After a year marred by store closures and budget cuts, marketers enter a new chapter more optimistic and more cautious.

Retail marketers were up against a challenge unlike anything taught in business schools last year. The pandemic and its economic fallout caused a chain reaction across every retail category and, inevitably, marketing. When nonessential retailers closed stores, furloughed employees and switched growth strategies, marketing departments had to bear the brunt of significant budget reductions.

"It's been a really significant year of upheaval for marketers across all industries," said Ewan McIntyre, vice president, analyst at Gartner for Marketers. "I think from a retail perspective that is just as pronounced, if not more pronounced, than any industry."

The challenges ushered in last year are still present. In response, chief marketing officers are turning to low-risk strategies in 2021. Seventy three percent of CMOs said they intend to focus on current customers rather than develop strategies to enter new markets, according to Gartner's recent CMO Strategic Priorities Survey emailed to Retail Dive.

Retail marketers are treading a fine line between wanting to try innovative strategies and expand on the digital front while also minimizing risk, the report indicated. While a focus on the retention of existing customers is a safe bet, it might not be enough to thrive, especially in the current unpredictable conditions.

Marketing budgets are still in for a tight squeeze

It's no surprise that marketing budgets shrunk as a result of the pandemic, said McIntyre. The majority of CMOs, about 65%, had prepared for cuts because of the mandatory shutdown of some locations.

By the end of 2020, however, global ad spend dropped even lower than expected. The ad market declined by 10.2% — that's double the reduction seen from the 2009 recession, according to a recent report from WARC.

Companies like Tapestry, Best Buy, The RealReal, Capri Holdings and Chico's announced unquantified reductions to their marketing budgets. Kohl's, Kirkland's and At Home also slashed costs in that department.

Even Amazon, whose overall net sales rose 40% in the second quarter, announced cuts. CFO Brian Olsavsky said on a July call that the e-commerce giant cut marketing costs by about a third in the second quarter of 2020 to manage the demand triggered by the pandemic.

WARC's ad report projects that it could take at least two years for ad spend to recover from the downturn.

Contrary to reports, some marketers do expect budgets to bounce back by more than 15%, said McIntyre, citing a survey conducted by Gartner. He said the expectation might be unrealistic given the extent of time it would take to get residents in a large country like the U.S. vaccinated.

"2021 frankly is going to be more like 2020, than it was like 2019," he said. "Marketing may well be confident that they're going to see their budgets increase. But if I look at data from the office of the CFO, for example, or some data that we have from the Gartner Board of Directors there's a strong indication that marketing budgets will continue to be squeezed in 2021."

E-commerce has been rising all year long, and those that already had a strong digital presence are reaping the benefits. Black Friday illustrated this digital shift last year, with shopping apps hitting a record 2.8 million installs, according to estimates from Sensor Tower Store Intelligence. Smartphone shopping was up 25% from the previous year, according to Adobe Analytics data.

Though the pandemic has accelerated the push for digital retail platforms, that doesn't mean that every dollar spent on digital is money well spent, said McIntyre.

Marketers need to take "a long hard look, that is, into digital media spending, the efficiency that we're getting from it, and this idea that nobody ever got fired for spending on paid digital needs to go away," said McIntyre. "Frankly, this idea that ‘offline bad, digital good' just doesn't hold any water."

The pandemic pivot might become the marketing norm

From responding to the pandemic to the Black Lives Matter protests and political division, the events of 2020 spurred the need for marketers to address inefficient industry practices. Marketers implemented years' worth of innovation within a few months to keep up with digital natives.

As a result, marketing has adapted a more agile way of planning, said Shar VanBoskirk, vice president and principal analyst for Forrester. Historically, marketers planned their strategies 12 to 18 months in advance, which in retrospect was not very timely, she said.

"All of a sudden then, the circumstances of last year showed that buying media 18 months in advance of a condition like what we all went through last year makes absolutely no sense. So, I am seeing CMOs really working to hasten the way that they do media planning," she said. "They're putting pressure on their media partners to allow them more flexible terms so that they can have guaranteed performance."

Having flexibility in their contracts allows marketers to make faster adjustments to their messaging or product placement if a major event happens.

