Dive Brief:

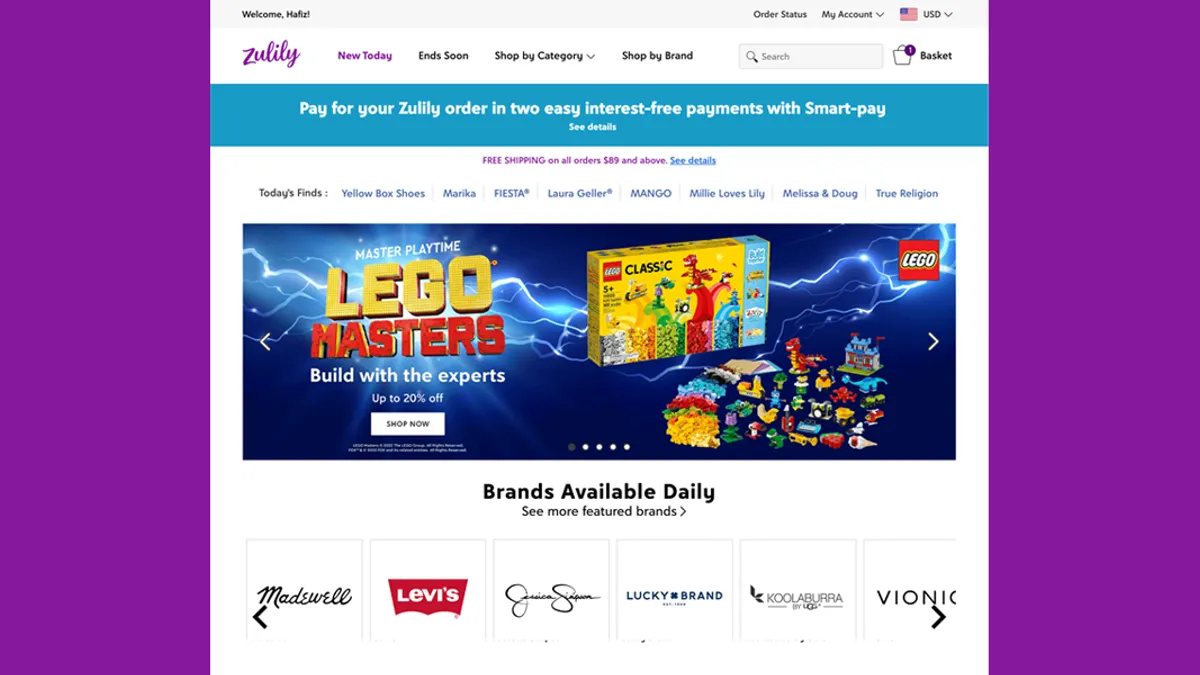

- Zulily, the online discount women’s and children’s apparel retailer, has tapped Hilco Streambank, an intellectual property firm, to sell its intangible assets, according to a Tuesday press release.

- Among the assets are Zulily’s customer data, social media assets, domain names, code for the Zulily proprietary app and over 200 trademarks, according to the announcement.

- The retailer is accepting indications of interest until March 13. If the company receives an acceptable offer, it may start the transaction before that deadline, according to Hilco Streambank.

Dive Insight:

Zulily, which launched in 2010, peaked at a market cap of $7 billion in 2014. The following year, Qurate Retail Group purchased the company for $2.4 billion.

Qurate, which owns HSN and QVC, sold the e-commerce platform last May to Regent, a Los Angeles-based investment firm. As part of the agreement, its former parent company paid $80 million of its outstanding debts.

In early December, Zulily filed Worker Adjustment and Retraining Notification paperwork in three states, indicating the layoffs of over 800 people. Weeks later the company ceased operations and said it would liquidate its assets.

Earlier this month the company tapped Gordon Brothers to handle the liquidation of $85 million in inventory. Zulily said that, along with retail inventory, it is selling assets from its fulfillment centers in Ohio and Nevada.

“Zulily targeted an attractive audience — discount shoppers looking for the best deals on women’s and kids’ apparel, footwear, and home goods,” Hilco Streambank Senior Vice President Richelle Kalnit said in a statement. The e-commerce site had $666 million in sales in 2023, according to the company.

“A buyer of Zulily’s IP will have a prime opportunity to reengage these customers and to build on the Zulily brand recognition, including over 6.4 million social media followers across platforms, to acquire new ones,” Kalnit said.