Customers may be drawn to the autonomy and time savings scan-and-go checkout promises, but distractions ranging from rambunctious kids to in-store signage increase the chance they'll forget to scan products and walk out of the store with free merchandise — potentially costing grocers in the end, according to Adrian Beck, emeritus professor of criminology at the University of Leicester in the U.K.

Retailers and tech companies employ various safeguards, including front-end audits, but these all too often fail to flag un-scanned items, said Beck, who has researched loss prevention for self-checkout and scan-and-go programs.

In an analysis published last year of more than 140 million scan-and-go transactions across 13 major retailers in the U.S. and the U.K., Beck found added product loss of as much as 10 basis points for every 1% of sales. That means if a store did 10% of their sales through scan-and-go, product loss could go up an additional 1%.

According to the National Retail Federation, retailers currently lose around 1.4% of their product stock each year through theft, employee error and other factors, equaling more than $50 billion.

Beck's research also found that risk went up along with the size of shoppers' carts. Shoppers with 50 items in their cart had a 60% chance of having at least one un-scanned item, while shoppers with 100 items had an 86% chance of error.

Considering the already thin margins grocers operate with, an additional loss of up to 1% could be a significant blow.

"You can quickly see how you’re just simply not making any money," Beck told sister publication Grocery Dive.

The threat of theft — accidental or not — looms as retailers have rolled out scan-and-go technology in an effort to reduce front-end friction for shoppers. Meijer's Shop & Scan service is now available at all 246 of its stores, while Dollar General and Kroger have also introduced the technology to hundreds of stores.

Meanwhile, Walmart pulled out of its Scan & Go program last year, just four months after its launch at more than 100 stores. A spokesperson at the time cited low participation and too much "friction" in the program, but in an interview with Business Insider, the company's former head of Scan & Go said theft was also a reason for pulling the plug.

In May, Walmart rebooted the concept at a new supercenter prototype in Toronto. Customers access the scan-and-go program through the My Walmart app, then exit through a bright yellow lane. Walmart also offers "Check Out With Me," a program that puts checkout in the hands of device-toting employees stationed throughout the store.

The retailer's Sam's Club chain has continued to offer Scan & Go, and is looking to introduce new elements like computer-vision product identification to speed up the process, SamsClub.com CEO Jamie Iannone said at the Groceryshop conference last month.

Taking further precautions

To combat scan-and-go theft, retailers and tech companies employ front-end audits that verify customer scans against the products in their carts. Some, like Meijer, set an algorithm that will randomly select customers for a bag check. The program will notify store associates via an app or software, and they will then verify purchases before allowing customers to leave the store.

According to Meijer's website, "Shop & Scan orders get randomly selected for a service check. This helps us to understand any items that aren't scanning properly into the app so we can make improvements."

Other programs, like Kroger's "Scan, Bag, Go," require an employee to verify each customer order. Once the associate approves the order, the customer can pay through the app or at a self-checkout station.

But products can still slip through the cracks under these methods, Beck said. Rather than require workers to sort through a full order — and thus bog down what's supposed to be a quick process — audit programs usually give employees a random assortment to check, he said. But if intentional theft is taking place, the stolen items are most likely at the bottom of the basket. If a customer has 40 or more items, the chances of the associate finding the stolen products right off the top is unlikely, Beck explained.

Retailers also face theft risks with traditional self-checkout machines, research shows. In a much-publicized 2016 report, Beck and colleagues noted that a significant number of products went un-scanned by customers, and that retailers and service companies needed to provide additional training and protection measures to curb potential loss.

The same advice applies to scan-and-go, Beck said. To offer a foolproof scan-and-go experience, retailers need to offer several layers of security. This includes having a robust user identification system in place, establishing rules and expectations for customers and training employees to carry out thorough audits. Other systems like cameras, high-tech carts and training programs that help employees spot theft and encourage them to interact with shoppers can reduce theft further, he said.

As of now, Beck said, retailers are not doing enough to educate associates on how to properly check for stolen goods during the auditing process. They're also not educating consumers thoroughly on how to use the technology to reduce unintentional theft.

