Dive Brief:

-

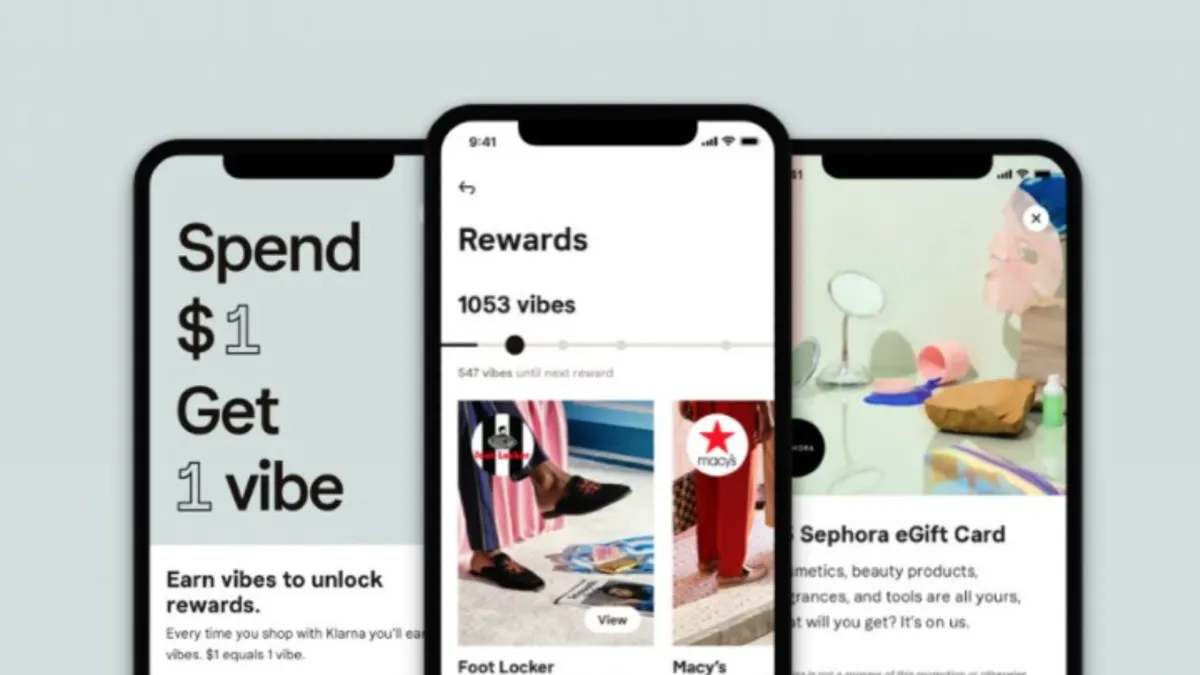

On Tuesday, installment payments platform Klarna introduced its no-fee customer loyalty program called Vibe. The program will be made available to U.S. customers in June and extended to Germany, Australia, Sweden and the U.K. within the next year, according to the company's announcement.

-

As Vibe members make purchases through the Klarna app or use Klarna at one of its partner retail stores, and pay off their purchases on time, they'll earn one Vibe (or point) for every dollar they spend, which can be redeemed for rewards including gift cards from partners like Starbucks, Sephora and Uber. Members will also be able to access online and offline sales and shopping experiences, per the company announcement.

-

The company noted that it developed its program through feedback from customers who were displeased with the difficult navigation of traditional credit card loyalty memberships and wanted more freedom. Customers will be able to earn an "extra layer of rewards" if they shop at a retailer where they already are a loyalty member.

Dive Insight:

In addition to Klarna's partnerships with retailers, including Rue21, Toms and Asos, and the introduction of its 'shop now, pay later' app, the company recently reached a milestone of 7.85 million customers. The company acknowledged in its Vibe announcement that customer loyalty programs have been a staple for some time, but it's hoping to attract consumers through rewards that aren't attached to high interest rates and fees that typically come with credit cards.

"Vibe members have the freedom to shop everywhere and will enjoy access to unique, tailored benefits from hand-picked partners in addition to exclusive offers, deals and other rewards," Sebastian Siemiatkowski, CEO of Klarna, said in a statement.

Loyalty programs have undergone revamps at many retailers over the past several years as credit cards fall out of favor and experiential rewards gain in importance. Klarna isn't the first to see the value in a model that allows customers to spend points at multiple different retailers. The Plenti program, developed by American Express, was built on similar ideas, but fell apart in July of 2018, shortly after some of its main partners dropped out of the scheme. Some retailers have taken on a similar model on a smaller scale, building out loyalty programs that allow customers to earn rewards by spending at any of their individual banners, including Gap, Inc. and Ascena.

More recently, retailers including Sephora and Macy's have been reexamining their own loyalty programs and adding new benefits for members.