While many of us aren't traveling across borders just yet, we're certainly shopping across them. It's predicted that the global e-commerce market will reach USD 6.07 trillion in 2024, growing at a compound annual growth rate (CAGR) of 11.34%.

With e-commerce records being shattered, the big question is: How can merchants maximize their share of consumer spending? It's simpler than you might think; merchants can increase sales by catering to consumers' preferred ways of paying.

Here are the top five local payment methods merchants can't afford to ignore if they want to go global.

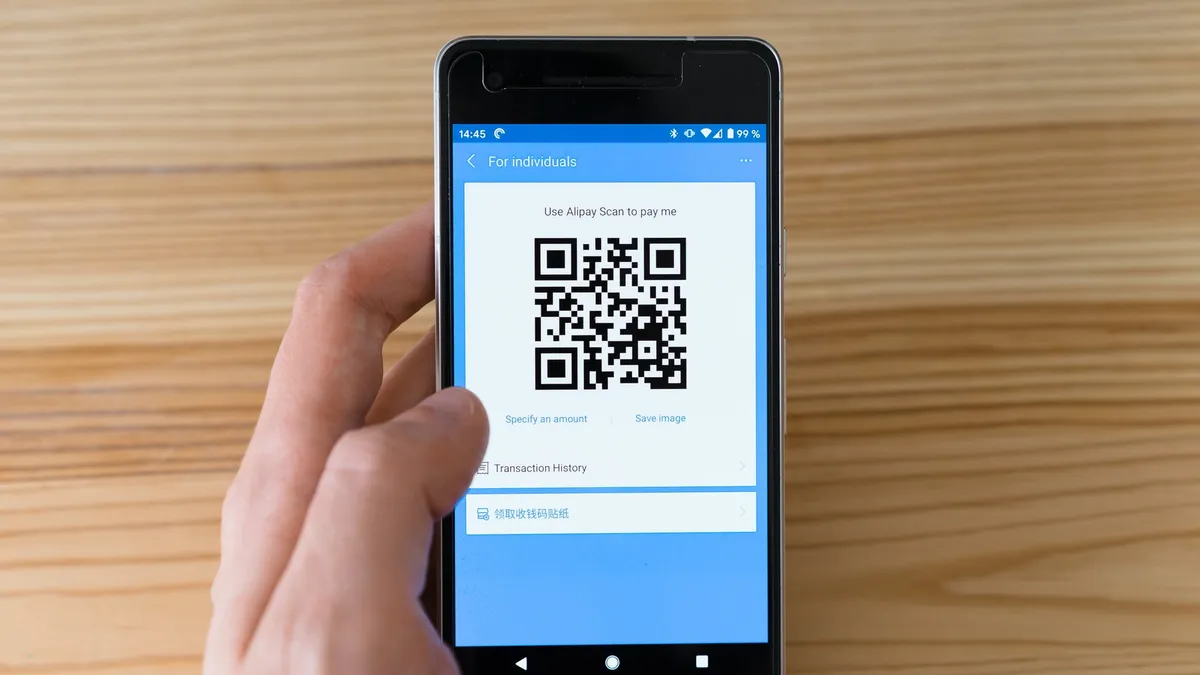

1. Alipay

It's hard to overstate just how important Alipay is to global e-commerce. Just look at the numbers: Alipay has over 1.3 billion active users. According to Alipay, in a statement made in June 2020, the company processed USD 17 trillion worth of transactions in mainland China over the course of a year.

So, what exactly is Alipay? It's the most popular mobile payment platform in China. It started in 2004 as a service that allowed buyers and sellers to trade confidently in a new e-commerce environment. Today, Alipay provides domestic and cross-border payment services through partnerships with more than 200 financial institutions. Alipay's most popular product is an e-wallet and mobile app that allows customers to make purchases directly from their mobile … at over 3 million merchants worldwide.

Asian consumers, and the Chinese in particular, vastly prefer paying with digital wallets. Counterfeit money, coupled with the social perception that cash is unhygienic, helped accelerate the adoption of e-wallets in Asia. It enabled the region to leapfrog to digital payments and become one of the world's most cashless societies.

2. GrabPay

GrabPay is one of the fastest-growing e-wallets, popular in Southeast Asian countries like Singapore, Malaysia, the Philippines, Thailand, Indonesia, etc. Consumers can use GrabPay in retail stores, food stalls, and e-commerce shops and make money transfers and payments in physical stores via QR code. Grab, the super app which supports GrabPay, offers a wide range of virtual products and services, including transport, food delivery, and payments.

Online merchants have an incredible opportunity to increase reach in Southeast Asia with GrabPay. Over 4 million Grab users in Singapore alone, and 75% of Singaporeans use GrabPay daily.

According to PPRO's data, Southeast Asia's top-5 e-commerce markets (Indonesia, Malaysia, Philippines, Singapore, and Vietnam) have been growing at an average rate of over 27% year over year. However, the region is underbanked, and credit card penetration varies widely. Take Indonesia, for example. The e-commerce market there is growing faster than India's, but only 3 to 5% of the population has a credit card.

For this reason, GrabPay is one of the best ways to reach consumers and increase sales in this region.

3. SEPA Direct Debit

Let's take a look at another corner of the globe. The use of digital payments is forecasted to grow in Europe by 70% between 2020 and 2025. Payment methods such as SEPA Direct Debit have become firmly established for online shopping in the region, providing innovative and secure payment and verification solutions based on online banking.

SEPA refers to a bank transfer method for euro payments within the 36 countries of the Single Euro Payments Area, an initiative of the European Union to simplify payments within and across member countries.

When paying with SEPA Direct Debit, consumers pay directly from their bank account and enjoy a simple, secure payment experience no matter where the merchant is located. Bank transfers are incredibly important for Europeans who, as a general rule, are debt-averse and security conscious.

4. PIX

Now, to Brazil. A young consumer base and rapidly growing middle class – combined with the highest internet penetration globally – makes Brazil one of the most attractive e-commerce regions for businesses that want to tap into new markets.

PIX is the first instant payment system available to Brazilian consumers, potentially reshaping the Brazilian payment landscape. Introduced by the Central Bank of Brazil in November of 2020, PIX has seen incredible growth with over 254 million registered keys and over 93 million users in its first six months of existence.

Why has PIX taken off so quickly? Let's look at the other reigning champ of Brazilian payments, Boleto Bancário. At checkout, a consumer using Boleto Bancário generates a boleto, then pays via online banking or in-person at an ATM or participating shop. The funds are available for up to three days (excluding holidays and weekends).

On the other hand, PIX enables real-time money transfers and payments 24 hours a day, seven days a week – an entirely new proposition for Brazilian consumers and businesses. It only requires a PIX key, and funds are available in real-time. It's widely considered the future of payments in Brazil.

5. PayPal

It should come as no surprise to see PayPal on this list. The PayPal wallet allows merchants to access PayPal's user base of more than 403 million active accounts across 200 markets worldwide.

The UK – one of the most popular consumer markets for American merchants – has 32 million PayPal users. Although it's a card-centric market, the PayPal wallet is gaining incredible traction as one of the preferred ways to pay.

And no other country in or around Europe has embraced e-commerce more enthusiastically than the UK. The UK's e-commerce market, currently the third-largest globally, is predicted to be worth GBP 264 billion by 2024, a 37% increase since 2020.

The global opportunity for merchants

While they cater to the unique preferences of local consumers, the payment methods on this list are shaping a borderless e-commerce future.

For merchants with their eyes set on growth, accepting the correct local payment methods at checkout is key to unlocking the opportunities cross-border markets have to offer.