Walmart Connect last week made the latest addition to its suite of offerings for advertisers, launching a Display Advertising API that expands the onsite display ads that its partner agencies can offer through their platforms. The move is part of the broader evolution of the retailer’s advertising business, which grew 27% to $4.4 billion in 2024.

In beta tests with ad tech firms Pacvue, Skai and DataCaciques, the Display Advertising API helped drive a “huge” lift in performance when brands bought search and onsite display ads together, stated Ryan Mayward, senior vice president of sales at Walmart Connect.

Generally, customers seeing a brand’s ads in both search and display channels are three times more likely, on average, to buy the brand’s products, and they tend to spend 40% more on those items compared to consumers who saw just search ads, Mayward said. Similarly, campaigns for hardline products running both search and display ads concurrently saw an incremental sales increase of 39%, while campaigns in the retailer’s entertainment, toys and seasonal category saw a 67% boost, compared to campaigns with just search ads alone.

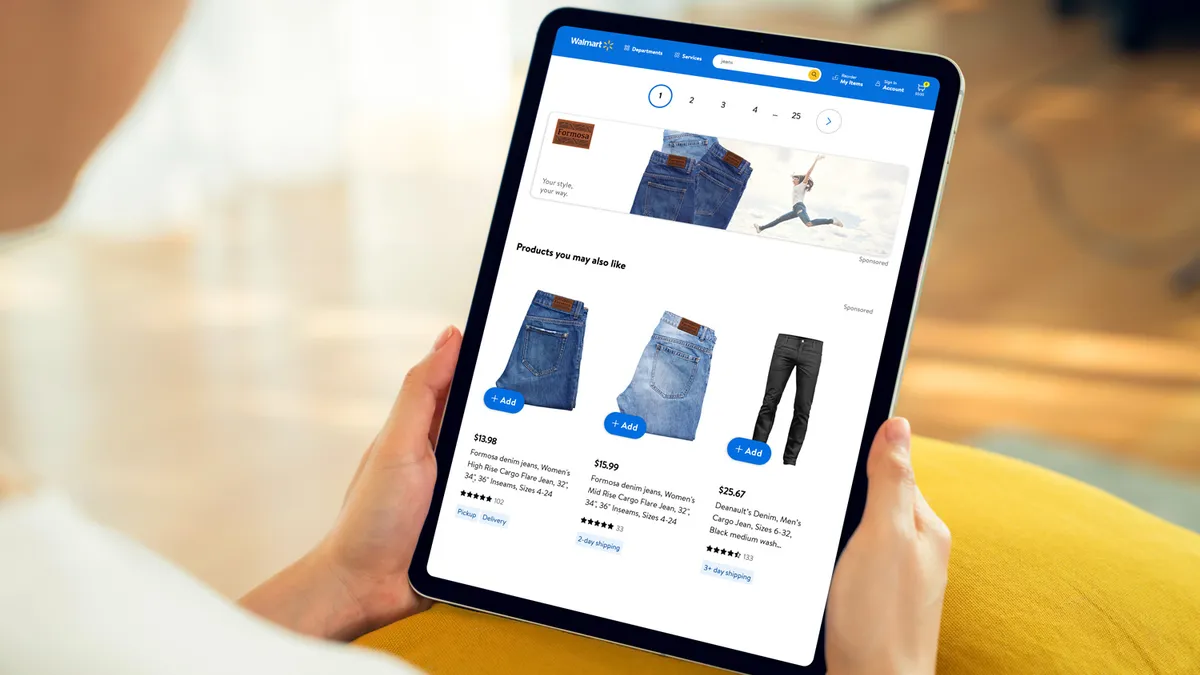

While Walmart has enabled self-service buying of display ads in the Walmart shopping app for a few years, marketers had to access Walmart Connect and buy through the company’s interface. The launch of the new API allows marketers to use their existing technology partners for campaign management, reporting and optimization tools — which could be a benefit for marketers looking to buy ads across an increasingly fragmented retail media landscape.

“The purpose of those companies is to help solve complexity for advertisers that are selling their products across multiple e-commerce platforms,” Mayward said. “We want to support that.”

Connect’s evolution

Walmart Connect, formerly Walmart Media Group, is relatively new, at least compared to offerings from competitors including Amazon and Target. Until about two years ago, the company was mostly concerned with creating a best-in-class paid search platform, and has since worked to build a tech stack in house. Walmart Connect now includes self-service buying tools, campaign management APIs and second-price auctions.

Simultaneously, Walmart Connect has grown its offsite media business, standing up the Walmart DSP in partnership with The Trade Desk and integrating with social platforms and major media companies to access connected TV (CTV) inventory — the fastest growing part of its ad business for the last couple years, Mayward said.

The two parts of the business have worked in tandem, enabling advertisers to reach Walmart’s customers offsite, drive them to the retailer’s app and use paid search to close the sale. But while those functions address the top and bottom of the funnel, the middle of the funnel has been underserved.

“The connective tissue in the middle — the consideration element of the funnel — has not been our strongest area. Onsite display is that connective tissue,” Mayward explained.

With offsite media filling the top of the funnel with prospects, display ads in the shopping app help close the gap before the bottom-of-funnel sale. Cost-per-click ads can help builds sales and drive incrementality, engaging with and pushing consumers into more high-intent searches or other shopping experiences.

Clean rooms and CTV

For brands seeking deeper insights about audience segmentation and performance than what it can provide with its standard reporting capabilities, Walmart Connect has been testing a clean room environment in partnership with an agency partner and several large CPG clients.

“The clean room will be a new area for us to help brands understand how to use more granular data to answer questions that they have that standard reporting metrics don't answer off the shelf,” Mayward said.

The complexity of Walmart Connect’s data is compounded by the CTV products that it has incorporated in the last few years. The company has seen significant demand for CTV from marketers, especially major food and consumable brands, who hope to use shopping-based signals to better target CTV ads and then used closed-loop measurement to determine outcomes.

Despite all the investment in the long-gestating convergence of CTV and retail media, experiments and testing are still needed to determine exactly what CTV can do — from driving consideration to product detail pages to attracting new-to-brand buyers and driving return on ad spend.

Walmart for years has been testing and learning with brands by accessing CTV inventory from NBCUniversal, Disney, Paramount and others through its Walmart DSP. Now, CTV is set to become an even larger part of the business as Walmart integrates the acquisition of smart TV maker Vizio, which closed in December and is expected to create new opportunities for advertisers.

“Vizio just compliments everything in that [growth],” Mayward said. “They're obviously operating independently and will for the foreseeable future, and you'll hear more from us during the NewFronts about what we have cooking.”