Dive Brief:

-

PayPal, an online payment provider, expects the popularity of QR codes and buy now pay later options to rise because the pandemic has changed consumers' payment preferences.

-

Since PayPal's launch of QR code payments for businesses last May, many merchants have adopted the low-cost contactless payment option. In Q1 2021, the company added a merchant to its QR code payment option every 28 seconds, PayPal CEO Dan Schulman said during the Q1 2021 earnings call.

-

The BNPL payment option is also gaining traction among PayPal users, attracting 3.3 million unique customers and 330,000 merchants since its launch in August 2020.

Dive Insight:

PayPal is wagering on the growth of QR codes, a square sketch that can be scanned for digital information that involves a transaction. It's also betting that the buy now pay later installment payment trend will continue this year. The company's executives made comments to that effect Wednesday during a call with analysts to discuss first-quarter earnings, including record revenue of $6.03 billion, up 29% from $4.62 billion in the quarter last year.

PayPal's QR code early adopters have increased transaction volume, and the re-engagement rate for the BNPL option is also high, Schulman said.

Since offering QR code payments for business use in May 2020, PayPal has drawn more than 1 million merchants to the feature. The company processed nearly $6.4 billion from QR code and card payments in-store in Q1 2021, Schulman said. He said he believes QR code-based payments will continue to gain momentum in 2021.

PayPal's merchants who use the QR codes are experiencing increased sales from consumers who frequently pay with that method, PayPal's Senior Vice President of Omni Payments, Jim Magats, said by email last month.

"Last Saturday night I went to have dinner… and they're [the restaurant] printing a receipt with a QR code on it right there," Schulman said during the earnings call. "It's a small anecdote, but I think it's a good example of what we're seeing in our business, where there's this convergence of online and offline that is really benefiting our business."

PayPal introduced the buy now pay later option last year and processed more than $1 billion transactions with that payment plan option in Q1 2021, up 36% from $750 million in Q4 2020. The company had about 3.3 million unique active users on its BNPL payment plan in Q1 2021, up 19% from 2.8 million in Q4 2020.

"50% of the customers who have used buy now-pay later have repeated [the payment option] within three months, and 70% have repeated it within six months," Schulman said.

PayPal’s 330,000 unique merchants using BNPL as of the end of Q1 2021 was up 33% from 250,000 in Q4 2020.

The company plans on expanding its BNPL option to Australia by the end of Q2 and into Europe by the end of the year on the heels of quick customer adoption and increased use.

Consumers using PayPal's digital payment service climbed 21% to 392 million in Q1 2021, up from 325 million last year. The San Jose-based company's total payment volume also increased 46% to $285 billion in Q1 2021, from $191 billion in Q1 2020.

Schulman expects digital wallets and cryptocurrencies to be a major growth driver for PayPal too. Since the launch of cryptocurrencies on PayPal, the company has seen a rise in user engagements. About half of PayPal crypto users open their app every single day, Schulman said. The company is also working with government agencies from across the globe to develop government-issued digital currencies.

"Both cryptocurrencies and central bank-issued digital currencies can play a critical role in shaping a more inclusive recovery and a more equitable financial system," Schulman said. "Our leadership in all forms of digital currency has been widely embraced, enabling numerous positive conversations with central banks, regulators, and government officials around the world."

Also during the quarter, PayPal announced it agreed to acquire Curv, for an undisclosed amount. Curv is a digital asset security technology company that will "accelerate and expand its initiatives to support cryptocurrencies and digital assets," PayPal explained.

According to a Morningstar analyst report on PayPal the company has "competitive opportunities and threats that create a fairly wide range of outcomes," in the long run despite it being a "unique player within the electronic payment ecosystem."

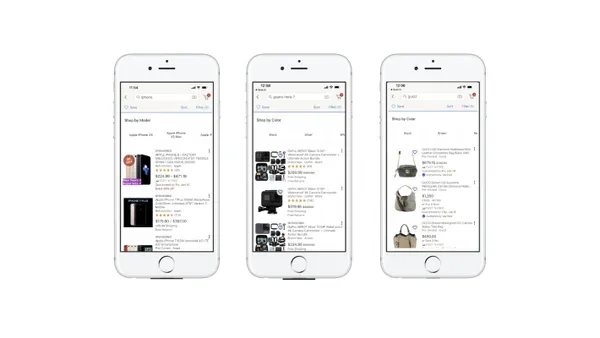

The company faces increased competition too. "With e-commerce becoming a more material portion of the market, traditional point-of-sale acquirers are building out their online capabilities," the Morningstar report on PayPal said in February. "This suggests to us that competitors are interested in replicating the PayPal model. On the consumer side, services such as Apple Pay represent a new type of competition for PayPal."

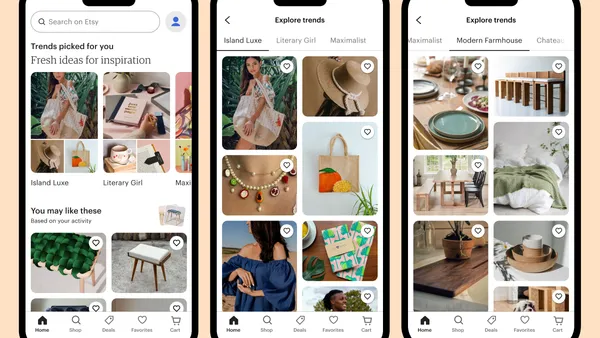

To get ahead of the competition curve, PayPal plans on building up Venmo, a peer-to-peer digital payment brand operated by a PayPal subsidiary.

"Venmo is going to move down the same path that the PayPal super app digital wallet is going down," Schulman said. "It's going to become a super app itself, putting in more and more capabilities and services around, again, shopping and basic consumer financial services and payments…[and] has international expansion in front of it."

PayPal’s super app initiative will be rolled out over the next 18 to 24 months, and it will offer a host of services such as digital transactions, peer-to-peer transactions, in-store payments, QR codes, loyalty programs, investing, shopping, marketing, and money management tools, according to an analyst report on PayPal from financial services firm William Blair.

"We continue to believe PayPal’s 377 million active users represent a powerful distribution platform for new technologies/features for PayPal and its partners, and that its ability to capture/use data will create opportunities," the Wednesday report from William Blair said.