Dive Brief:

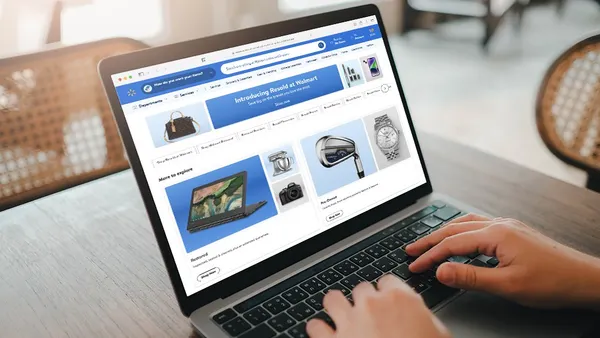

- Walmart rebranded its media network from Walmart Media Group to Walmart Connect, part of a larger overhaul the retailer is enacting as it looks to scale the offering into a top-10 advertising platform, according to a company announcement.

- Walmart Connect will focus on three areas: leveraging owned properties like Walmart.com, Walmart+ and the Walmart app to create holistic campaigns for advertisers; building out in-store experiences through assets like TV walls and self-checkout screens; and applying first-party data to improve media performance for sellers operating outside of Walmart's proprietary sites.

- On the last point, Walmart has partnered with ad-tech firm The Trade Desk to create a new demand-side platform (DSP) that is aiming to launch in time for the 2021 holiday season. The changes serve as another indication that Walmart is ramping up efforts to create a meaningful advertising competitor to platforms like Amazon and Google, with a spotlight on its capabilities in omnichannel retail.

Dive Insight:

Walmart is revamping its retail media network as the ad industry prepares for significant disruptions to mainstay targeting tactics. With the death of cookies looming on the horizon and Apple's plans to alter its Identifier for Advertisers early in the spring, marketers continue to prioritize first- and second-party data. Walmart Connect is emphasizing its strengths in those areas through its existing store empire and offerings like Walmart+, a membership service akin to Amazon Prime.

At the same, Walmart aims to better utilize retail channels like the 170,000 digital screens installed across its more than 4,500 stores. The blend of physical and digital capabilities speaks to the company's broader positioning around omnichannel advertising that helps it differentiate from digitally focused competitors, according to chief customer officer Janey Whiteside.

"We've built a substantial business that can serve clients in a way no one else can — as a closed loop omnichannel media company," Whiteside said in a press statement. "By expanding our offerings we're creating measurable value for our partners and customers alike in our ecosystem and beyond."

The company pointed to recent activations like its drive-in movie showings as an example of a physical experience where advertisers could reach customers with their ads.

Walmart is among a number of retailers, including Target, Kroger, CVS and Walgreens, that have sought to establish their own advertising businesses as demands for first-party shopper data and alternatives to the major digital platforms grow. Walmart Media Group has steadily gained traction over the years, and notched noteworthy gains as the pandemic pushed marketers to reassess their strategies, particularly when linking digital and physical retail.

In December, Walmart stated its retail media network grew net new advertisers by 40% in 2020. The Walmart Advertising Partners Program, a self-serve ad portal that debuted last January, accounted for about half of Walmart's sponsored products ad revenue.

Walmart stated that its ad revenue and overall number of advertisers doubled in the last fiscal year, though it did not break out specific figures. Growth has been reflected in product expansion: Last summer, Walmart introduced its first omnichannel analytics solution, Performance Dashboards, to help brands better track and manage their campaigns. But Walmart Media Group experienced changes that indicated a shakeup was in the cards. In October, the division lost its leader, Stefanie Jay, a key player in developing Walmart's ad strategy since 2015, as reported in Ad Age.

With the overhaul, Walmart is looking to expand a footprint outside of its owned properties as well, mirroring the way companies like Facebook grew into advertising empires. A DSP partnership with The Trade Desk is central to that strategy, with Walmart bringing in outside technology expertise to develop a product that aims to be available to suppliers and their media agencies ahead of the critical holiday sales period.