CMOs were quick to reorganize their priorities. As the pandemic shifted the way retailers communicated to their customers, CMOs had to trim away traditional media and place a special focus on contactless digital mediums.

"We started watching marketing move into a more innovation role," said VanBoskirk. "I think marketing got very comfortable, historically, playing maybe a sales enablement or a communications function, but not really a thought leadership or a business strategy role."

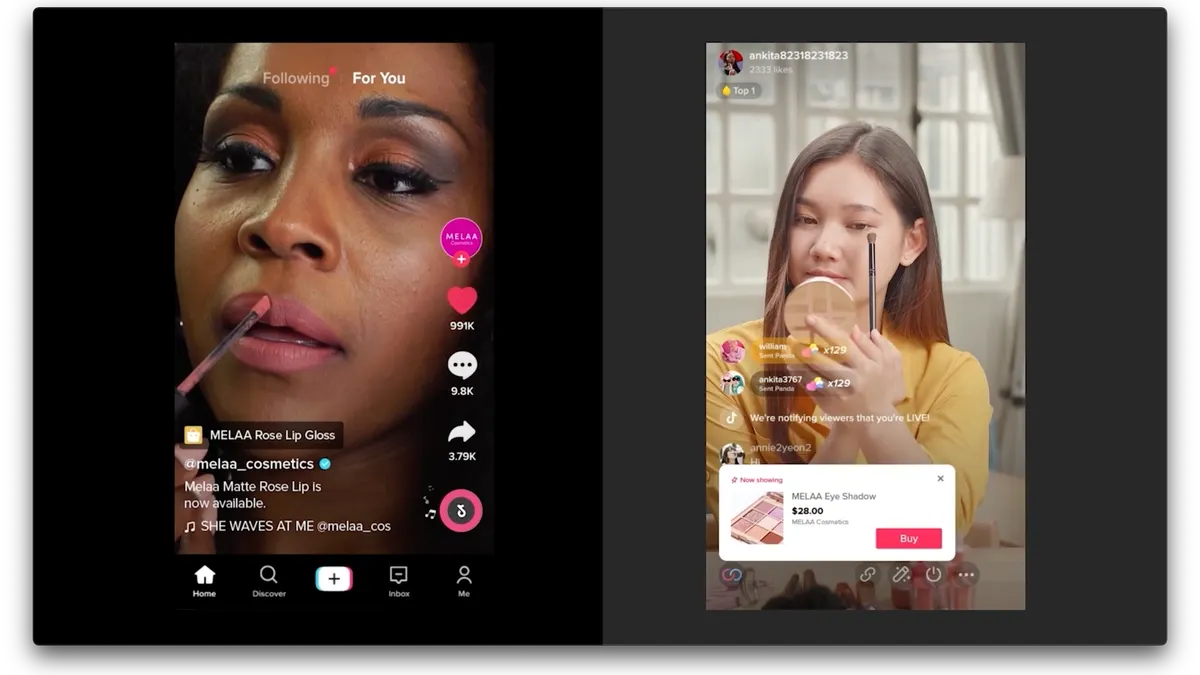

Email marketing continually received investments due to their addressability, meaning marketers could use this channel to send marketing messages like health protocols or changes in store hours to their target audience, said VanBoskirk. The emergence of new platforms in mobile communications like Tiktok and Instagram Marketplace meant marketers needed to adapt to less comfortable mediums.

Social and performance-based media, such as cost-per-click or cost-per-action, were appealing to marketers in 2020 due to the cheap price tag, she said. However, she said traditional retailers can learn from direct-to-consumer brands' ability to provide an authentic and personalized experience to their consumers.

"I am actually telling marketers, not to go too far toward the performance-based approach. I get the appeal because economically, it's guaranteed," she said. "I actually think it's the goodwill in brands that will carry them out of such a difficult economic time."

Consumers have changed their expectations on brand experiences and personalization as they become more digitally engaged. In a recent Forrester survey, about 63% of consumers said they prefer brands that contribute to local communities, and 57% said they intend to purchase from companies that contribute to sustainability more often over the next two years.