Fairway's play

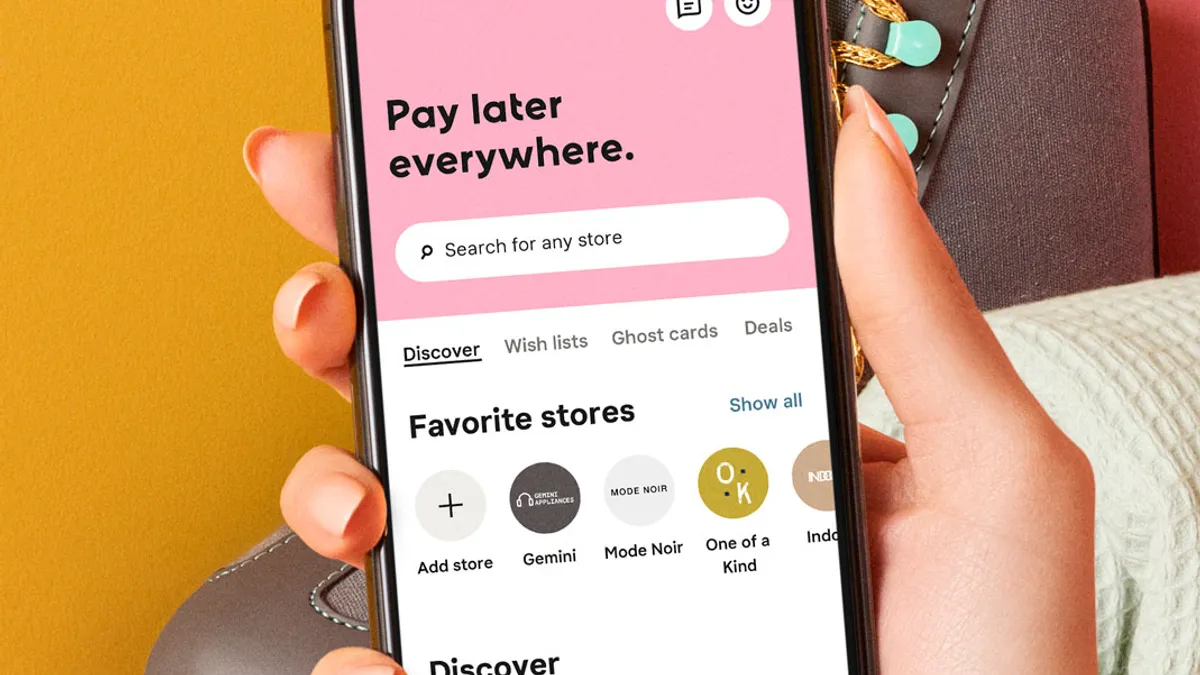

Last year, New York-based Fairway Market debuted mobile self-scanning checkout in partnership with tech startup FutureProof retail. The company now offers the service in all 15 of its stores.

Mike Penner, director of retail operations and technology at Fairway, told Grocery Dive the company has taken numerous steps to mitigate loss due to checkout theft. Shoppers are informed when they use the program that they are subject to a random audit. If products are found that don’t match the receipt, the associate will ask the customer if they would like to purchase it.

The app also requires customers to have a profile picture on file and to verify their identity via facial-recognition technology before they start shopping. Customers without a profile picture will be flagged and required to talk to customer service to ensure they're the one shopping, Penner said.

William Hogben, CEO of Future Retailproof, told Grocery Dive that customers who first start using the technology are more likely to be flagged for an audit. But as customers continue to use the program, their shopping patterns are tracked by the system and they'll be flagged less often.

Penner noted that customers who aren't familiar with the technology are a higher risk for unintentional theft, but said Fairway is taking proper steps to mitigate loss.

"We’re trying to educate the customer on how it works so their next experience gets smoother and smoother," he said.

Threat from advanced technology

For grocers that want to continue providing scan-and-go, investing in the technology can be worthwhile, said Beck, because it offers checkout innovation without the hassle and expense of retrofitting stores with expensive hardware.

Malay Kundu, CEO and founder of StopLift, a checkout vision system, told Grocery Dive scan-and-go can cut down on labor costs in stores where adoption is high. It can also promote smaller basket sizes with more frequent trips as customers don’t have to wait in long self-checkout or manned checkout lines, he explained.

Customer adoption could be a problem, however. A survey conducted last year by YouGov found 43% of respondents said they would try scan-and-go to avoid long checkout lines. But according to the report Beck authored last year, just 2.8% of all transactions came through the technology.

Newer competitors are also threatening scan-and-go systems, most notably smart carts and computer vision.

Startups like Caper and Veeve have developed AI-powered shopping carts designed to one-up scan-and-go by automatically logging products as customers toss them into the basket. Customers then pay through a card reader on the cart.

AI-enabled, checkout-free technology offered by Amazon Go as well as a growing cadre of startup firms also promises to scale up. The technology is expensive; the original Go store in downtown Seattle costs more than $1 million in hardware alone, according to Bloomberg. It also hasn't yet scaled to near the size of a conventional grocery store.

But Go has, in Beck's view, solved the problem of theft at retail.

"They’ve redesigned what we mean by loss," said Beck. "There’s no malicious theft in those stores. They say 'if you’re getting out and we haven’t identified it, then good luck to you.' Retail theft will disappear because it’s completely up to the retailer. When I spoke to them they said we really don’t have any loss."