DevanOnDeck held a pair of dad jeans close to the camera to give TikTok users a detailed look of the product, all while describing which demographic this item would appeal to and how to style it.

On its first shoppable livestream on TikTok in December, Walmart tapped DevanOnDeck, who has over 3.2 million followers on the short-form video-sharing app, and other top creators to showcase different apparel products.

The event received seven times as many views as the company initially expected, and Walmart's TikTok following rose by 25%. In fact, it was so successful the retailer did a second shoppable livestream event in March, this time focusing on beauty products.

Walmart's events are just a glimpse of what the livestream shopping market can offer retailers. Livestream shopping in China is already a multibillion-dollar market, and in the U.S., experts expect the industry's growth to take off, reaching up to $6 billion this year and $25 billion by 2023, according to Coresight Research.

In a time when shoppers are wary of being in physical shopping centers due to the pandemic, retailers, brands and social media apps have all jumped on the shoppable live content playing field in some way. In recent months, Nordstrom announced over 50 interactive livestream events, Facebook partnered with Anne Klein to debut its live in-app shopping feature and Petco hosted a live shoppable pet fashion show through Facebook Shops.

"From the consumer side of things, the appetite for that live content increased right at the same time" as when retailers were attempting to find interactive methods to put products in front of consumers, said Matt Moorut, senior principal analyst at Gartner. "It sort of makes a perfect storm where, from both sides of the equation, there's more of a reason to get involved in livestream commerce."

Businesses throughout the world have used livestreams in 2020. Mall of America in Minnesota collaborated with shopping app Popshop Live to introduce stores to customers, and Your Mark, a Chinese mall operator based in Hunan province, hosted over 200 livestream sessions a day during COVID-related lockdowns between Feb. 10 and 14 last year, according to Coresight Research. Meanwhile, a shopping mall in Singapore launched the country's first-ever livestream shopping festival mid-last year.

Holding a product in front of a camera while listing its winning qualities in an attempt to convince viewers to make a purchase is not a new concept. In reality, this method of showcasing products has been on television as far back as the 1980s when the likes of HSN and QVC were founded, Moorut said.

"The way that it sort of changed more recently is that the functionality now exists in a much more robust sense on social platforms, bringing close together influencers, brands, retailers to the consumers themselves in a whole number of different platforms and channels and avenues," he said. "That just means that the pathway from discovery to actual purchase is much closer than it used to be."

Retailers look to China for answers

China's appetite for livestream shopping foreshadows what the U.S. market could be. In China, where influencers would spend hours (sometimes all day) livestreaming, KPMG and research firm AliResearch expect the industry to reach $305 billion this year.

"We have the two largest markets by retail sales in the world," said Bob Hoyler, consultant at Euromonitor International. "I think it's natural for retailers to look at things that worked in one country to see if they might work in the other."

While retailers may be hopeful for the industry's growth in the United States, experts from Euromonitor International said there are some key differences between the shopping environment in the U.S and China to consider.

Though mobile purchases are becoming more prevalent recently, U.S. consumers have historically preferred to place orders on their desktop, experts said. Retailers generated 42% of their online sales from mobile devices, according to a 2020 study from Quiq.

"Livestreaming often happens on mobile phones," said Han Hu, research analyst at Euromonitor International. "China kind of skipped the process of PC-based e-commerce and just jumped to mobile commerce, and the fact that we have higher acceptance of mobile e-commerce drives the boom of livestreaming."

The live shopping market began in China by way of the gaming industry, she said. Taobao, a shopping website owned and operated by Alibaba Group, was one of the first platforms in China to crack the code on how to build a solid e-commerce livestream model, she added.

Some Chinese platforms monetized livestreaming through advertising fees or charged commissions based on virtual gifting from viewers in the past, Hu said.

"A reason why we're behind is because we have not developed these kinds of all-inclusive super apps in the same way that we see in the Chinese market."

Bob Hoyler

Consultant, Euromonitor International

Now, livestreaming has become less of a sales tool, where shoppers come in search of products sold below retail price, and more of a marketing tool, Hu said. Influencers explain product features in an entertaining way, bringing in celebrities as guests. Livestream shopping also appeals to viewers in remote areas in China that may not have access to some brands and retailers, she added.

"China is not very evenly developed in some lower-tier markets," she said. "So consumers can't actually get [to retail stores] to touch or feel the products. Then, with livestreaming, someone can help to explain the products that's more vivid."

Though U.S. retailers can draw inspiration from China's business model, the consumer environment can be hard to replicate, Hoyler said. Unlike China, the U.S. doesn't have "super apps," where consumers shop, make payments and connect with influencers all in the same place.

"We don't really have that to that extent in the United States. I think that's also a reason why we're behind is because we have not developed these kinds of all-inclusive super apps in the same way that we see in the Chinese market," Hoyler said. "Not to say that's not coming. That probably is something that's on the horizon right, but it's definitely an obstacle that the U.S. market has to overcome."

Building livestreaming's foundation

The renewed energy around livestream shopping in the U.S. is targeted towards younger consumers, with social media influencers playing a big role as key opinion leaders in the space, experts said.

