Dive Brief:

-

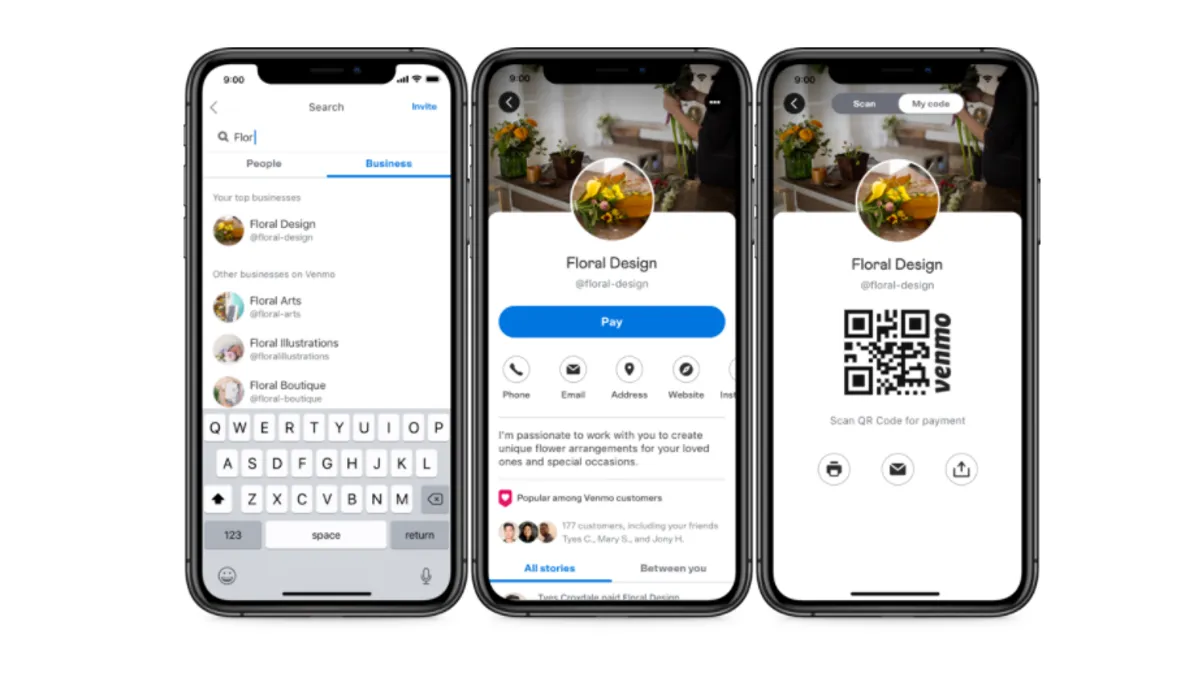

Venmo announced on Wednesday that it launched Business Profiles, a feature which allows small businesses to create profiles and accept payments for their goods and services.

-

With the payment platform's Business Profiles feature, sellers can accept contactless payments, attract new customers and gain transactional insights regarding customers. Businesses can track their company transactions, the number of customers and their customer database, according to a company blog post.

-

For now, the feature is only available to select retailers for free, but the company plans to make it available to other businesses within the coming months and possibly charge them fees to use the service, per the company blog post. Sellers with personal Venmo accounts can set up a company profile without creating a separate login.

Dive Insight:

In its announcement, Venmo acknowledged that the current economic climate has been challenging for small businesses, many of whom are sole proprietors. With the Business Profile pilot, the peer-to-peer payments platform follows in the footsteps of companies like Builder.ai, eBay, Facebook and Instagram, which have introduced tech tools and funding for small businesses.

The move also comes after Venmo engaged in partnerships with retailers and rolled out a new feature. Last October, the payments platform enlisted retailers like Target, Sephora and Sam's Club as collaborators for its cashback incentives on its rewards card. Back in August, the company also debuted an instant transfer feature that allows users to send funds immediately to their linked bank accounts for a fee.

Venmo mentioned in its announcement that it has more than 52 million users. The company noted that establishing company profiles allows small businesses to tap into that network of users without needing a substantial advertising budget.

Using the Business Profile service, merchants can use a unique QR code at their point of sale to facilitate contactless payments or send the code to customers via AirDrop on iOS or via their profile link. Allowing smaller sellers to have contactless payments follows in the footsteps of larger retailers like Walmart and Amazon who've rolled out contactless payments for themselves or other stores. It remains to be seen whether the coronavirus pandemic will push consumers to adopt contactless payments due to cleanliness concerns the outbreak has sparked.