Dive Brief:

- Beyond sold a majority stake in Zulily to Lyons Trading Company, the operator of off-price online retailer Proozy.com, for $5 million, the company said Tuesday. The sale comes a month after Beyond bought BuyBuy Baby for $5 million.

- Beyond will retain a 25% stake in Zulily under the terms of the definitive agreement, which valued Zulily at $6.7 million.

- The sale will enable Beyond to focus on its largest growth opportunities, Beyond’s Chief Operating Officer Alex Thomas said in a statement. The company said the sale’s impact is expected to be immaterial to its full-year adjusted earnings per share.

Dive Insight:

Beyond last month said it’s pursuing multiple paths to achieve profitability. But Zulily no longer appears to be part of that plan. With the sale to Lyons Trading Company, Zulily is now on its fourth owner in less than two years.

Jefferies analysts, led by Jonathan Matuszewski, had a positive take on the deal. “We view this favorably, as funneling proceeds into core brands (Bed Bath & Beyond, Overstock) should have a higher ROI than an attempt at reincarnating Zulily,” they said in a Tuesday note.

Beyond’s Principal Executive Officer Marcus Lemonis, who was just named to that role last week, cautioned investors and analysts last month that while things are on the right track, the company is unlikely to reach profitability this fiscal year. The sale of Zulily is another effort to bring Beyond closer to that goal.

“We have made significant progress in improving the performance of Bed Bath & Beyond and Overstock.com through sequential margin improvement, improved site experience, vendor consolidation and right-sizing our fixed expenses,” Adrianne Lee, Beyond’s president and chief financial officer, said in a statement. “With the recent acquisition of BuyBuy Baby, we want our team laser focused on our core brands as we march towards profitability.”

Established in 2015, Minnesota-based Proozy describes itself as a “one-stop destination for premium brands and unbeatable deals on a variety of apparel, accessories, and footwear.” Proozy says its brand offering includes Under Armour, Adidas, Reebok and Oakley. Proozy and Lyons Trading Company did not immediately respond to a Tuesday request for comment from Retail Dive.

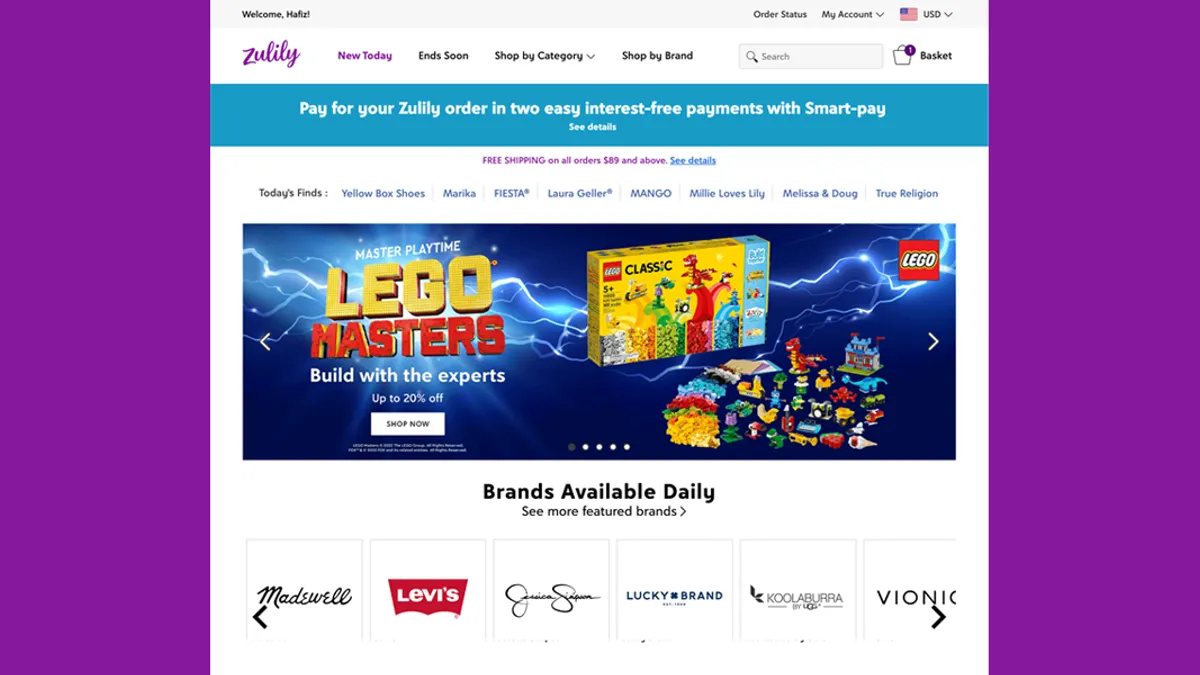

Launched in 2010, Zulily’s market cap peaked at $7 billion in 2014. QVC Group, formerly Qurate Retail Group, bought Zulily for $2.4 billion in 2015. It sold the brand in May 2023 to Los Angeles-based investment firm Regent in a deal that included the repayment of $80 million in debt.

But by late 2023, Zulily was laying off hundreds of people and went out of business about seven months after the private equity acquisition. Beyond Inc. bought the defunct company’s brand assets and intellectual property about a year ago for $4.5 million.