It’s been another week with far more retail news than there is time in the day. Below, we break down some things you may have missed during the week and what we’re still thinking about.

From Tuesday Morning being warned of a delisting to Old Navy facing pushback on an extended sizing decision, here’s our closeout for the week.

Advocates petition against Old Navy’s decision around reducing extended sizing

Last month Gap Inc. drastically reduced Old Navy’s months-old BodEquality extended sizing initiative, blaming lack of demand for those items in part for its significant supply chain problems. Those issues early in the year undermined what is usually the conglomerate’s best performing brand. As many analysts have noted, however, Old Navy’s stumbles were also due to the brand missing style trends in all sizes, as well as to supply chain snafus affecting much of the industry.

The new policy once again makes it more difficult for customers in need of certain sizes by limiting the assortment to select stores. Customers will receive free shipping on their online orders only if they’ve determined that their local store doesn’t carry their size, according to Old Navy’s update on its policies.

Extended sizing advocates are now imploring the brand to restore its BodEquality promise, saying they fear that other brands will follow suit. While a few years ago several retailers and brands moved to make their sizing and merchandising more inclusive, companies like Loft and now Old Navy recently have walked that back.

“We do not want BodEquality to fail,” a Change.org petition reads. “We want this launch to be given more time to get a loyal plus-size customer base, instead of becoming the scapegoat for other brands to not try launching plus sizes.”

Deckers’ COO steps down

Deckers on June 10 announced that Chief Operating Officer David Lafitte has stepped down from his role to take on another opportunity, according to a company press release.

Additionally, the company announced that it has created the role of chief supply chain officer, and that it has promoted Angela Ogbechie to fill it, effective June 24. Ogbechie has worked with Deckers since 2008, most recently as the senior vice president of global operations and supply chain strategy.

"Our logistics network was instrumental to our record-breaking success in fiscal 2022, and we expect it will continue to play a meaningful role in our overall operations moving forward,” Dave Powers, chief executive officer and president of Deckers Brands, said in a statement.

Swarovski names first external CEO

Iconic jewelry brand Swarovski named Alexis Nasard as its new CEO effective July 4, according to a company LinkedIn post this week. This is the first CEO outside the founding family since it was created in 1895. The brand noted this is part of the transition from a family-managed to a family-owned business.

“[W]e are taking an important further step in establishing a sustainable governance model. With Alexis Nasard as the new CEO, we are very pleased to have been able to select a highly experienced and transformational leadership personality who is capable of leading Swarovski in the affirmation of its iconic Luxury heritage and through its business transformation,” said Luisa Delgado, chair of the board of directors, in a statement.

The news follows an announcement in October that the brand would begin searching for an external CEO appointee, after members of the founding family Robert Buchbauer and Mathias Margreiter had stepped down from the CEO and CFO roles respectively, as reported by Women’s Wear Daily.

Tuesday Morning faces possible delisting

Nasdaq has put Tuesday Morning on notice for not complying with its requirements for trading on the stock exchange. The home retailer’s stock, which was trading around $0.30 as of press time, has traded below $1.00 for at least 30 days, prompting the delisting warning.

The company has until Dec. 5 to regain compliance with Nasdaq’s minimum bid price requirements.

Tuesday Morning relisted on the Nasdaq just over a year ago after delisting in May 2020 when it filed for Chapter 11. Last year CEO Fred Hand said the relisting “signifies the Company’s recent financial and operational achievements as we continue to build a stronger company.”

Tuesday Morning also said this week that Bridgett Zeterberg — the retailer’s executive vice president of human resources, general counsel and corporate secretary — announced her resignation from the company, effective June 24.

E.l.f. Beauty doubles down on skincare

E.l.f. Beauty is looking to raise more awareness around its skincare offering, launching an E.l.f. Skin awareness campaign this month and introducing a new brand ambassador in Dr. Jing Liu, a dermatologist “with a passion for making high performance skincare accessible for all.” The beauty company is grounding itself in clean ingredients and cruelty-free certifications, along with affordability.

“E.l.f.’s mission is to disrupt industry norms and our journey into skincare aligns with this mission,” Kory Marchisotto, chief marketing officer at E.l.f. Beauty, said in a statement. “We’re democratizing clean and effective skincare.”

