.8 verticals, compared to 3.7 verticals in the same period last year, while non-members bought across 2.3 verticals on average.

-

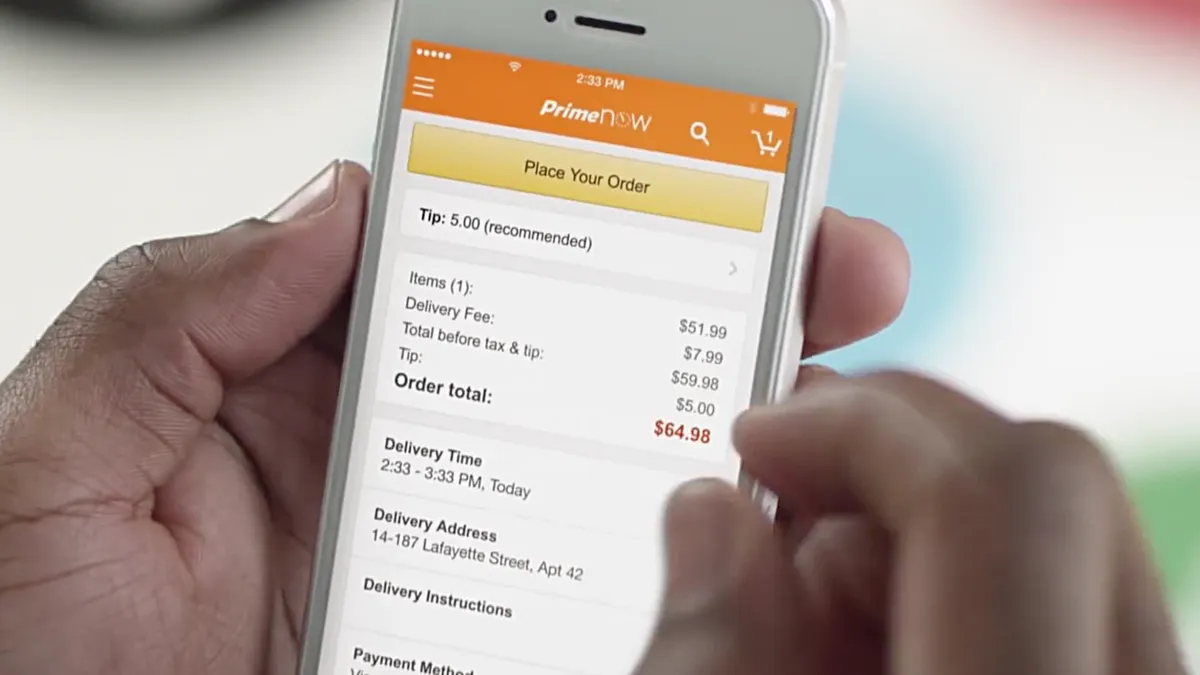

Prime members fork over $99 a year in exchange for a range of delivery options as well as access to services including Amazon's growing streaming multimedia library.

Dive Insight:

Amazon doesn’t disclose its Prime numbers, so determining membership is a statistical guessing game. Research from different firms comes up with different numbers: This past summer, Consumer Intelligence Research Partners found that as of the end of June 2016, American Prime members numbered 63 million, up from 44 million at the same time last year, representing 52% of Amazon's total American customer base.

As long as Amazon holds the details of its Prime membership close to its vest, the scope and buying patterns of the program will remain a series of educated guesses as well. While research has found that Prime members highly value shipping options, they’re also privy to a galaxy of free benefits including entertainment and music streaming services, photo storage and other amenities. Amazon founder and CEO Jeff Bezos continues to find ways to make Prime membership irresistible, creating a virtual cycle that traps customers with a host of benefits and keeps them buying from the company’s huge assortment once they’re locked in.

“We believe Amazon has again upped the value-proposition ante for its Prime membership program with the Nov. 18 one-day $79 annual membership promotion tied to the launch of its 'The Grand Tour' series, which stars the three former stars of the highly-successful BBC series 'Top Gear,'” Moody's Vice President Charlie O'Shea said in a statement emailed to Retail Dive. “We also believe that Amazon will continue to expand its content eco-system, which could include Twitter-like streaming of sporting events, and while these content-related efforts are very expensive and likely require a longer-term return horizon, our view is that they will further deepen and widen the company's competitive moat via increasing the 'stickiness' of its Prime program, and are therefore credit positive.”

Cowen found still other movement at Amazon: For example, the number of shoppers making grocery and consumable purchases is up 12% from last year, while falling 2% at Wal-Mart and increasing 1% at Target. And Amazon purchases in the category of electronics and other general merchandise increased 12% in October compared to last year, a deceleration from the 23% year-over-year average growth in the third quarter but in line with the 15% year-over-year growth in the first half of the year.

Amazon reported third quarter net sales of $32.7 billion last month, up 29% from $25.4 billion in the year-ago quarter, buoyed by the runaway success of Prime Day, a now-annual shopping event exclusive to Prime members. But operating expenses of $32.1 billion (a 29% increase from Q3 2015) cannibalized profits: Shipping costs alone amounted to $3.9 billion, up 43% over year-ago totals.

“Prime Day... was, once again, very helpful in accelerating transactions, but also generated significant fulfillment costs because of the availability of free delivery as part of the Prime subscription package,” Neil Saunders, CEO of retail research agency and consulting firm Conlumino, wrote in an email to Retail Dive. “This, once again, underlines the fact that online, while lucrative in terms of growth, volumes and takings, is far less effective at generating profit.”