The report also signals that consumers are increasingly becoming more tech-savvy and demanding more from brands.

Major retailers are catching up on that front — mostly out of necessity, said Ronald Goodstein, associate professor of marketing at Georgetown University.

"The expectation that all the customers are going to return to the stores is not reasonable. I think that they are training customers that you can shop and do everything you needed to do [online]," he said. He added that "the big danger for all these stores going online is, what are you doing to continue to build your brand?"

To elicit excitement from customers, marketers often use discounts to promote their products, Goodstein said. But in doing so, they risk losing equity and do little to build the brand. Without building their brand, companies risk becoming "a comparison set to what you can get on Amazon."

Instead, retailers need to make room for mission-driven messages where marketers produce content not just to sell a product but also to sell an idea. To do that, marketers have to explain what it means to build a brand that resonates with quality to their CFO, he said.

Some CMOs have started focusing on brand strategy over analytics, personalization and marketing technology for the first time, according to an announcement from Gartner last July. About 33% of CMO's surveyed ranked brand strategy as one of their top three priorities — a significant upshot from being in the bottom half of the list in 2019.

"You're going to have to teach your CFO what brand equity means. What does it mean to have a brand that resonates quality?" Goodstein said. "Because some of the marketing budgets now is going to have to go to building the brand, not announcing more sales."

The role of a CMO

An ineffective marketing team can no longer hide behind a booming economy or a good quarter, said VanBoskirk. If the CMO couldn't deliver on their goals or didn't contribute to the brand's strategy, it became more obvious, she said.

Several top brands had either named or fired their CMOs, even before the pandemic — in some cases, completely reinventing the title. The role itself has become far more complex as the pandemic pushed companies to look for a specific set of skills in their CMO in addition to having a broader umbrella of responsibilities.

The term "marketing" can be somewhat ambiguous, which is why other functions in the firm have taken on the marketing job, VanBoskirk said. In 2021, she expects marketers to realize that customer experience and marketing have the same goal: Demonstrating the brand promise.

"I believe the marketing function is responsible for those three things: customer understanding, brand strategy and brand experience. And what you call that person who is responsible for the function that runs those three things could be anything from a chief marketing officer to a chief growth officer to a chief experience officer, or to a chief customer officer," said VanBoskirk. "In most companies where it's not called the CMO, it's because the CMO somehow didn't take responsibility for those things."

With consumers spending more time online, digital and data competency are some of the skill sets that brands now expect when appointing a new CMO, according to Tim Derdenger, associate professor of marketing and strategy at Carnegie Mellon University.

Understanding these pandemic-driven trends and how consumer behavior will evolve are some of the top concerns of marketers. A survey from Dentsu last October indicates that a little over half of CMOs (52%) feel unprepared for the next six to 12 months.

CMOs need to recognize "that these trends aren't going away. They're just going to get more prominent," said Derdenger. Big firms have the workforce and the resources to implement quick changes to fully integrate online and physical shopping experiences, "but for small- and medium-sized businesses, they're going to have to make these transformations as well, to be competitive again."

In addition to keeping up with the trends, brands are pressuring CMOs to plan strategies on a shorter timeline — a struggle they've had for years, only exacerbated further by the pandemic.

"Over a significant period of time, marketing is just not as good at doing scenario planning as other functions within the enterprise," said McIntyre. The COVID-19 pandemic has seemed at times as if it "masks some of the other significant challenges — the geopolitical, cultural and political challenges — that brands have had to respond to in 2020. It's been such a year of change," he said.

Marketers should also beware of the hype around future-forward digital capabilities, he said. While there are benefits around investing in these innovations, CMOs must make sure that these technologies are appropriate for the company's needs.

Marketers have learned to switch gears from making near-term reactions to a crisis to making long-term cultural shifts within the marketing space, McIntyre said. Now that marketers have a better understanding of consumer trends, they ideally have the muscle to anticipate potential scenarios, he said.

"If good comes out of the challenging situation, it will be that marketing becomes more fiscally responsible, and we'll get better at being able to defend and prove the value of our budgets," said McIntyre. "Perhaps next time around, marketing won't be the first on the list for budget cuts because we've gotten better at this stuff.