E.l.f. has skincare collections that cover oily and acne-prone skin, sensitive skin and normal or dry skin. The company sells at Target, Walmart and Ulta, as well as its own site.

Retail Therapy:

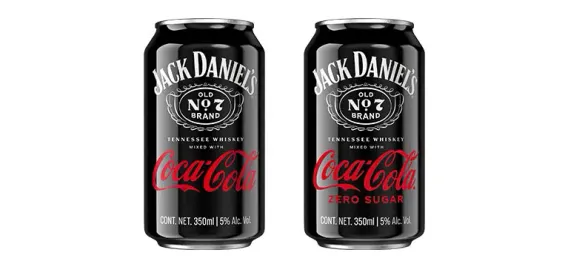

Raise a glass to branded cocktails

“It’s 5 o’clock somewhere” is the energy brands are taking into this week. Coca-Cola, in what seems like a move that should have happened earlier, is teaming up with the owner of Jack Daniels to make an official “Jack and Coke” canned cocktail.

So rather than spending $6 on a solo cup whiskey and soda beverage at the bar, fans will soon be able to buy a brand-sanctioned canned version with prominent logos. That seems to be the only difference. The cocktail will debut in Mexico in late 2022 and will later be available in other markets.

The three words they chose to describe the cocktail with: “consistent, convenient, and portable.” Notably missing is “good.” But at least you don’t have to worry about the bartender shorting you on the whiskey this time.

If you’re more of an “I can afford a Chanel private store” type of drinker, then may we present Gucci’s first signature cocktail: Elisir d'Elicriso. Mixology maestro Giorgio Bargiani says it smells somewhat like his hometown of Pisa in Italy, according to Women’s Wear Daily, but we would guess it smells more like new money.

What we’re still thinking about:

$3.5 billion

That was Revlon’s total debt when it entered Chapter 11 bankruptcy this week. The cosmetics giant is hoping to use the process to simplify its capital structure and cut its debt, which last year left it paying for more in interest payments than it made in operating income. RapidRatings analysis shows the company hosted negative cashflow for five years running, surviving in recent years on cheap debt capital.

The company has some $575 million in financing lined up to keep it operating through bankruptcy. It has some steep challenges ahead, though. Revlon said it is behind on its orders because of shortages of raw materials and is facing the closure of two manufacturing facilities for lack of inventory.

7.2%

That’s how much May retail sales increased year over year. Compared against pre-pandemic levels in 2019, that figure rose to 31%.

However, inflation — which reached a rate of 8.6% in May — caused retail sales to be closer to flat. Analysts remained optimistic, reporting the sales growth indicated a fairly steady consumer.

“Despite the highest inflation in 40+ years, consumers have demonstrated uncanny staying power thus far in 2022,” Wells Fargo analysts said this week. However, they warned that spending on goods may slow in the months ahead.

Several categories — which saw gains early in the pandemic, like home goods, sporting goods and electronics — experienced declines or minimal growth in May.

What we’re watching:

Adidas sues Nike for patent infringement of key technologies

Athletic retailer Adidas filed a lawsuit against competitor Nike on June 10, alleging patent infringement on nine Adidas patents. The brand specifically targeted Nike’s core mobile apps, such as Nike Run Club, Nike Training Club and SNKRS in the filing.

Adidas is asking that the court award it “damages in an amount sufficient to compensate” for the patent infringements, and an injunction against Nike to stop using the patented technology listed.

The latest legal battle shows that owning the rights to key technologies is important to both brands ability to remain competitive. Nike itself has a pending complaint against Adidas with the U.S. International Trade Commission asking for several Adidas shoe imports to be blocked because they infringed on a patent for Nike’s Flyknit technology.

Despite both companies being athletics apparel brands at their core, this latest lawsuit is not focused on design patents, or how an item physically looks. This filing is purely about utility patents, or how an item is used or works.

At the time of publication, Nike’s SNKRS app is currently ranked number 28 on the top iOS app list by Apptopia. Adidas’ Confirmed app is currently ranked 17.

While many of the apps Adidas targets in the filing aren’t new, many of Adidas’ mentioned patents are getting closer to their 20-year term. For example, the mentioned U.S. patent number 7,805,149 was a continuation of a patent originally filed in 2004.

Adidas did not respond for comment on the lawsuit and Nike stated they do not comment on pending litigation.