Dive Brief:

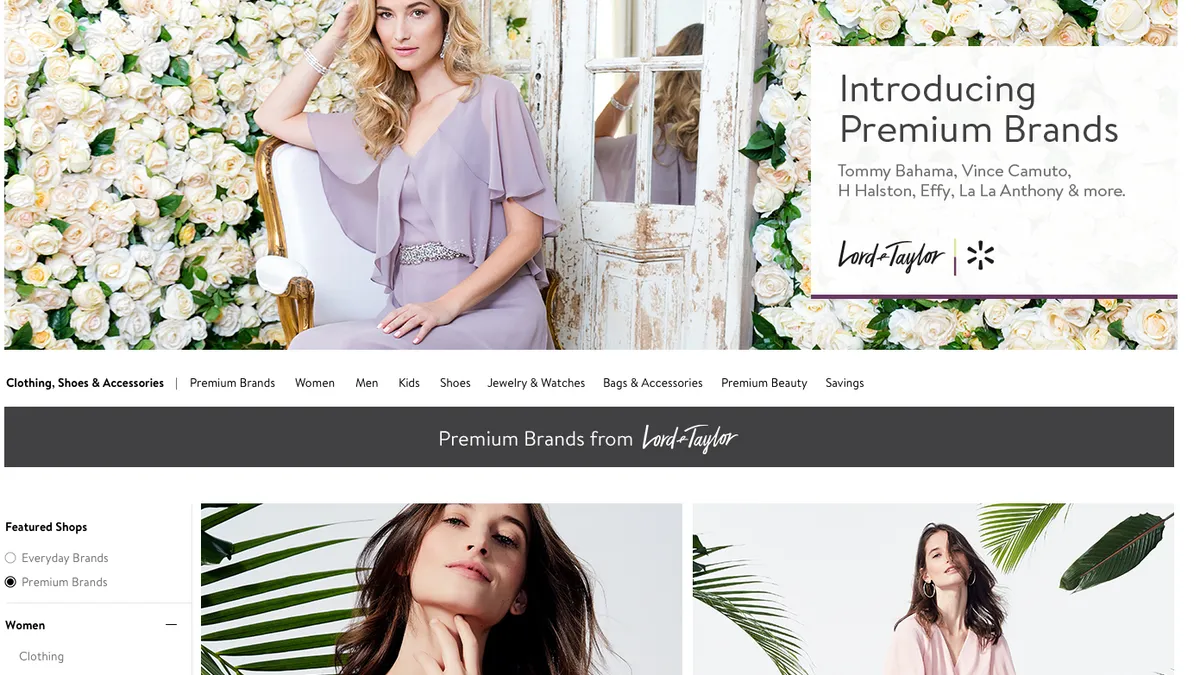

- In the coming weeks, Walmart.com will roll out a digital Lord & Taylor flagship store on its new online "fashion destination," which will offer up two shops — one for everyday brands and the other for premium ones — the company said in a blog post. The news confirms speculation of the deal, which was first reported by The Wall Street Journal in October.

- The new web mall will include more than 125 premium brands, including Tommy Bahama, Vince Camuto, Miss Selfridge, La La Anthony, Lucky Brand, H Halston and Effy, the company said. While the company believes Lord & Taylor's store complements Walmart's "affordable" fashion assortment, a "Premium Brands from Lord & Taylor" header will run across premium brand pages.

- The move is a part of Walmart.com's effort to rebrand as a fashion destination. The fashion website will also feature watches, luggage and travel, seasonal shops and premium beauty, the company said.

Dive Insight:

The way Walmart looks and feels online has changed dramatically since it's $3 billion Jet buy and acqui-hire of now Walmart e-commerce chief Marc Lore. In the nearly two years since, Lore has spearheaded a plan to amass trendy, millennial-friendly brands like Bonobos, Modcloth and Moosejaw. Those, however, weren't meant for Walmart.com, but rather Jet — a marketplace that targets a much younger and wealthier demographic than the company's parent.

Walmart.com's new "fashion destination" and overall e-commerce redesign shows that the company is modernizing in an effort to attract younger, wealthier customers to its flagship website too. "The new experience is aligned with how customers shop the category, with editorial elements that inspire customers to browse and buy, and has already generated positive customer response,” Denise Incandela, head of fashion at Walmart U.S. e-commerce said in a statement.

For Lord & Taylor, this deal could offer a new sales channel, which it badly needs. Earlier this month, unnamed sources told Reuters that Hudson's Bay Co., is looking to revive — or possibly sell — the upscale department store chain (which it has owned since 2012).

Unlike Walmart's marketplace, this new fashion destination is more of a web mall, and analysts are split on whether premium brands like Lord & Taylor will thrive there as they are forced out of shuttering brick-and-mortar malls. "What the heck are both sides thinking? Where is there any crossover whatsoever between Walmart and Lord & Taylor customers and, if you were Lord & Taylor, is THIS where you’d go prospecting?" Paula Rosenblum, managing partner at RSR Research, wrote in a discussion forum on Retailwire in October when rumors of the arrangement first broke.

But others said this could be just the challenge to Amazon that Walmart needs.

"It seems that Walmart is being tremendously creative — and hopefully will be successful — with their approach," Naomi K. Shapiro, strategic market communications at Upstream Commerce, also said in that forum. "Don’t make the mistake of thinking Walmart is stuck in its original image. It’s the only company I see that can launch (and succeed) in a successful, mass effort to challenge Amazon.