There came a time when teens clad in low-rise jeans and T-shirts with giant logos from the likes of Express, Gap and Abercrombie & Fitch filled every high school classroom in America.

That point in time, however, is not 2021. As of spring, some of the most popular brands for young consumers back then are now ones teens say they no longer use, according to a survey from Piper Sandler.

Express, Gap and Abercrombie & Fitch were three of the top brands teens preferred in 2001, according to Piper Sandler. Gap and Abercrombie have, for nearly a decade, been ranked among brands male and female upper-income teens no longer wear. Though Express hasn't been on the undesired list in recent years, it hasn't been in the best standing either, with its ongoing store reduction and its third-place ranking in S&P Global Market Intelligence's "Most Vulnerable U.S. Retailers" list as of Aug. 16.

Top brands no longer worn among upper-income teens

| Spring 2020 (Male) | Spring 2020 (Female) | Spring 2021 (Male) | Spring 2021 (Female) |

|---|---|---|---|

| Under Armour | Justice | Under Armour | Justice |

| Adidas | Aeropostale | Adidas | Hollister |

| Nike | American Eagle | Gap | American Eagle |

| Gap | Hollister | Nike | Forever 21 |

| Reebok | Victoria's Secret | Puma | Gap |

| Puma | Adidas | Sketchers | Old Navy |

| Hollister | Under Armour | Hollister | Abercrombie & Fitch |

| Sketchers | Gap | Reebok | Aeropostale |

| Champion | Old Navy | Old Navy | Brandy Melville |

| Old Navy | Abercrombie & Fitch | Champion | Adidas |

Source: Piper Sandler

"It's not easy to stay in that position," said Hana Ben-Shabat, founder of research firm Gen Z Planet and author of the book "Gen Z 360: Preparing for the Inevitable change in Culture, Work, and Commerce." "You have a new generation, and you have a very different cultural context. Fashion can only exist in the cultural context that surrounds it."

Specialty brands, once considered a staple, are now staging a comeback in an attempt to lure the young consumer group that has ghosted them for trendier brands.

But the teens they're trying to attract now aren't the same ones they found popularity in, Ben-Shabat said.

"Gen Z, compared to other generations, are truly trendsetters," she said. "They, sometimes through their digital communities, create trends almost overnight."

Getting back in touch with the teen market

Over the years, key players such as Nike, American Eagle and PacSun have emerged as some of the most popular apparel brands for teens, according to Piper Sandler. Brands like Lululemon, Urban Outfitters and Shein have also gained traction in the teen market. As a result, some of the brands that lost market share have fine-tuned their image and product offerings to match the taste of younger consumers.

Gap launched a teen collection last year with sustainability as the collection's selling point, which taps into Gen Z's interest in making eco-friendly purchases. Despite years of decline, Gap recently found bright spots in its trajectory like its partnership with rapper Kanye West for a Yeezy Gap line, and in a year where consumers opted for comfortable clothing, Gap's hoodies found TikTok fame. The hashtag, #GapHoodie, currently has about 7.3 million views on the short-form video-sharing app.

After years of attempting to rebrand, Abercrombie & Fitch stores look much different from what they were back then. The stores are bright and its style has shifted away from its rebellious image. After years of being on the list of brands teens no longer use, Abercrombie didn't show up on that portion of Piper Sandler's fall 2021 survey.

"Certainly, with the more inclusive movement, the customer did not want to see objectified naked men and women. They wanted to see more people that represented who they are."

Kristin Kohler Burrows

Senior Director, Alvarez & Marsal Consumer and Retail Group

In its heyday, Abercrombie & Fitch stores were dark, and photos of half-naked models would be plastered on shopping bags, posters and products. The distinct smell of perfume would permeate the space.

"You would walk by them even outside, and you could smell it," Kristin Kohler Burrows, senior director of Alvarez & Marsal Consumer and Retail Group, recalled. "I mean, they would purposely have the door open."

