As we all know, information has become extremely valuable, and when it comes to proliferation of data, payments are the motherlode. In 2015, there were more than 144 billion non-cash payments in the U.S. alone. That’s 144 billion swipes at a POS terminal or “confirm payment” clicks online. And with each purchase comes a bundle of information: at the bank level, the time, date, and total amount of purchase; at the store level, demographics, products and services purchased, where a customer is at in their relationship with you, past behaviors, and channel preferences.

But the raw data alone is only the beginning. The holy grail is parsing that data in a way that unlocks the experience of your brand for each customer, from the time they make first contact until they make you their preferred shopping experience. That requires personalization.

Which brings up the question: What exactly does personalization mean? A survey by the sales consulting firm Invesp found that 61 percent of online marketers understand that personalization is important, but 51 percent admit they’re not sure how to do it. Is it personalization if my email starts with the customer’s first name? Is it personalization if I push an ad based on a customer’s last purchase? And the big one: At what point am I being too personal? When do I go from the well-intended marketer to the intruder who expects immediate access to personal information, or seems to just already know too much?

As a facilitator of payments between retailers and customers, we serve as a kind of chaperone, staying in the background, ensuring a positive experience. We want payments to be hassle-free, seamless, safe and optimized to serve the interests of the people on both sides of the transaction. And in today’s digital-native, mobile, individualized culture, that means personalizing at a pretty intimate level. And that means there needs to be a certain level of sophistication and sensitivity to how you handle transaction and customer data.

If we’re being honest, the idea that you can over-personalize the customer experience doesn’t quite hold up anymore. That same Invesp report notes that 57 percent of online shoppers are OK with providing personal information as long as it is for their benefit. Where marketers run into problems is when they get too personal too fast, or when they think they’re personalizing but they’re really just segmenting – talking to an avatar representing a chunk of the market without really understanding the real people they’re talking to. An overeager or inattentive retail marketer can very quickly alienate the very person he most wants to win over.

Using predictive data analytics, we can get a peek at a myriad of spending patterns, then tailor communications to any combination of those factors to the point where we’re speaking to a customer’s real life. Here are some ways to go well beyond the basics – without being intrusive.

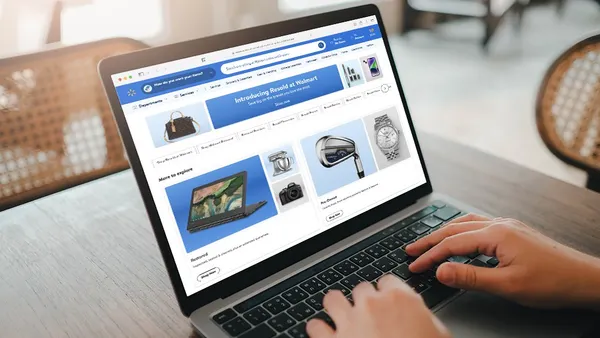

Be omnichannel. The most important yet subtlest tactic for personalization is just being where they are. No, at this point we can’t truly call the experience personalized, but it is THE way you will get customers in the door (or onto your site, or in your app). In a 2016 study by Adobe, 66 percent of consumers expressed frustration when content wasn’t synchronized across devices. It makes perfect sense: 79 percent of those polled switch devices mid-activity (for millennials that leaps to 90 percent). As consumers we all do it: Something sparks your interest, you look it up on your phone, then move on with your day and come back to the site on your laptop 6 hours later. Far from invasive, it’s simply meeting your target customer’s baseline expectations. It gets you in the door.

Give them what they want. You’re connecting with customers on their preferred channels, you’re collecting data – now what? Use this opportunity to get to know the whole customer. Don’t stop at one data attribute; instead you can overlay multiple data points until a fuller picture of an individual clicks into place. With several customer profiles instead of just two or three, you can create messages, services and offers that really resonate. Starbucks has been the showstopper here, with a mobile app that has not only driven sales but tracks users’ purchases and pushes deals that makes sense. This kind of personalization feels authentic and is truly useful – so your audience will feel supported and well-served.

Have a goal. Your choices should be strategic, with an eye toward the tangibles you want to achieve beyond short-term engagement targets. Rather than focusing on consumer reach or CTR, tie your personalization goals to real performance goals such as reducing costs, retaining customers, increasing revenue, or driving adoption rates of new channels or tools.

Follow best practices. If you think about it, the standards for interacting with consumers online is pretty much the same as it is for interacting with people in everyday life: Be available – show up where your shoppers are, and keep your lines of communication open. Be reliable – make sure you have enough bandwidth to handle site traffic, fix bugs in your apps when they’re flagged, and follow through on your promises. Be safe – deploy multilayered authentication and security protocols at login and checkout. And get the customer’s conscious, enthusiastic consent when you ask for their personal information.

As we develop more collaborative partnerships around shared data, we have an important opportunity to guide payments and its related industries to develop better products that customers value and that fully empower them to own and control their own purchasing decisions. That is how you earn consumers’ respect and win, if not their hearts, at least their repeat business.

Kevin Brown is VP of Product and Marketing for Wirecard North America.