Holiday traditions of any kind are hard to shake, their constancy underpinned by the comfort and security that comes from fulfilled expectations. But retail's foremost holiday tradition seemed endangered just a few years ago, as the rise of e-commerce (with its own Cyber Monday event) and the retail apocalypse threatened to make shopping at stores obsolete. Long lines at stores that, in some cases, devolved into chaos helped give Black Friday a black eye.

Black Friday may not be the make-it-or-break-it day for retailers that it once was, but it remains the informal launch of what remains their most important shopping period. Just over 18% of holiday shoppers have already started shopping (up from 16.9% last year), and 35.2% say they'll start after Halloween (up from 31.8% last year), with just 20% leaving their lists unchecked until December, according to research emailed to Retail Dive from GlobalData Retail.

While consumers are shopping earlier, about a quarter will start on Black Friday, according to Stephanie Cegielski, vice president of public relations at the International Council of Shopping Centers, who also told Retail Dive in an interview that 63% of holiday shoppers plan their shopping around the sales event, and 87% of millennials do.

"Black Friday really is the 'official' kick off to the holiday shopping season," Jim Fosina, founder & CEO of Fosina Marketing Group, told Retail Dive in an email. "However this year, we believe that it should be viewed as the 'Clash of the Titans' — multi-channel edition. The battle lines are being drawn between Target, Walmart, Amazon and Best Buy, the players both online and offline that are poised to reap the largest share of Black Friday sales and profit volume."

Stores are back

Having four walls and well-stocked shelves is hardly the name of the game in retail anymore, and most have received the message. Stores need to be neat and tidy and well-stocked as always, but must also ensure that the goods, layout, signage and, perhaps most important, the humans working inside are in sync with their customers.

That means employing data from customers to know what to sell, and to rethink stores as distribution points for experiences more than for products, according to Doug Stephens, founder of Retail Prophet and author of "Reengineering Retail: The Future of Selling in a Post-Digital World."

Adi Biran, CEO of space rental firm Splacer, agrees. "Consumers are turning to online retailers to make purchases, yet creating experiences in real-time that will resonate with consumers encourages them to bring that relationship online when they are ready to make a purchase," she told Retail Dive in an email. "Brands have also realized that sometimes the social engagement generated from an interactive experience is more important than merchandise purchases in the moment."

Although experts like Stephens and Biran see the new ideal for physical stores as a year-round imperative, the holidays are an especially opportune time to create compelling touchpoints. That doesn't mean hyping deals limited only to stores, which leads to customer frustration and even melees, but spreading opportunities across time and channels (even if prices or quantities are limited).

And shoppers are primed for it. More will head to physical stores this year — 88% overall — a six percentage-point increase from last year, according to the annual "In-Store Holiday Shopping" survey from cloud-based retail execution and workforce platform Natural Insight.

Furthermore, several retailers have responded to negative consumer attitudes about Thanksgiving Day shopping by staying shuttered on the holiday, and those closures may be stoking excitement for their Black Friday sales events, according to Fosina.

"People have that day off, they've just spent time with family, and, however you celebrate the holidays in December, it is a big weekend to be out," ICSC's Cegielski said. "There is a psychological component — there's a satisfaction to getting something on sale — but also retailers put out new merchandise and there's something nice about how the mall and shopping centers are decorated and it's a feel-good time."

The fall of Cyber Monday

While brick and mortar has proven to be more enduring as a sales channel than many observers thought a decade ago, that's hardly the only reason for Black Friday's longevity.

Legacy retailers, rather than ceding the web to Amazon and other pure-play retailers, have grabbed more digital sales for themselves. That's served to downplay the other shopping event of Thanksgiving weekend, Cyber Monday. Holiday shoppers will spend an average $57 more on Black Friday than on Cyber Monday this year, although a great majority (68%) of Black Friday shoppers will be doing most of their shopping online, according to a survey of more than 1,500 U.S. shoppers from deals site BlackFriday.com.

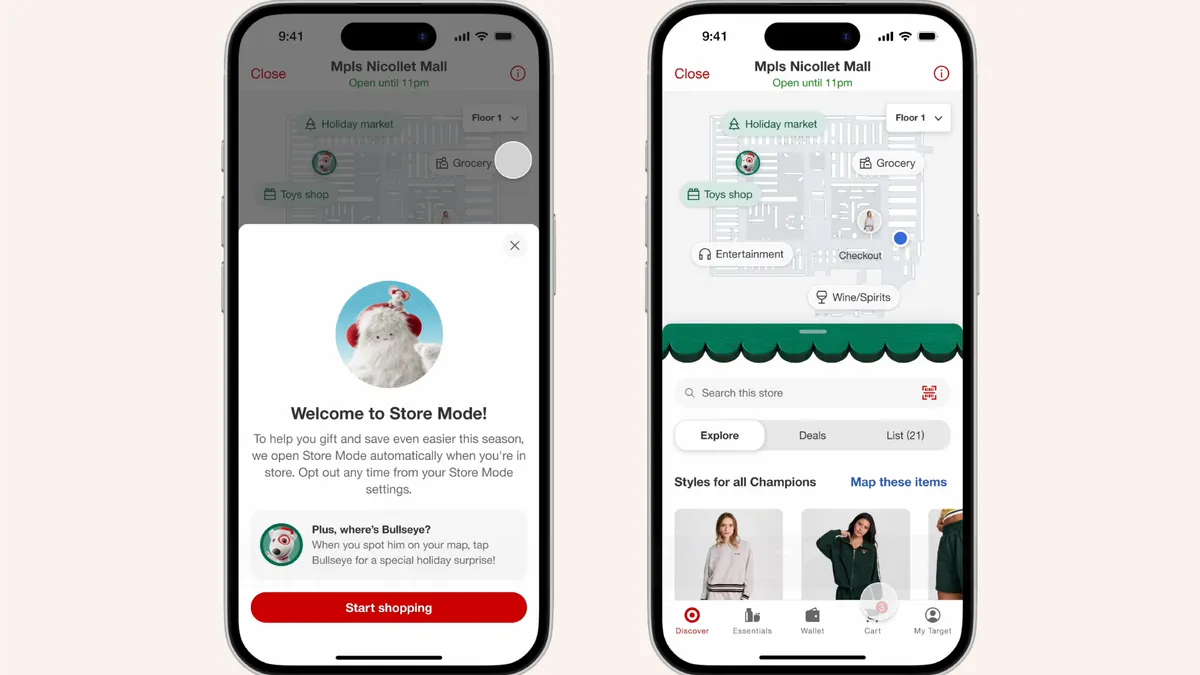

Stores are important for Black Friday e-commerce, too, however. "As Target plans to launch thousands of 'hours of joy' across its stores so children can engage with and test new toys, and with Party City creating pop-ups for Halloween, retailers are making moves to grab consumer attention with the understanding that consumers may engage in-store, only to make final purchases online," Splacer's Biran said.

Be prepared

Retailers prepare for the holidays months ahead, and this year promises to reward their efforts with a stellar Black Friday, in light of a robust economy and strong consumer confidence. But they must be nimble enough to respond to real-time events, not least the weather. Thanksgiving weekend is a volatile meteorological period in most parts of the U.S., according to Paul Walsh, global director of consumer weather strategy at IBM Services' The Weather Company.

Making merchandising plans based on last year's numbers rather than on accurate weather forecasting is "leaving money on the table," Walsh warned in an interview with Retail Dive. This year, for example, the northern part of the country — cities like New York, Philadelphia, Boston and Chicago — are poised to experience milder weather on Black Friday compared to last year, while southern areas like Atlanta will be colder, he said, driving demand for winter outerwear in the South and Southeast.

"In terms of the overall holiday spend, that's not really directly influenced by weather, but what people buy is," he said. "There will be less demand for winter items than last year— but stronger in the South."

While the weather can help drive or impede traffic to stores, it can also wreak havoc on e-commerce fulfillment when customers hunker down during a snowstorm, he also said, noting that it can be quicker to ship a package from a far-away warehouse if the routes that surround the one nearby are disrupted.

Competing with Amazon

Black Friday may be back, but Amazon isn't going away, and the e-commerce giant remains a formidable force around the sales day.

Nearly a quarter of consumers (24%) always price compare on Amazon on Black Friday and Cyber Monday, according to deals site BlackFriday.com. Indeed, more than half of shoppers anticipate using Amazon for product research this year, followed by 37% who seek out consumer reviews or search engines, according to research from The NPD Group.

Amazon also keeps customers checking in on Black Friday by blasting out limited price cuts, fomenting that classic Black Friday feeling — the fear of missing out. "While most online Black Friday deals are assumed to be limited in quantity, Amazon really makes it fun with its Lighting Deal format," Phil Dengler, co-owner of deals site BestBlackFriday, told Retail Dive in an email. "EBay does something similar, as it will say 'Limited quantity available' and show the total number sold and how many were sold in the past hour. For really popular eBay doorbusters, this is often a nerve-wracking experience."

While the closure of Toys R Us and a retreat more generally in big box retail created an opening for smaller retailers, marketing and sales will be dominated by the top "titans," Fosina said. Those include the likes of Amazon, Walmart, Kohl's and Best Buy, which have already started marketing deals on electronics and toys, according to Dengler.

"My sense is that this year Black Friday will return to a strong position as the leading indicator of holiday consumer activity," Fosina said. "Consumers are anxious to celebrate the season this year."