In recent years, retailers have focused on developing an omnichannel marketing strategy — reaching customers regardless of how they interacted with the business — in person, through ads, social media, apps or mobile devices. By making it easy to connect anytime, anywhere, retailers can build better customer loyalty and relationships.

But the omnichannel approach isn’t just limited to marketing. Retailers should also consider an omnichannel approach to payments.

The rise of multiple payment options

During the pandemic, customers flocked to digital out of lack of options. With brick-and-mortar stores closed, consumers made purchases through e-ecommerce and social media sites and apps. For many, this was their first time buying this way — and they liked the convenience. As the pandemic eases, consumers will undoubtedly return to brick-and-mortar stores, but they still expect retailers to offer multiple payment options that are convenient, fast and secure.

Payment strategies should benefit retailers, too

But retailers need a payment strategy that does more than collect money. It should enhance the customer experience by reducing payment friction, making it easier for customers to complete their purchases. At the same time, the payment strategy should also improve the merchant experience by decreasing infrastructure silos and making the most of their technology investment.

A digital-first approach to payments will be essential as retailers prepare for the post-pandemic customer.

What a digital-first payment strategy looks like

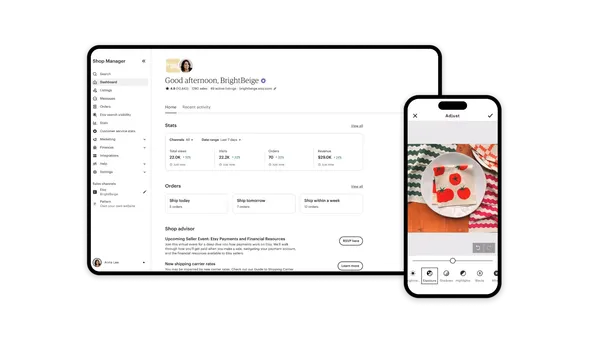

Retailers increasingly rely on digital technologies to make it easy for consumers at every stage of their purchasing journey. This digital-first mindset recognizes that buyers’ expectations are changing faster than ever and that businesses must adapt to keep up, said Gavin Barlow, vice president, direct sales for Cybersource, a Visa solution. While that’s challenging, there is good news, he added. “The digital environment, together with the right technology partners, creates the ideal platform for innovation, agility and speed to market.”

With that same focus on digital technologies to make the overall shopping experience seamless, retailers should also consider how a digital-first strategy can make payments just as frictionless.

Some retailers are taking advantage of unexpected opportunities. At the height of the pandemic in the U.S., when most businesses were closed, automotive-service chains were open. Getting a service such as an oil change typically required face-to-face interaction. However, by creating touchless payments, Cybersource helped merchants set up a pay-by-link option, Barlow said. “When it came time to pay, you received a text by phone with a link to pay. That protects the consumers and staff.”

Creating that kind of solution is quick, Barlow said, and the payoff can be enormous. “Creating compelling digital experiences is an opportunity to attract and retain more customers and drive a lot more business.”

A digital-first payment strategy isn’t just for use during a pandemic. It becomes one more brand touch point, affecting future purchases and helping drive revenue and customer lifetime value.

Effect of payment strategy on business

Although consumers may use multiple channels in their shopping journey, they may not be channel hopping as much as we think, Barlow said. If a consumer starts shopping on mobile, they are likely to finish shopping on mobile. The same happens if a consumer shops in-store. This emphasizes the need for retailers to think through a consolidated payment strategy for all the channels a consumer may use, he said.

Even though the imperative to create a great customer experience at checkout is clear, it can still be a struggle. A report by 451 Research found that one in five online merchants say their current payment-acceptance infrastructure inhibits their business growth. It’s easy to see why: Consumers have little patience for hiccups in the purchasing process. Forty-seven percent of consumers abandoned their online shopping cart in the last six months because of difficulty completing the purchase. Of those, 67% ended up not making the purchase from that retailer — either going to a competitor or not buying the product at all. “What’s really clear is that consumers are prioritizing businesses that are offering seamless and secure shopping experiences, and that includes digital payments,” Barlow said.

Creating a digital-first payment strategy

To create a digital-first payment strategy, companies should start by looking at three aspects, Barlow advised.

Determine if the current payment platform is built for digital-first. That means, is it modular with elements that allow you to select your preferred channels, payment types and acquirers? “One of the things we’ve seen that doesn’t work is when a retailer is locked in with specific providers. That flies in the face of being agile,” he said. Look for a payment platform that is flexible and open so retailers can select the solutions they need. This allows them to pivot and change consumer experiences as necessary. Likewise, the platform partner should be innovative and battle-tested to help companies adjust and scale with change.

- Understand customers, digital behaviors and buying habits. Retailers can’t divide experiences into in-store experiences or mobile experiences because the same customer uses various ways to purchase. Although they may start and end a shopping trip in-store this time, they may complete the entire process online via computer or mobile phone next time.

- Implement a 360-degree approach to payments. Ensure your payment platform has payment acceptance on a global scale and payment methods that deliver the right experience locally. The payment platform should have fraud mitigation and use network tokens and other security measures to protect the business and consumers. Some industries, such as grocery, were not the traditional target of fraudsters, but with the recent growth in e-commerce grocery sales, that has changed. A platform must be adaptable to evolving needs.

With an innovative and flexible payment platform, and an experienced partner with a clear view of a great customer experience, retailers can develop a digital-first strategy that benefits both merchants and customers.