Dive Brief:

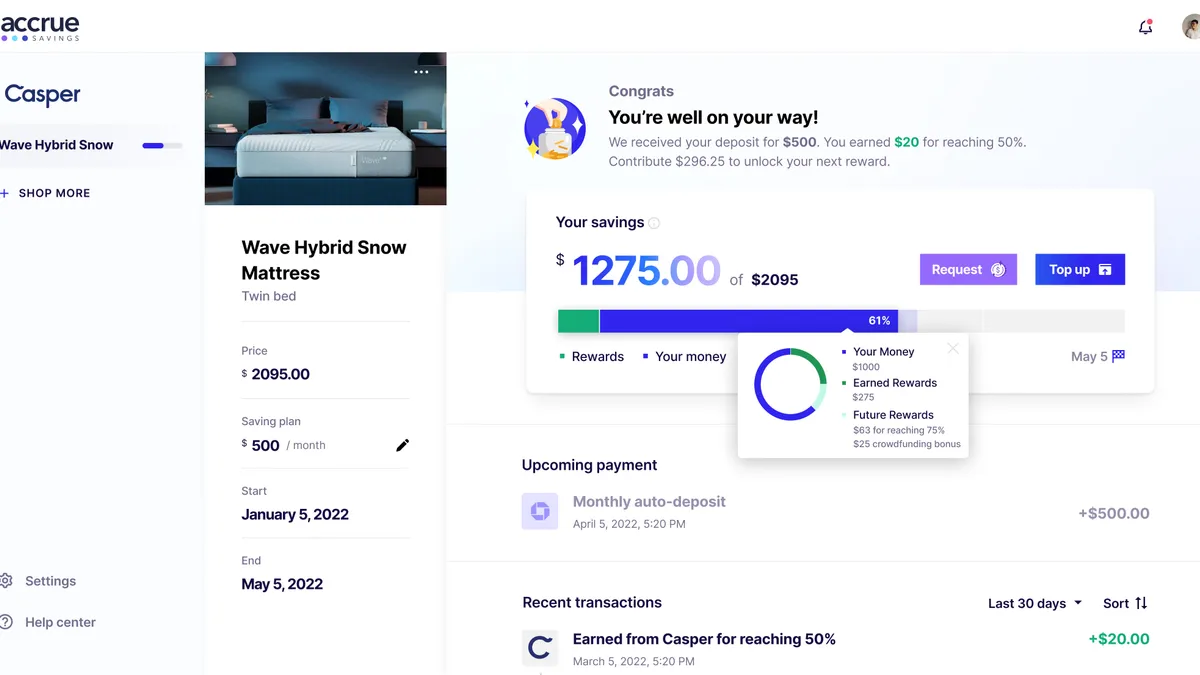

- Fintech startup Accrue Savings has raised $25 million in a fundraising round led by venture capital behemoth Tiger Global Management, according to a press release today. Accrue provides a payment tool by which consumers can save money toward the purchase of goods from about a dozen retail brands and receive rewards along the way.

- New York-based Accrue counts consumer retailers like shoe and apparel company Allbirds and mattress maker Casper among its partners. In November, the company announced raising $4.7 million in a seed round of funding.

- Accrue founder and CEO Michael Hershfield said the new infusion of capital will help the company grow quickly, driving hiring efforts and expanding retail partnerships. Hershfield is also a venture advisor at New York investment firm Silas Capital, which invested in Accrue, and was formerly the vice president of product and commercialization at the workspace real estate firm WeWork, according to the Silas website.

Dive Insight:

Hershfield founded the business last March and the company launched its Accrue services late last year.

As one of three siblings, Hershfield, who's Canadian, grew up in a savings-focused home. He recalled his mother's efforts to feed the family of five dinner for $10 or less, and "that sensitivity translated to me," he said.

That savings approach is what's missing for consumers, he contends, given younger generations' negative view of credit and the debt some are now accruing through installment purchases.

Historically, payments innovation has focused on credit — think retail credit cards and buy now, pay later — "and there hasn't been a lot of innovation around savings," Hershfield said. The majority of Americans are saving for certain purchases, he said. During the pandemic, Americans saved a massive $2.7 trillion.

"I believe there's a misnomer that Americans don't save," he said. Accrue offers "something that Americans are already doing; it's just creating a better solution to it."

For example, a shopper who wants to save for a pair of Allbirds shoes can choose a payment schedule using an Accrue savings account, which is linked to their bank account. As the shopper makes periodic contributions — with the option to solicit offerings from family and friends to complete their goal — the brand also contributes to the purchase when a customer hits certain milestones.

When the shopper has reached the savings goal, that amount is loaded onto a virtual Accrue debit card that's used for that specific purchase. Accrue partners with Blue Ridge Bank to hold consumers' funds. Shoppers can withdraw their funds if they choose during the process; rewards from the retailer are returned in that case.

While consumers don't pay any fees, Accrue makes money at the point of purchase, through card interchange fees (typically 1% to 1.5%) and performance fees merchants pay. Hershfield said the latter varies based on merchant size and average order value, so he couldn't comment on that fee percentage.

The Accrue approach is similar to the old layaway concept, but the company is "mission-driven" with respect to encouraging consumer savings, Hershfield said. "The business is raising the awareness around savings," he said.

The company now counts 15 retailers as partners — many direct-to-consumer brands — and Accrue plans to grow as retailers seek to provide diverse payment options, the CEO said.

Prime categories for Accrue include those where consumers often sock money away for bigger purchases, including travel, furniture, home, jewelry, health and automotive, Hershfield said.

Accrue investor Tiger Global has contributed to a flood of investments for fintech companies, generally, and a wave of money for payment companies in particular. "Accrue Savings helps brands reach more customers and gives consumers a responsible purchasing option," Tiger Global Partner Alex Cook said in the release. "It's a win-win."

The New York investment firm Twelve Below, which led Accrue's seed funding round, also recognizes a retailer benefit. Retailers are always looking to cultivate deeper customer relationships, and they grapple with rising customer acquisition costs, said Taylor Greene, a partner at Twelve Below, which focuses on fintech and healthcare.

Getting a shopper to save for an individual product is "a much more sustainable way to onramp a consumer to your brand and, ultimately, get them to make the purchase for something," Hershfield said. He doesn't see Accrue as a BNPL competitor but "a complement to BNPL in the merchant's chest of options."

Accrue's latest fundraising round comes amid heightened scrutiny over BNPL, which has grown increasingly popular with consumers.

Concerned about consumer debt levels, the Consumer Financial Protection Bureau has demanded information from five of the biggest names in the buy now-pay later arena. Affirm, Afterpay, Klarna, PayPal and Zip have until March 1 to comply.