With consumer, regulator and investor pressures growing in recent years, swapping out chemicals deemed harmful in product and packaging portfolios has become part of some retailers’ ESG strategies.

At the end of 2024, the nonprofit Toxic-Free Future released its retailer report card, which examines 50 retailers’ corporate chemical policies, such as those restricting plastics of high concern and toxic plastic additives. The list of retailers included e-commerce giants, grocers, restaurants, pharmacies and more.

According to information compiled by Mike Schade, director of TFF’s Mind the Store program, retailers continue to make progress on addressing chemicals and plastics in products and packaging: 22 retailers (44%) have current, measurable goals for reduction, and 34 (68%) had made reductions since 2020.

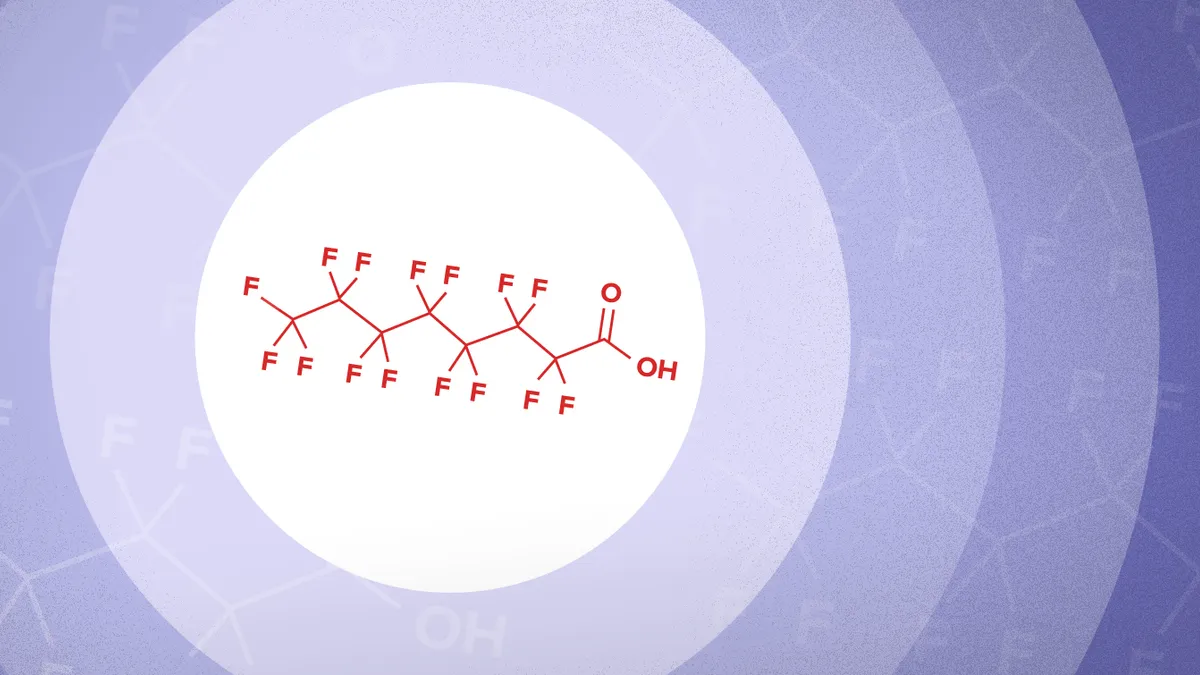

Regarding PFAS, 15 retailers (30%) have a phase-out goal; McDonald’s, Restaurant Brands International and Target specifically have 2025 goals to eliminate or reduce PFAS in packaging.

The TFF report also looked at action on PVC plastic in packaging. Nine retailers seek to do away with PVC from packaging, including CVS, Lowe’s, Sephora, Starbucks, Target, Walgreens and Walmart. This comes against a backdrop of heightened regulatory scrutiny of PVC: The U.S. EPA in December designated vinyl chloride, a synthetic plastic polymer in flexible packaging component PVC, as a high-priority substance for risk evaluation under the Toxic Substances Control Act. One possible outcome of such a review could be a ban.

Separately, the nonprofit Clean Production Action released its 7th annual Chemical Footprint Project late last year. It examines how large companies have reduced their use of chemicals of high concern, beyond just regulatory requirements. Packaging is just one piece of the chemical footprint equation, which also includes chemicals used in products and in the manufacturing process.

CPA says it tracks more than 50,000 chemicals of high concern, “many of which are associated with an increased risk of cancer, reproductive problems and birth defects, and adverse effects on the mental, intellectual, and physical development of children.”

CPA’s report sought to recognize some of what’s working as retailers shift to chemicals considered safer. “The 7th CFP Report results demonstrate the growing maturity of some of the world’s most successful businesses across six industry sectors in moving away from hazardous chemicals to safer solutions,” said report co-author Angela Pinilla, program director of the project at CPA, in a December statement.

In one example, CPA highlighted Reckitt, which owns brands like Air Wick, Lysol, Woolite and Clearasil, as a leader in reducing chemical footprint in the household and personal products space.

“Our ambition is for all our plastic packaging to be recyclable or reusable by 2025. We’re swapping multi-layer laminates for mono-materials which are easier to recycle, removing black dyes from our bottles that can impede the recycling process, and exploring the use of ingredients from circular feedstocks, which biodegrade better and which have a lower chemical footprint,” Reckitt was quoted in the report.

The U.S. Plastics Pact, which brings together retailers, brand owners and packaging manufacturers, aims for participants to eliminate all items on its Problematic and Unnecessary Materials List by 2030; that list includes PVC, polystyrene, intentionally added PFAS and more. As of 2023, 22% of USPP’s participants did not sell items with materials from that list.