Abercrombie's reputation suffered in the past through lawsuits for discriminating against a job applicant who wore a hijab and a transgender employee's firing. Abercrombie also closed the book on its oversexualized marketing strategy in 2015.

"I think with Abercrombie, they really just lost touch in terms of who the teen boy and the teen girl were and are," Burrows said. "Certainly, with the more inclusive movement, the customer did not want to see objectified naked men and women. They wanted to see more people that represented who they are."

Gen Z is a more racially and ethnically diverse group than previous generations, with 25% identifying as Hispanic, 14% as Black, 6% as Asian and 5% classify as another race or two or more races, the Pew Research Center reported in 2019. A slight majority (52%) are non-Hispanic white, significantly less than the 61% of millennials who identified as non-Hispanic white in the early 2000s.

Personalized, authentic connections with Gen Z

Express has also been testing out a new store concept that tailors its product assortment to resonate with the community it is located in, called Express Edit. The stores have offered personalized private styling appointments, a much smaller footprint than its mall-based locations and a merchandising strategy that grouped matching pieces together to make it easier for customers to create outfits.

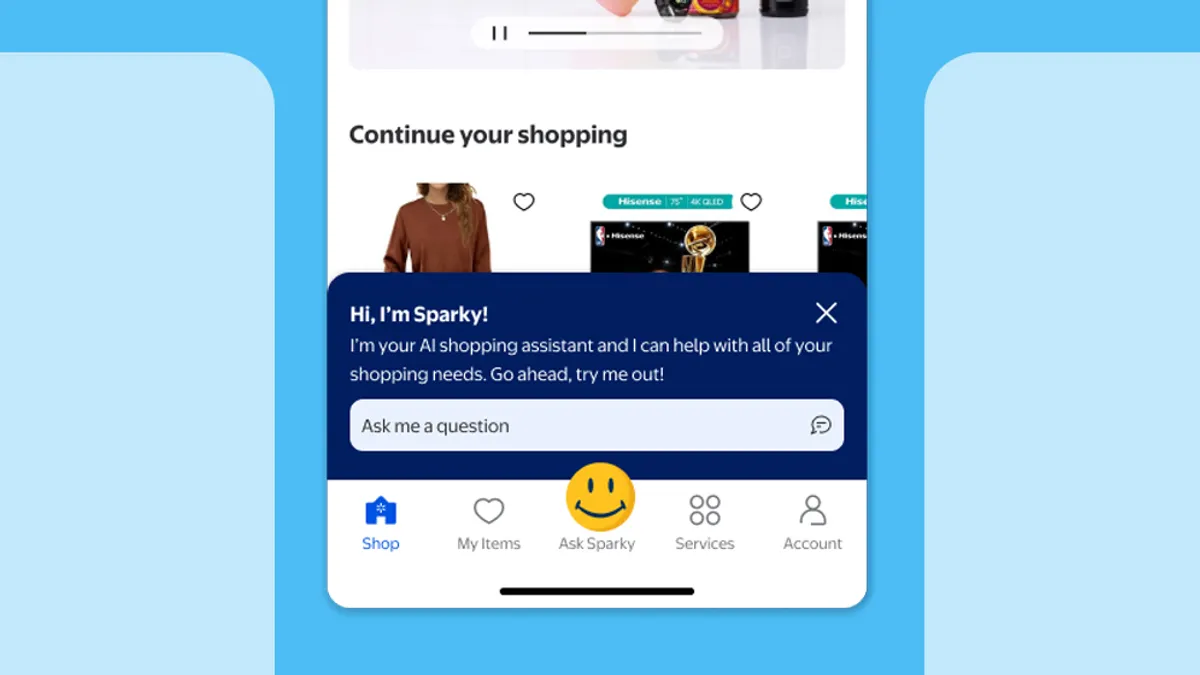

Brands that offer personalized shopping experiences, whether it be online or offline, tend to do well with Gen Zers, said Dara St. Louis, senior vice president and founding partner at Reach3 Insights. "They've only known marketing as being one-to-one marketing, so everything is on-demand."

