Payment processing has been viewed as a commodity like copper or crude oil. And like a commodity, choosing which payment processor has been a decision based on "lowest cost."

While that logic may have made sense when the credit card was the only sheriff in town, the payment processing industry seems to change daily. Within a short span, we've gone from cash and credit cards to alternative payments methods (APMs). Ecommerce used to be a rounding error not too long ago but it will account for a quarter of all global retail by 2024. And COVID-19 is spawning new shopping behaviors that may last for decades.

Here's what that means.

Payment processing today is a critical part of the shopper experience ecosystem. The legacy, siloed payment systems of yesterday no longer serve the needs of today's shoppers. Instead of choosing a payment processor solely on the lowest cost, it's time to evaluate and modernize your entire shopping experience. Here are a few things to consider:

Are you giving shoppers what they want?

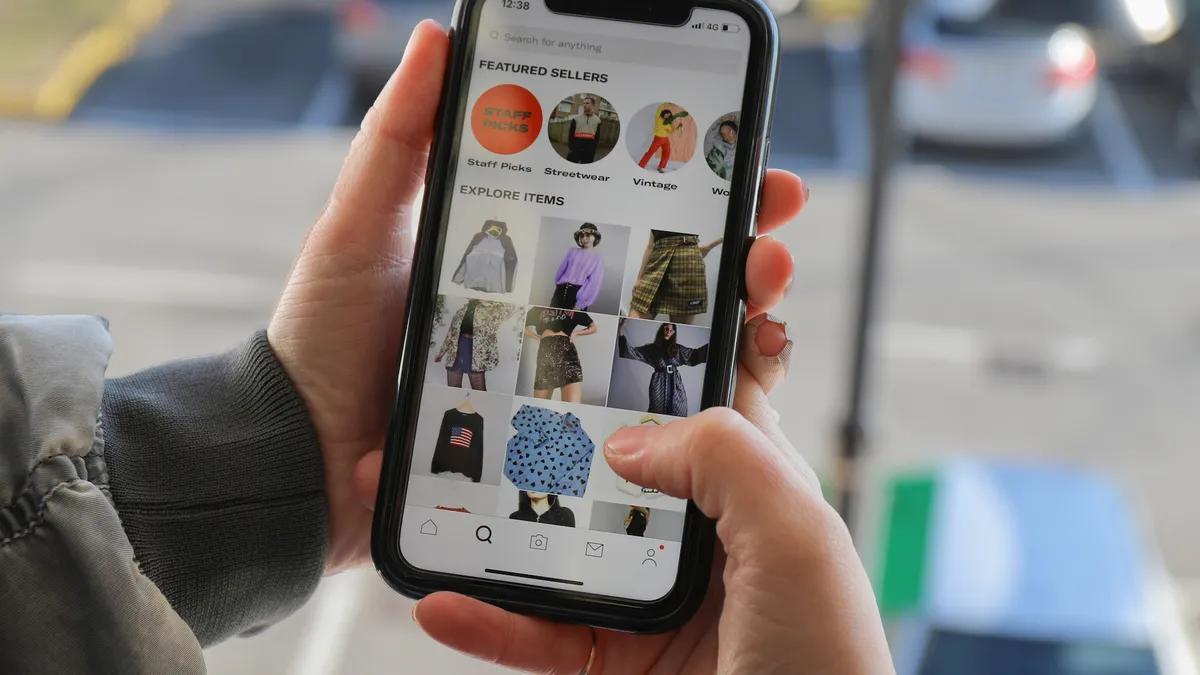

APMs = growth. Your customers want more flexible payment options, especially your mobile shoppers. This has given rise to alternative payment methods like digital and mobile wallets to financing tools. APMs already account for over 43% of global transactions and that figure is expected to rise over the next few years..

As shopper demands and expectations continue to rise, one-click checkout has stepped into the spotlight as the holy grail of the mobile shopping experience. Not offering shoppers their preferred method of payment or not offering a fast, convenient way to complete their purchase are the main reasons for the industry-wide cart abandonment rate of over 70%. The cart abandonment rate spikes even higher on mobile, to 85%. Just at checkout, this adds up to nearly $1T in abandoned checkouts in the United States alone every year, and upwards of $10T globally.

You want a payment processor with built-in APM integrations so you can offload the headache of managing multiple backend and frontend APM integrations. A streamlined checkout experience can reduce the friction during that final step of the buying journey.

More importantly, you give your shoppers what they want: their payment method of choice and the convenience of one-click checkout. You benefit from higher conversion and lower cart abandonment rates and your customers benefit from an amazing customer experience.

Is there access to other capabilities?

Any discussion around payments needs to take into account what happens before with the all-important moment of conversion: the checkout experience. Are payment capabilities integrated into checkout capabilities? If so, what is the ROI of "bundling" those capabilities into a single provider versus decoupling them?

An equally important capability is fraud prevention. In addition to reducing false declines with stronger fraud detection and prevention measures, it is worth evaluating how your fraud prevention capability delivers against the entire customer journey. Shoppers demand ease and convenience. Selling through a shopper network means that your shoppers don't have to enter in their payment and billing information, even if they have never shopped at your site before.

Additionally, shoppers with network accounts are at a lower fraud risk because they are already known and trusted within the network. That means a better shopping experience for shoppers and peace of mind for retailers with a 99% approval rate. It's a win-win.

What's the competitive advantage?

Assuming the first two considerations are leaving you with a "can't decide" conundrum among multiple payment-only processors, here is the final thing to consider: the competitive advantage. One of those competitive advantages will come down to access to first-party data.

Recent privacy changes from Apple and Google mean merchants will not only lose the ability to track shoppers anonymously through cookies, but it will also be more difficult to do device-based authentication. Smarter customer acquisition and post-purchase experiences will be more important than ever with this impending cookie apocalypse.

The Bolt network offers merchants access to first-party data with over seven million checkout-ready shoppers and hundreds of thousands of new Bolt account shoppers added every month. Even first-time shoppers benefit from a one-click checkout experience with no redirects, usernames or passwords. And each merchant that joins the Bolt network creates more value for shoppers and other merchants alike, creating a strong network effect and providing all with an alternative to the big global marketplaces.

The payments industry continues to evolve with new players entering every day, leaving merchants with a dizzying array of choices and feature parity. Instead of choosing a payment processor in a vacuum, merchants should consider the total cost of ownership by looking at the entire shopping experience. This consideration must include APM integrations, convenient one-click checkout experiences, fraud prevention, and access to other capabilities like one-click account creation.

The end result will be a modernized payments infrastructure that provides a great customer experience, also while helping merchants alleviate the burden of choice.