Dive Brief:

- Starting in October, new purchases in the U.S. made with PayPal's buy now, pay later option won't have any late fees if a consumer misses a payment, the company said in a press release Wednesday. Currently, late fees in the U.S. range up to $10 per missed payment, a spokesperson for PayPal said by email.

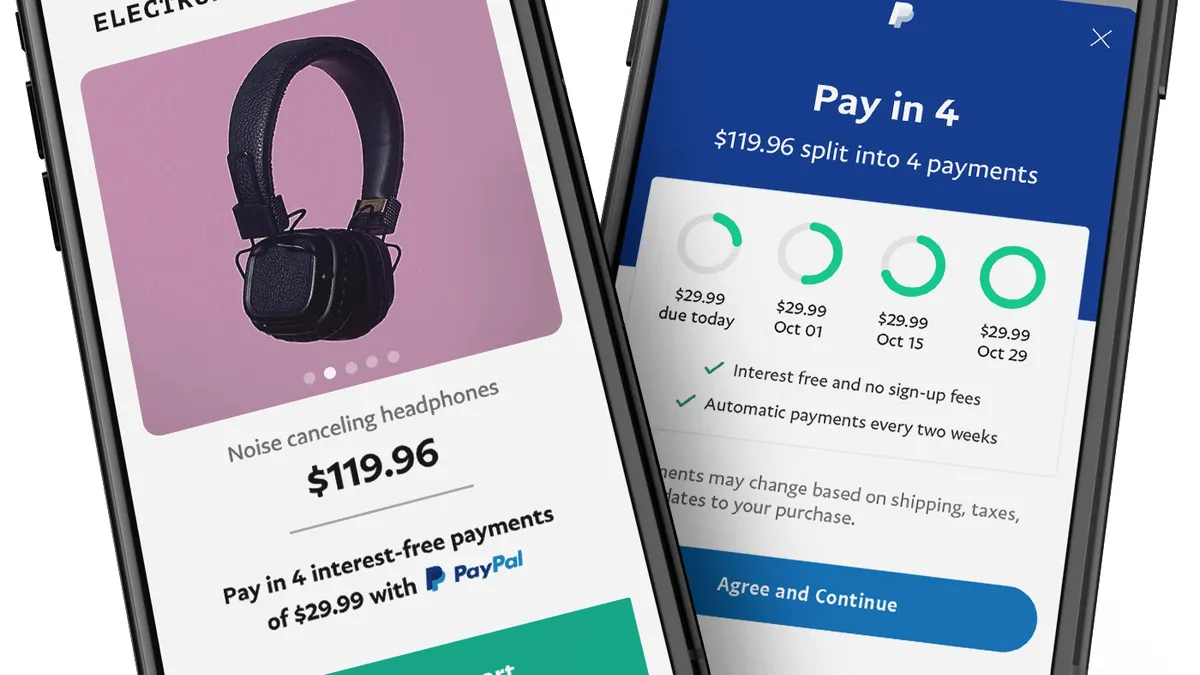

- The PayPal service, which lets U.S. consumers pay for a purchase in four installments, is interest-free to the users and comes at no additional cost to merchants. PayPal makes money on the service, as do the merchants, thanks to increased sales with the BNPL tool, according to the company.

- The company is also jettisoning late fees on purchases in the United Kingdom and France in October, making a clean sweep of the penalties worldwide, the spokesperson said. It never had late fees for purchases in Germany and Australia.

Dive Insight:

The BNPL trend started in Australia and Europe and is catching on in the U.S. too, with a flock of competitors, including Afterpay, Klarna and Affirm all wooing consumers. Because the payment method is generally interest-free, it has become an attractive alternative to credit cards for many consumers.

The BNPL payment option proliferated online as the COVID-19 pandemic drove up e-commerce, but some merchants and payment providers are making the option available in stores too.

San Jose, California-based PayPal lets consumers use its BNPL option to make purchases at "millions of online stores," according to its website. The consumer makes an initial payment and gets the goods right away, and then makes three additional payments every two weeks until paying off the tab.

PayPal assesses during the transaction whether to extend the financing option to a particular consumer. Merchants get paid upfront while PayPal takes the risk of extending the credit.

"The late fees are an important part of the BNPL revenue model, particularly for the fintechs who take high credit losses because of their loose underwriting," Brian Riley, an analyst with the industry consultant Mercator Advisory Group, said via email. "PayPal is in a unique spot because they have a broad global base of established customers. A PayPal account has at least one funding source, and frequently a backup. As a result, the risk is well contained."

In most states, PayPal's late fee is up to $10 per missed payment, but in eight states it's not allowed to charge any late fees (including Mississippi, Pennsylvania, Delaware, Indiana, Maine, Arkansas, Oregon and Maryland).

The company uses a calendar app and reminders to help keep customers on track with their payments, and extends a grace period of three or ten days for them to catch up on missed payments in the U.S., depending on state regulations. Ultimately, the company shifts customers to "delinquent status" if they don't follow through on payments, the PayPal spokesperson, Joseph Gallo, said by email.

PayPal launched its versions of BNPL in the U.S., France and the United Kingdom last year, with four installments in the first two countries and three in the third, respectively.

The company didn't have late fees in Germany because it charges interest on the service there, and it didn't do so in Australia because of "market dynamics" there, Gallo said. That's probably a reference to competition from the big BNPL player Afterpay. That Melbourne-based rival was purchased by U.S. payments company Square for $29 billion earlier this month, underscoring the popularity of BNPL.

For retailers and merchants, it seems a no-brainer to offer BNPL options. The payment method increases users' total tab, boosts their buying on goods put in their carts and improves repeat business, PayPal said in the release.

"We're very excited about PayPal's decision to no longer charge late fees, as it provides value for our consumers while also giving them the reassurance that a missed payment will not incur additional financial penalties," David Oksman, luggage retailer Samonsite's vice president of marketing and e-commerce, said in the release.

PayPal's tag line for the service is "Enjoy now, pay later." Still, some regulators have been asking hard questions about whether the services are good for consumers or plunge some deeper into debt.

A March blog post on the Federal Reserve Bank of Atlanta website noted BNPL's "growing popularity is gaining regulators' attention, both here in the United States and in other countries."

"Critics of the product categorize it as a way for consumers to buy things they can't afford," the post said. "Proponents of the product say it helps a consumer on a budget to make larger-dollar purchases and position it as a preferred alternative to a credit card, which can have a higher interest rate."

In the United Kingdom, the government has been deliberating over how the Financial Conduct Authority might regulate BNPL payment services.

The new policy on late fees isn't related to its other payment methods with its Venmo card or for the PayPal Credit installment financing option available in the U.S. and U.K., Gallo noted.