Accelerated efforts to digitize over the last few years sparked a significant shift in how businesses make and receive payments. With businesses mobilizing to meet consumer demand and shoring up their supply chains by diversifying with global suppliers, more business-to-business (B2B) spending is happening online and internationally. This is especially relevant for the retail sector, which relies on the accessibility of services and materials from across the world.

The impact of these changes is felt most by small- and mid-sized businesses (SMBs), many of which are now conducting global business and experiencing new, "big business" problems at a smaller scale. SMBs need simple solutions tailored to them, and available at their fingertips.

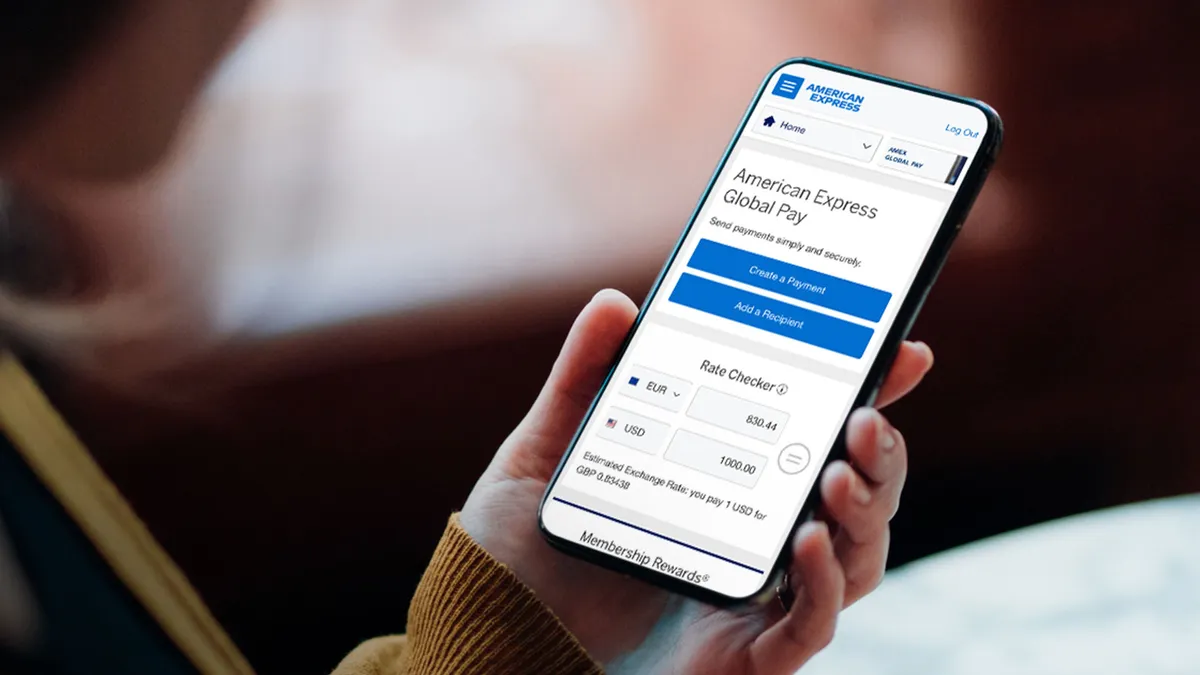

Enter American Express Global Pay – a digital payment solution that enables U.S. businesses to securely1 make domestic and international business-to-business payments funded from their business bank account to suppliers in more than 40 countries, across a range of currencies, using a simple, mobile-friendly platform.

According to a recent survey by American Express2, 64% of U.S. small and mid-sized business owners and financial decision-makers said they expect their total spend with businesses outside of the U.S. to increase over the next six months and cite access to a wider range (43%) of products and services and supply chain diversification (35%) as some of the top business benefits of cross-border B2B spending.

The survey also revealed one quarter (27%) said the complexity of the process is one of the top obstacles when making cross-border payments. When asked about what attributes they are looking for in a cross-border payment solution, nearly half (48%) said transparent fees and rates, on par with a simple user experience (44%).

"Businesses today start, grow and compete on a global scale," said Dean Henry, Executive Vice President of Global Commercial Services at American Express. "Our U.S. Small Business Card Members told us they want an international payment solution focused on simplicity, convenience and the chance to earn rewards – so we built American Express Global Pay to enable these businesses to easily and effectively manage their B2B payments globally on a secure platform, backed by the trusted service and unique benefits of American Express Membership."

American Express Global Pay offers a self-service user experience ideal for busy business owners, who can access American Express Global Pay in the same place they manage their American Express Business Card account, including from their mobile device.

The new cross-border payments solution follows simple and intuitive steps, helping business owners reduce the risk of common errors and delays with fields that dynamically update based on the country of payment3. And payments may be eligible for same business day delivery through American Express Global Pay's connection to faster payment systems, such as SEPA Instant Credit Transfer, which includes all of the European Union — with an estimated delivery date provided when an order is placed4.

Business owners can access transparent exchange rates and send payments with peace of mind knowing they have the powerful backing and dependable customer service of American Express. Eligible customers can also earn 1 Membership Rewards® point for every $30 equivalent on their foreign exchange payments5 (maximum of 4,000 points per payment).

With American Express Global Pay, American Express empowers small businesses to go global, easily making B2B payments how they want, where they want, and when they want.

To learn more about American Express Global Pay or to apply online, visit American Express Global Pay.

American Express Global Pay is a money transmission service provided by American Express Travel Related Services Company, Inc. (American Express). This service is not available to consumers and is currently available only for American Express Business Card customers. Your business must submit an application, which is subject to review and approval by American Express. When you are creating a payment, we display the fees that we will charge you and the exchange rate that we are offering you. We make money from the purchase and sale of foreign exchange. There are many factors that may influence the fees and the exchange rates that we offer to you, including but not limited to market volatility, currency pairs, and transaction size. We may change the fees and the exchange rates that we offer you at any time, for any reason and without notice. Recipient banks or intermediary banks may charge their own fees, which can reduce the amount delivered to your recipient. For a list of our money service business licenses and information about addressing complaints and other disclosures, visit www.americanexpress.com/us/state-licensing.html. The American Express Global Pay service is a separate service from your American Express Business Card and has different features and terms. If you cancel your American Express Business Card (or if American Express cancels your Card), we will close your American Express Global Pay account. This means that you will not be able to make any more payments using American Express Global Pay. Please click here for Frequently Asked Questions.

- American Express Global Pay incorporates encryption, both for stored data (such as account information) and for payments created and transmitted in real-time. The American Express Global Pay platform is deployed within American Express' state-of-the-art data center that features advanced online and offline security and monitoring against internet attacks. American Express Global Pay implements American Express standards relating to information integrity, transaction security and information security.

- American Express Global Payment Solutions Survey, June 2022

- Payments are subject to various reviews and delays can happen for a number of reasons. The recipient bank has its own policies on when to make funds available to the recipient of the payment.

- Same business day payments not available for all customers/payments. When a customer creates a payment using American Express Global Pay, American Express provides an estimated delivery date, which takes into account factors such as the size of the payment, the time of day and relevant holidays. American Express does not guarantee the delivery date. Payments are subject to various reviews and delays can happen for a number of reasons. The recipient bank has its own policies on when to make funds available to the recipient of the payment.

- American Express awards one (1) Membership Rewards point for every USD $30 equivalent of foreign exchange payments that the customer sends using American Express Global Pay. The maximum award per payment is 4,000 Membership Rewards points. Other terms apply.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo.