Apple’s new wearable watch received the most attention at the company’s highly-marketed “big reveal.” But Apple Pay — the company's new mobile payment system — may have the biggest implications for the retail business.

Here what's retailers need to know.

The promise of Apple Pay

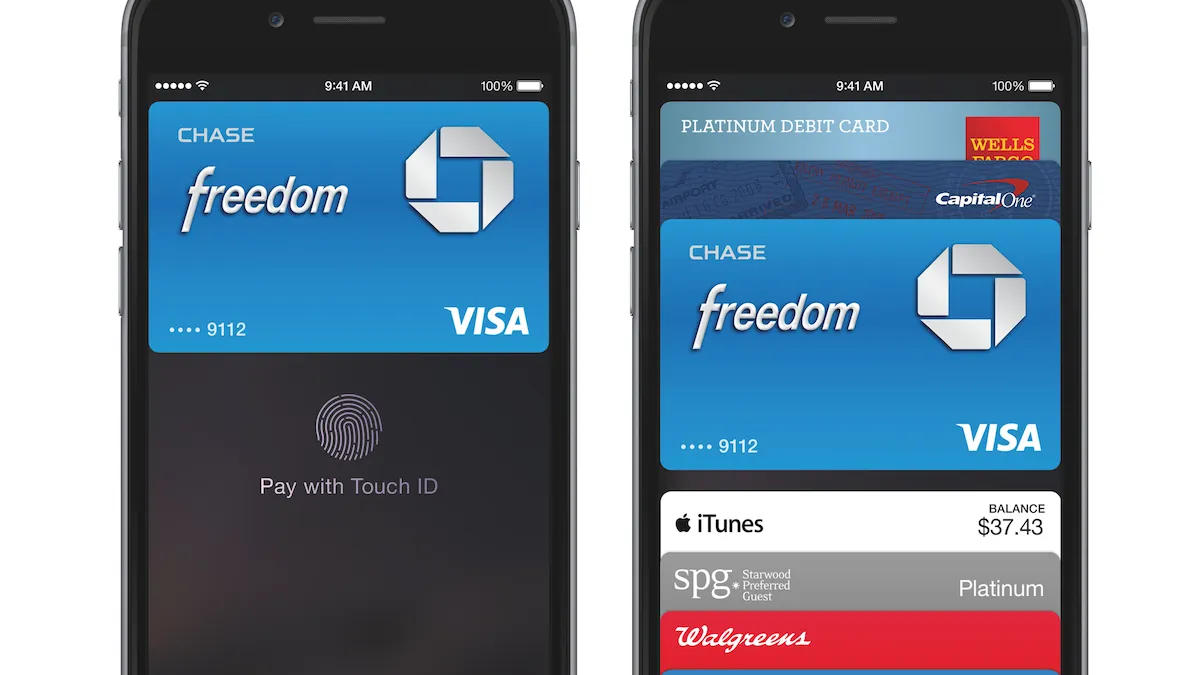

Apple is partnering with Visa, American Express, and Mastercard to roll out its new payment system, as well as banks such as Bank of America, Wells Fargo, and U.S. Bank. More than a dozen major retailers including Sephora, Whole Foods, Macy’s, and Walgreens will accept the payment system when it becomes available on September 19.

The fact that leading banks and credit card companies are partnering with Apple is a sign that the shift to mobile payment systems is getting underway. Unlike previous mobile payment ventures and alternative currencies such as Bitcoin, Apple Pay could achieve widespread adoption due to Apple's clout and the backing of the banks and credit card companies.

Unanswered questions: Apple Watch and security issues

The biggest draw to Apple Pay for consumers may be the additional security measures the payment method offers over credit and debit cards.

Card numbers, for example, are never sent to Apple servers or retailers. They are stored instead in the new iPhones’ Secure Element, a built-in security method. For each purchase, Apple creates a unique one-time payment number and dynamic security code that the retailer collects. Apple Pay will also require fingerprint authorization via its in-phone scanner for the signature.

Customers will be protected on many fronts: They never have to forfeit a card number and, if their phone is lost, the user can employ the Find My iPhone feature to disable Apple Pay.

But even with these security measures, Apple will still have to deal with the fallout from the recent iCloud hack that unearthed private photos from celebrities’ personal accounts. For its part, Apple CEO Tim Cook said the company will be ramping up its iCloud security measures in the upcoming weeks.

The new Apple Watch will also have Apple Pay capabilities, but the specifics of the device’s authentication technology have not yet been revealed. While the phone will require a fingerprint scan for each purchase, the watch is not fitted with a sensor, leading some to speculate on the security measures the Watch will have.

Interviews with MasterCard mobile payments executive Ed McLaughlin suggest the device might use other biometric data to authenticate purchases or, in simpler fashion, a pin code to be entered on the watch.

The future of payments

So will Apple's mobile payment system replace credit cards? Not so fast.

Apple Pay will be available at 220,000 retail locations starting in October. But when compared to the over nine million U.S. retail locations that currently accept credit and debit cards, Apple Pay has some catching up to do.

The payment system will only be available on iPhone 6, iPhone 6 Plus, and the Watch (when the Watch comes out next year). It also relies on near field communication (NFC) technology, something only 10% of retailers currently have. Wal-Mart and Best Buy have already announced that they will not be employing NFC technology in their stores, opting instead for a mobile technology network owned by retailers, in which they are part of, Merchant Customer Exchange.

Others are wondering if Apple Pay even offers any added convenience over traditional cards. To many, tapping your phone requires approximately the same effort as swiping a card.

But if it takes off, other mobile payment providers and smartphone companies will likely launch or expand their own contactless payment methods. And if customer preferences really do change from plastic to mobile, the days of credit cards could soon be over for retailers. But for many, that remains a huge "if."

Would you like to see more retail news like this in your inbox on a daily basis? Subscribe to our Retail Dive email newsletter! You may also want to read Retail Dive's look at four ways retailers can use social media to drive sales.