Dive Brief:

-

BJ’s Wholesale wasted no time trying to capitalize on Walmart’s decision to shrink its Sam’s Club division, announcing special offers for Sam’s Club members the day of Walmart’s announcement, directing laid off Sam's employees to BJ's application portal.

-

Sam's Club members can sign up for a discounted membership offer of $40 at their local BJ's or online at www.bjs.com/savings, according to a company press release. BJ's also said it has received "numerous inquiries" from Sam's Club employees and announced, in the next sentence, that "BJ's Wholesale Club is hiring." The Sam's closures could eliminate some 11,000 jobs, according to Fortune.

-

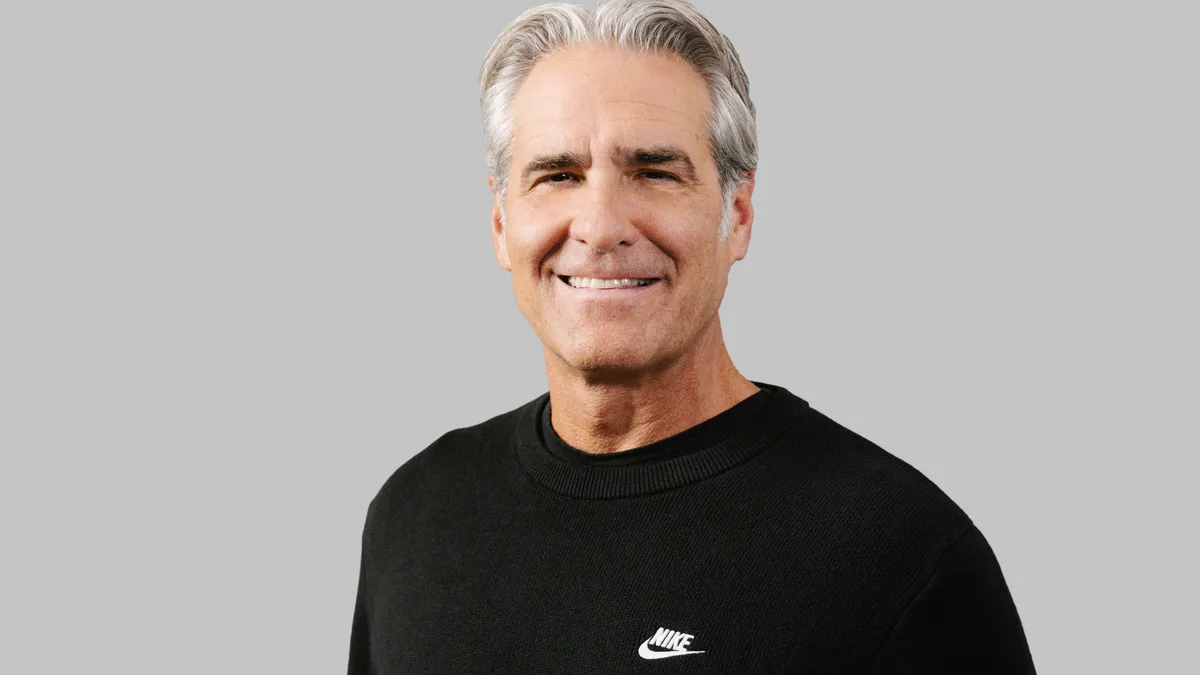

As BJ's chases Walmart customers and employees, the company's CEO and president, Chris Baldwin, has been elected as chair of the National Retail Federation's board. BJ's Baldwin will succeed Macy's CEO Terry Lundgren as the board chairman, the NRF announced Tuesday in a press release.

Dive Insight:

BJ’s may see an opportunity Walmart’s Sam’s Club closures, but it’s Costco that could get the greatest benefit.

BJ’s is under pressure as Amazon has increasingly moved into grocery and office supplies. Leonard Green & Partners LP and CVC Capital Partners Ltd., the club’s private equity owners, last spring were reportedly preparing for a possible sale of BJ's after abandoning the idea of an initial public offering. Speculation swirled then that Amazon might buy the retailer.

BJ's has recently revamped its website and mobile app and boosted its office supplies operations to appeal to small business owners, a key Sam’s Club segment. Costco, meanwhile, is already posting surprising sales growth, both on and offline, despite Amazon’s encroachment. In December the membership club saw net sales rise 14.3% to $14.94 billion in the five weeks ended Dec. 31. During the month e-commerce sales rose 32.2%.

Out of 63 Sam’s Club stores set to close, 46 (or close to 75%) are within 10 miles of a Costco location, according to research from Gordon Haskett analysts. If nearby Costco locations can recapture 50% to 75% of those sales, that represents a $1.5 billion to $2.8 billion opportunity (on an annualized basis) for the retailer, according to a note from Gordon Haskett analyst Chuck Grom emailed to Retail Dive.

Relative to Costco’s U.S. sales base of some $93.9 billion, that translates into a potential comparable sales lift of 160-290 basis points, Gordon Haskett found. "Moreover, there will also be an opportunity for Costco to attract new members in certain markets, particularly for business customers that are currently not a member of both clubs," Grom said. "All told, as we saw in 2009 when Sam’s exited the Canadian Market (six stores), the closures represent a new incremental tailwind for the company."