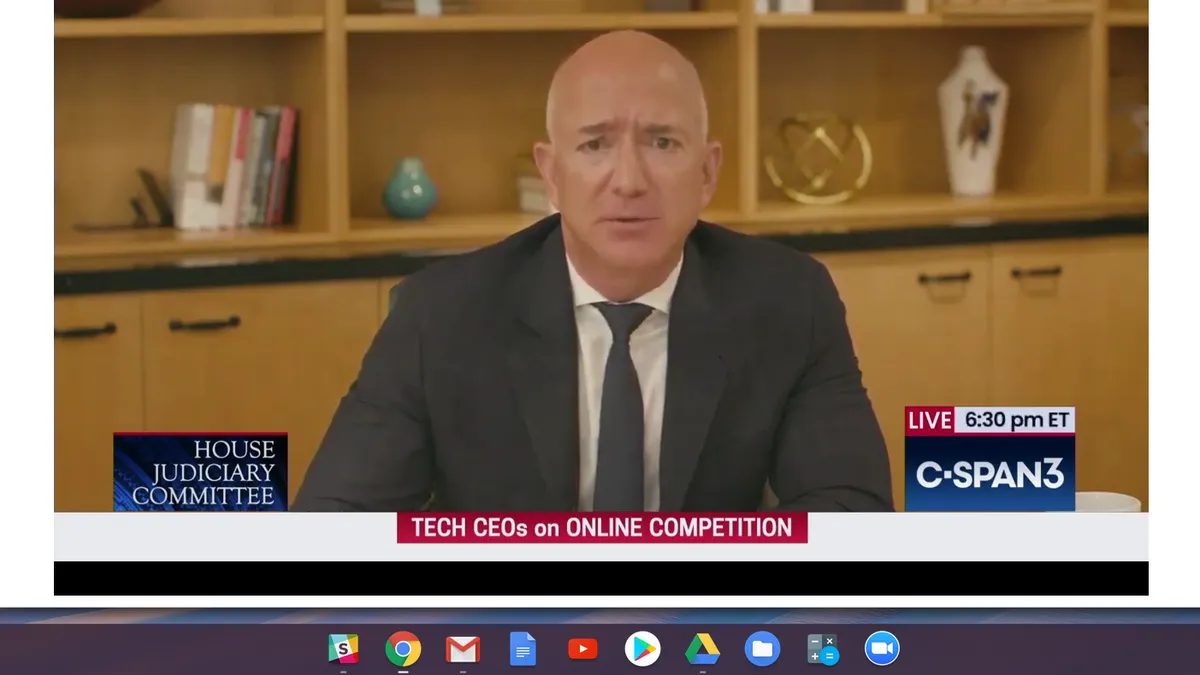

The U.S. House Judiciary Committee's antitrust subcommittee Wednesday corralled a foursome of tech CEOs — Facebook's Mark Zuckerberg, Google's Sundar Pichai, Apple's Tim Cook and Amazon's Jeff Bezos — and for over five hours delivered a bipartisan barrage of questions that sometimes left the tech titans at a loss for answers.

That included Bezos, who, like the other witnesses speaking remotely to the committee chamber, was cut off whenever he attempted to repeat the kinds of positive factoids that he habitually includes in his quarterly earnings reports and annual letters to shareholders. In a quest to determine whether Amazon enjoys advantages that could run afoul of antitrust regulations, Democrats and Republicans alike asked him about the fairness of Amazon's Marketplace and the prevalence of counterfeits or even stolen goods on its website.

Republicans, whose concerns centered on content bias, reserved most of their complaints for the other CEOs, while it was mostly Democrats who grilled Bezos, and they appeared to have prepared well. Rep. Mary Gay Scanlon (D-Pennsylvania), Rep. Pramila Jayapal (D-Washington), Rep. Hank Johnson (D-Georgia) and Rep. Lucy McBath (D-Georgia), among others, cited their own conversations with sellers and consumers and various investigative press reports in painting a picture of cutthroat, anti-competitive policies at Amazon.

In one exchange, Rep. Jamie Raskin (D-Maryland), who asked Bezos about Alexa's tendency to send customers Amazon's private label products when they voice-order items like batteries, got him to admit that Echo devices may be sold under cost, which could be an anti-competitive foul.

Scanlon also described Amazon's 2010, $500 million acquisition of Quidsi (founded by now Walmart e-commerce chief Marc Lore) as an example of unfair competition, saying that a price war that hobbled Quidsi and made it ripe for acquisition ended once Amazon took over, leading to price spikes for Quidsi's budget-minded customer base. Amazon shut down Quidsi entirely three years ago, saying it was unprofitable.

I had the opportunity to question Jeff Bezos on Amazon's questionable acquisition of smaller businesses to quash competition during a @HouseJudiciary hearing today. Americans deserve to know the truth about anti-competitive practices that hurt consumers. pic.twitter.com/zDRy1wEgej

— Congresswoman Mary Gay Scanlon (@RepMGS) July 29, 2020

But it was the Amazon Marketplace that was in focus, with members of Congress detailing accusations from sellers that Amazon routinely mines their data in order to compete against them through its own first-party marketplace, including developing private-label renditions of their best-selling products or burying their product listings unless they sign up for expensive advertising.

"We've interviewed many small businesses and they used words like 'bullying,' 'fear,' and 'panic' to describe their relationship with Amazon," McBath said, describing a seller of textbooks who told her that some 500 pleas to Amazon, including to Bezos, went unanswered after their listings were restricted without notice. The seller told the committee that restrictions occurred after its sales began to outpace Amazon's.

While Bezos touted Fulfillment by Amazon and its ads as tools that benefit sellers, for too many they add up to an expensive price of admission to the Marketplace, according to Nicholas Ahrens, vice president of Innovation at the Retail Industry Leaders Association.

"If you're getting preference because you're using FBA, the greatest innovation they ever had, or whether it's advertising or some of these other services, for some sellers those are positives," he told Retail Dive in an interview. "But if you're required to do them to be competitive, that's not fair."

Though Bezos routinely pushed back on specific examples, saying they didn't reflect official policy at Amazon, he acknowledged that individual instances of the problems described by lawmakers may have occurred, and promised to look into that. While he didn't always have answers regarding details, his main point throughout was that Amazon's top concern is always its customers.

"At Amazon, customer obsession has made us what we are, and allowed us to do ever greater things," he said in his opening statement.

This is an attitude that sellers, who now sell nearly 60% of the items sold through Amazon, know only too well. But it's hard to contemplate leaving a marketplace where "all the customers are," notes Jon Reily, global chief strategy officer of Dentsu Commerce, and former Amazon executive.

"To Jeff's point, you can't police every single person at the company all the time," he told Retail Dive in an interview. "However there's enough anecdotal evidence around that sellers are paying [a lot] to do business there. This isn't going away. He would be wise to take this very seriously."

Bezos also defended the company's history of fighting counterfeit sales and even stolen goods. But the track record, which has landed Amazon in hot water with brands and the federal government, demonstrates a lack of willingness to get serious about the problem, according to RILA's Ahrens. Bezos stumbled under questioning about what details sellers must provide in order to trade on the Marketplace.

"Jeff Bezos was completely familiar with details when he views it as important," he said. "This is a solvable problem. It is a choice. Amazon is a company with some of the best data scientists on the planet, but it's not even a technology issue. They ought to have a vetting process on the front end, but he doesn't know how they verify those sellers — how they check that they are who they say they are. This is a multi-billion dollar problem that our members are seeking to address."