Editor's Note: This piece was written by Amanda Bourlier, Head of Retailing, Euromonitor International. Opinions are the author's own.

While the end-of-year shopping season in North America is always a critical time for retailers, the holiday shopping season has taken on an even more important role in 2020. Retailers must contend with some of the same pressures as in past years, such as managing inventory of hot products and navigating shipping date cutoffs. At the same time, retailers this year face plenty of new challenges around public health, surging e-commerce and the sense that this holiday season requires a whole new playbook.

Prepare for a marathon season

In North America, the end-of-year shopping season has traditionally kicked off in late November. In the U.S., the season has historically been anchored by Thanksgiving and, in Canada, by Black Friday one day later. In 2020, however, major retailers such as Best Buy and Walmart announced they would offer deals between October and December, extending the holiday shopping season by over a month. Further, while Thanksgiving and Black Friday sales events will undoubtedly still take place in 2020, they no longer signify the start to the holiday shopping season. In 2020, Amazon's Prime Day on Oct. 13 and 14, with rival events by other major retailers over the same dates, served as the unofficial kickoff.

In addition to starting earlier, the 2020 holiday shopping season is likely to go on longer than in previous years and is expected to record a surge in e-commerce sales. Consumers are much more likely to return items they bought online than in-store, meaning they'll be looking to engage with retailers to make returns and exchanges in early January in a greater volume than in past years. Further, consumer trends have shifted so quickly and often in 2020 that demand planning is a challenge for most retailers. Several categories, such as apparel, continue to move sluggishly. Some retailers may find themselves needing to deeply discount unsold merchandise in January and February.

Prioritize clear shopper messaging

An end-of-year shopping season that starts earlier and ends later poses significant challenges for retailer operations and logistics, but it may also affect messaging to shoppers. In a suddenly longer holiday shopping season, consumers can no longer rely on their past experiences for when to find the best deals. Retailers must find ways to communicate clearly to shoppers when they should be buying.

This imperative to communicate is undermined in North America by the fact that many department stores and specialist retailers have engaged in frequent discounting over the past decade. Retailers thus face obstacles convincing shoppers that a given sale is truly the best one. Failing to do so risks creating frustrated shoppers and even leading shoppers to postpone discretionary purchases until January in anticipation of better, end-of-season discounts.

Promote value proposition, not just discounts

Shopper behavior is different during the holiday shopping season compared to the rest of the year. Time-pressed consumers are especially open to trying new services and visiting retailers they don't normally frequent to find the right gift. This makes the holiday season a prime moment for retailers to promote new services and channels and reach new consumer groups.

As a result, best-in-class retailers don't only try to offer the deepest discounts or the most promotions. Rather, top retailers take advantage of the attention on retail during the last quarter of the year to highlight their value proposition to consumers and drive strategic initiatives.

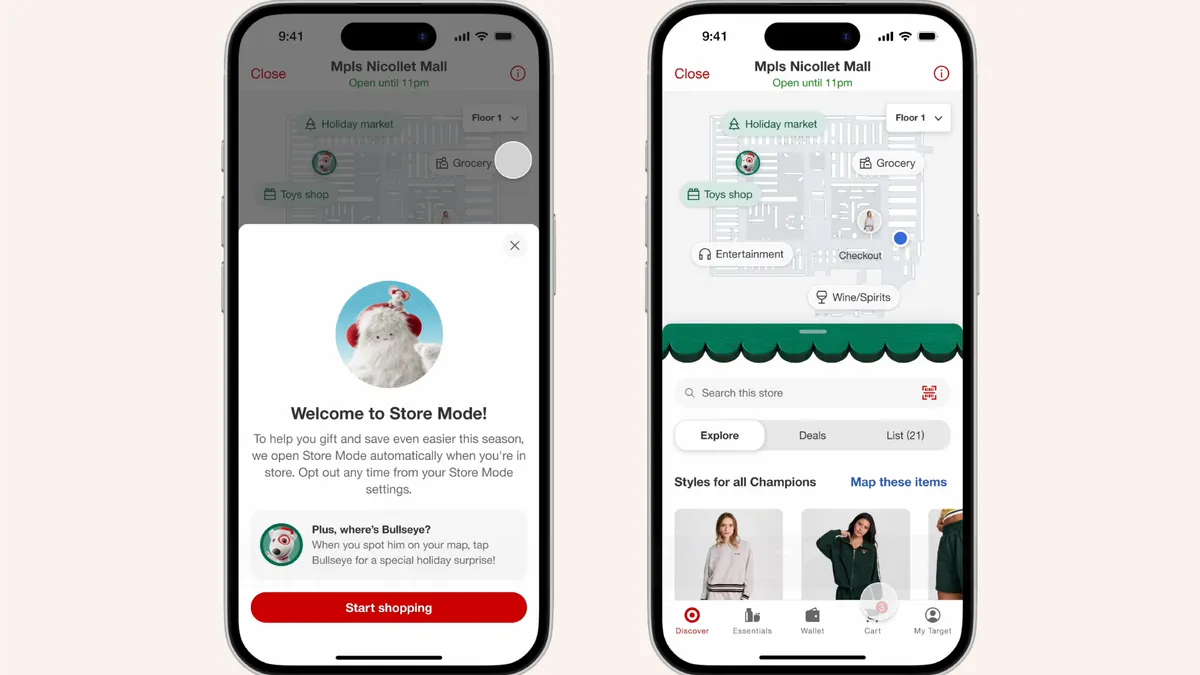

In 2019, for example, Target worked to increase the number of stores participating in its curbside pickup program, Drive Up, throughout the year. For the holiday season, Target claimed to be the only retailer in the U.S. offering the convenience of curbside pickup in all 50 states. Focusing on strategic advantages makes the most of consumers' attention on the retail sector during this time of year and works to attract and retain shoppers for the year ahead.

Lessons from 2020 will endure

Much has been written about how the 2020 end-of-year shopping season will be a season unlike any other. It is true that the 2020 holiday shopping season seems, at first glance, very different from previous holiday shopping seasons. But in terms of shopper preferences, future holiday shopping seasons will likely have more in common with 2020 than with 2019.

While the shift of holiday sales toward e-commerce has accelerated significantly in 2020, online retail spending has been growing for years in North America. According to Euromonitor International, e-commerce retail sales in the U.S. grew 15% in 2019 to reach $510.6 billion. Online holiday shoppers are likely to be even more entrenched in e-commerce following 2020.

Thanksgiving and Black Friday's role as the true start to the shopping season is also unlikely to return. Retailers had been inching earlier with pre-Black Friday sales for years because it makes their operations more straightforward and gives logistics partners more ability to balance demand.

Future holiday shopping seasons will hopefully be free of the public health concerns facing shoppers and retailers in 2020. But as retailers navigate this holiday shopping season that is unlike any they have seen before, they should be drawing lessons to apply to shopping holidays in 2021.