Teens today are also increasingly becoming omnichannel shoppers, experts said.

"They're really a generation that is going to blend across those boundaries," Claire Tassin, retail and e-commerce analyst for Morning Consult, said about Gen Z's shopping habits. Though most Gen Zers discover products on social media, many still prefer to shop in person. "It does require an understanding of how to sort of work well within those different social platforms, knowing that millennials and Gen Z use socials a bit differently," she added.

That said, younger consumers are less tolerant of poor online experiences. So much so that it can cause brands to lose Gen Z consumers, with 38% saying they'll give a brand just one second chance before abandoning it for a rival, an April study from Sitecore found. When an item is out of stock online, 74% of survey respondents said they'll switch to a different retailer.

Retailers like American Eagle have taken advantage of the online discovery process through marketing campaigns on Snapchat and its collaboration with Twitch creators. Abercrombie-owned brand Hollister has an account on TikTok with over 600,000 followers called Tiny Jeans. Though the account doesn't necessarily advertise products, it engages with users by following TikTok trends and teaming up with influencers on the app like Charli and Dixie D'Amelio.

@tinyjeans Squad goals @charlidamelio @dixiedamelio. @Reply to @wowww.its.taylor #HollisterTinyJeans

♬ She Share Story (for Vlog) - 山口夕依

Trying to "meet the consumer where they're at" is one way brands can connect and form lasting relationships with teens, said Erinn Murphy, managing director and senior research analyst at Piper Sandler.

"These overdone models that are really an unattainable image — that is not an image that resonates with the consumers today," she said, adding that consumers connect more with brands like Aerie and Nike because of their inclusive messaging and their ability to take a stance on social issues, like women's rights and racial equality. For Nike in particular, "a lot of what we've seen out of the company in the last five to 10 years has just been their aggressive and accelerated ramp to getting closer to the consumer," Murphy said.

Brands hop on the #trending bandwagon

Back in the day, brands often dictated trends. Now the tables have turned.

"It's almost like they're reversing the way fashion was created before if you think about it," Gen Z Planet's Ben-Shabat said. "Sometimes you can dictate the trends, but sometimes you have to listen to the trends that are coming because they could be so widespread that not being part of it could mean that you're going to lose to whoever it is."

Geared with the power of social media and its digital communities, teens build trends almost as quickly as they hop on to another one, leaving brands struggling to keep up, she said.

When Gen Zers were stuck at home for quarantine last year, many romanticized the idea of living in the countryside, open spaces and having picnics while wearing long floral dresses. That longing gave birth to a trend many now know as "cottagecore," said Ben-Shabat.

On TikTok, #cottagecore currently has over 7.7 billion views. Brands that already have products that fit the cottagecore aesthetic benefited from this trend as TikTok creators showcase products from LoveShackFancy and Reformation. The "Strawberry Midi Dress" by Lirika Matoshi, which was plastered all over social media last year, falls precisely into this category.

Several brands have attempted to capitalize on this trend, Ben-Shabat said. Some going as far as selling nearly identical dresses to the famed strawberry dress.

"If you are a traditional brand and you see these trends going up on TikTok, what do you do?" she said. "Are you able to react to it quickly and bring products that fit into that?"

Cottagecore is far from the only trend or aesthetic that has a robust following from teens. There's dark academia, light academia, e-girl, angelcore and many others — all of which have very distinct styles of clothing and color palettes associated with them.

With all these trends popping up, Ben-Shabat and other experts warn brands against being inauthentic because teens can be vocal about calling out bluffs. Experts said brands don't have to hop on every trend if it doesn't fit their identity.

"If you are able to be there, to be on TikTok and pick up these trends in the beginning, you can actually take advantage of that and ride the wave as long as it lasts," Ben-Shabat said. "But usually it doesn't last for long."