While the shopping habits of different cultures may differ, younger consumers, regardless of where they live, are similar in how they use social media to connect. Livestreaming taps into that trait because, unlike the shopping channel model, it gives viewers the ability to have a two-way conversation with the host, said Alessandro Bogliari, co-founder and CEO of The Influencer Marketing Factory.

Gen Z and millennial cohorts had the highest livestreaming usage rate worldwide in 2020, according to data from Euromonitor. In China, millennials used livestreaming the most at 41.9%, and in the U.S., Gen Zers used it the most at 21.5%.

"Influencers, they understand their community," Bogliari said, which makes the viewing experience feel more personalized, and could then lead to higher conversion rates. He added that influencers make livestream shopping "more relatable and appear less commercial."

Influencers do, in fact, affect the purchasing decision of many Gen Zers. Almost half of them purchased something based on an influencer's recommendation, according to a 2020 study from Kantar.

Chinese livestreamer Austin Li, also known as China's "lipstick king," famously sold 15,000 lipsticks in five minutes during Alibaba's "Ten Years, Ten People" event in 2018. On Taobao, he was credited for driving $145 million in sales at the country's Singles' Day shopping event in 2019.

"There is a big interest [in livestreaming] mostly because of the creator economy," Bogliari said. "I'd say, more creators and influencers are finding that they can start using livestreaming, not only to entertain others but actually driving as an additional revenue stream."

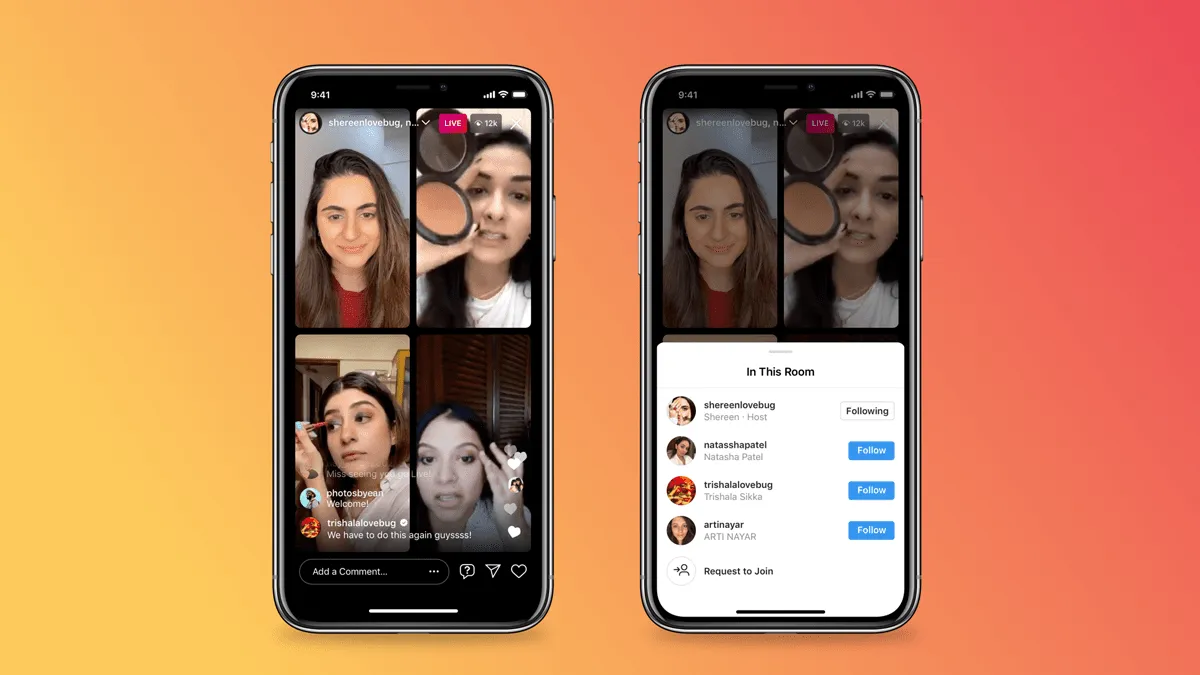

Social media platforms have expanded their livestream capabilities in recent months to give influencers and brands more options to interact with consumers. Instagram, for instance, launched a feature that lets users hold a livestream with three other people dubbed Live Rooms. Just last year, TikTok integrated shopping to their livestream for the first time with Ntwrk.

Still, the influencer landscape in the West is focused predominantly on lifestyle and less on the promotion of shopping content, Moorut said. And while consumers do like discovering products on their phone, where they often watch livestreams, they still conduct transactions on desktops because mobile shopping isn't as robust yet.

"There are also some technical integration difficulties," he said. "I'm saying that these sort of [livestreaming] platforms are becoming more mature, but this sort of technical ecosystem isn't to the same level as it is in China at the moment."

As more consumers get vaccinated and return to stores where they can see products physically before purchasing, the need for retailers to integrate livestreaming into their operations may be questioned, Moorut said. A recent survey from Kantar shows that 58% of consumers think physical stores have a better selection than online stores.

"I think that's going to be kind of an acid test for livestream commerce in terms of the rate of growth," he said. "So when those [stores] reopen, do those sorts of people still stick with livestream commerce or do they move back to what they've always preferred?"