Dive Brief:

-

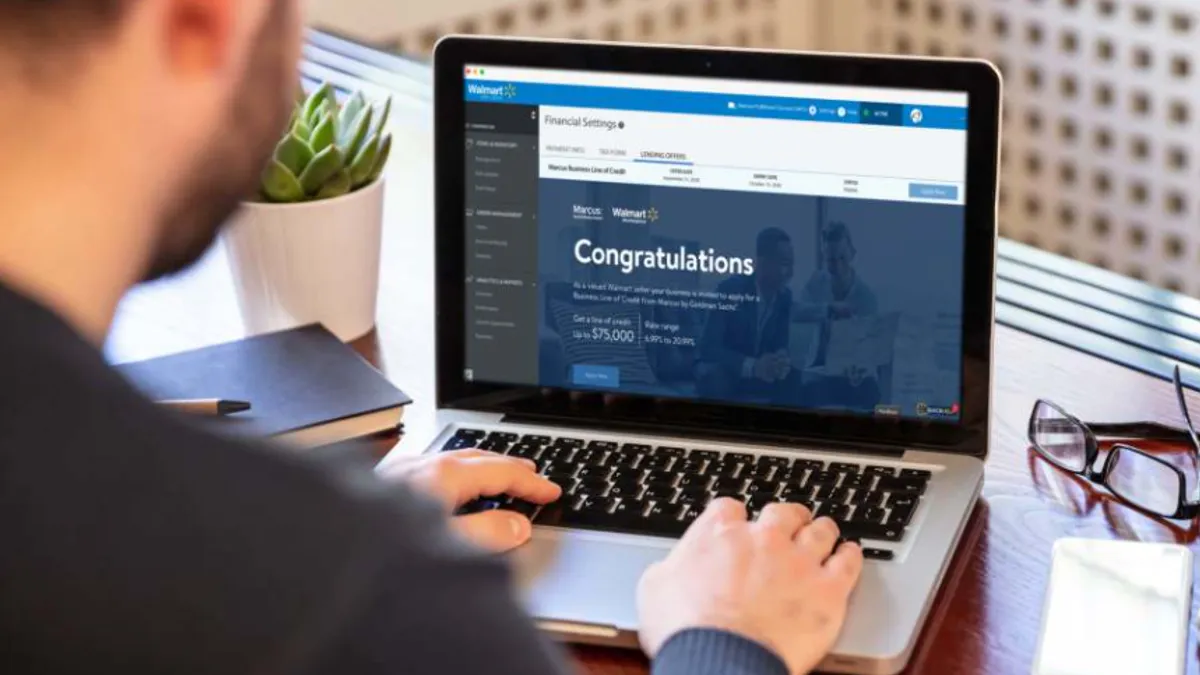

Walmart on Tuesday announced that it will provide eligible third-party sellers with lines of credit offered through Marcus by Goldman Sachs.

-

For now, sellers can apply for credit lines between $10,000 and $75,000, but the company plans to increase the maximum line of credit available for sellers in the future, according to the company press release.

-

According to the Walmart Marketplace website, sellers can request funds as needed over a 12-month draw period with fixed interest rates ranging from 6.99% to 20.99%. Per the company press release, the most creditworthy sellers will have access to the lowest interest rates.

Dive Insight:

The number of sellers on the Walmart Marketplace has doubled since last year, but the company cut down its product listing from more than 50 million to about 36 million items, according to a recent Marketplace Pulse report. The report also noted that the amount of online sellers grew by more than 5,000 since it partnered with Shopify in June to boost its marketplace.

In its announcement, the company stated that having thriving small and mid-sized businesses is crucial for the success of communities. Its approach falls in line with other companies such as Alibaba that have offered merchants flexible payment options. However, it differs from other companies like eBay and Facebook, which have each provided grants to small businesses upended by the coronavirus pandemic.

Goldman Sachs also partnered with Amazon to offer small and mid-sized businesses credit lines through Marcus in June with similar interest rates. However, Amazon merchants can access up to $1 million at a fixed interest rate.

"Access to affordable capital is more important than ever as businesses large and small work to adapt and evolve to serve customers and grow their businesses," Jeff Clementz, vice president of Walmart Marketplace, said in a statement. "Lines of credit offer businesses the flexibility to access money when they need, which could help them move fast and meet surging customer demand. It could also help fund innovation as we’re all working to adapt to constantly changing customer behavior and preferences."