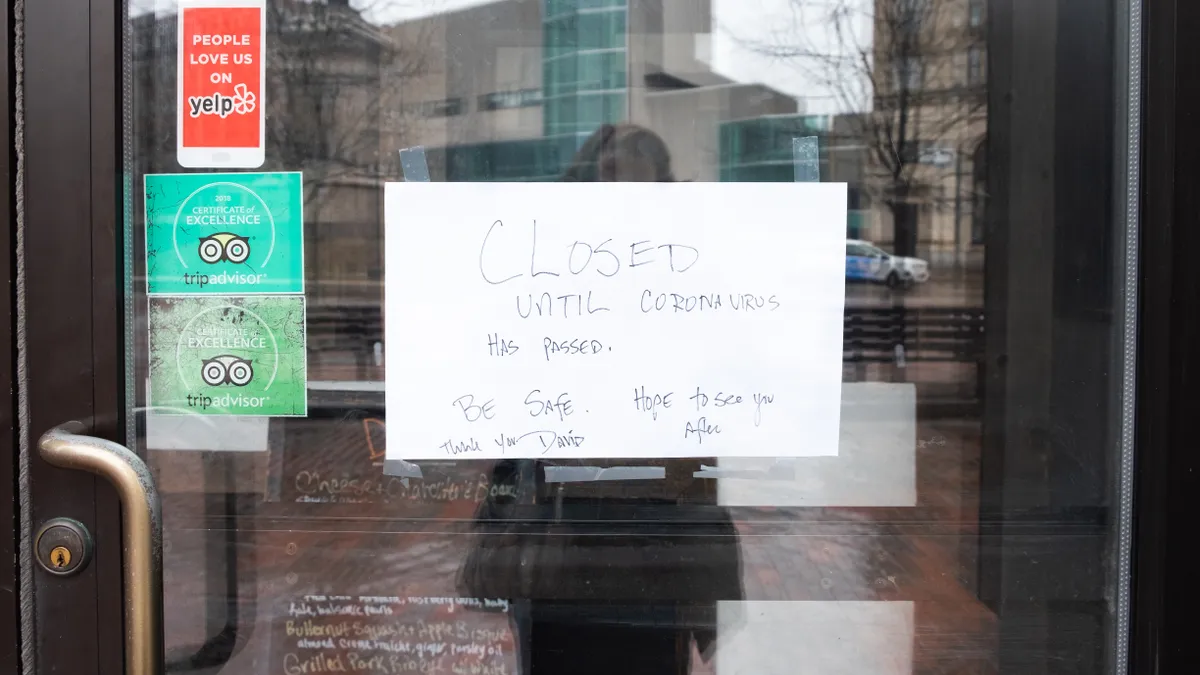

Across the U.S. this week, many thousands of stores and hundreds of malls lay dark, as the country tries to slow the spread of the novel coronavirus. Around 100 retailers have closed all or a significant fraction of their stores.

To state the obvious: American retail as we know it has never gone through an event like this, not at this scale or magnitude. That means the playbook is being written on the fly.

Even companies like J.C. Penney and Ascena, which are already in financial distress, are locking the doors and forgoing sales to try to mitigate against a pandemic that has killed close to 15,000 people worldwide and infected hundreds of thousands.

One thing all retailers making the decision to shutter have in common at the moment: Cash is of chief importance.

"At this point for retailers, it's not a matter of profit and loss — it's about the balance sheet," Joel Rampoldt, a managing director with consultancy AlixPartners, told Retail Dive in an interview.

He recommends retailers have a cash czar or war room scrutinizing every bill, every vendor contract and invoice, every rent payment — in other words, all cash moving in and out of the business. "You can go a long time without profit or even revenue. You can't go a single day without cash." He adds that any retailer that is "out of cash and out of ability to borrow is out of business."

Stockpiling cash

These days, as Rampoldt notes, retailers don't typically hold a lot of cash on their balance sheets. That has led several already to lean on their credit lines, which typically take the form of asset-based facilities.

Last week L Brands — in a press release announcing the temporary closure of all of its Bath & Body Works, Victoria's Secret and PINK stores — said that it had drawn nearly $1 billion from its secured revolver, giving it $2 billion in cash as it prepared to endure the closures.

Also last week, J.C. Penney made two draws totaling nearly $1.3 billion from its own revolving facility for working capital as it moved to close its stores, the department store retailer disclosed in a regulatory filing. Penney described the borrowing, which will cost the company up to 4% in interest, as "a precautionary measure to increase its cash position and preserve financial flexibility considering uncertainty in the U.S. and global markets resulting from COVID-19."

Ascena made a draw, too, taking out all it could under a credit facility agreement — $230 million — using similar language as Penney, saying it was "to increase its cash position and preserve financial flexibility in light of the current uncertainty in the global financial markets from the COVID-19 outbreak."

None of these retailers had banks of cash on hand to brace for their closures. Indeed, Penney and Ascena have both struggled with profit losses, and have been the subject of bankruptcy speculation (both have said they are not working on a filing).

These credit lines can be costly, in terms of fees and interest, but the need to maintain cash levels during the closures is immense. "This is exactly why you do that," Rampoldt said of retailers leaning on their asset-based loans. "You draw down revolvers to protect your liquidity."

Retailers in a tight spot

The problem is that retailers with falling sales and negative profits often rely on their revolvers to fund losses under normal circumstances. Now many are making big draws on asset-based credit lines to weather a period that will wipe out most of their sales for weeks.

"For some, like Nike and Apple, with extremely strong cash position, this is sustainable," Christa Hart, a senior managing director with FTI Consulting, said in an interview. For those stretched for cash, she adds, it could be a different story.

Last week, Cowen analysts led by Oliver Chen pointed out in a client note that retailers with higher leverage were more vulnerable to the effects of the closures. They cited specifically, among retailers they cover, J.C. Penney, L Brands and Gap Inc.

B. Riley FBR analysts, led by Susan Anderson, also looked last week at which retailers were the most and least vulnerable in terms of the liquidity to ride out the closures. The most stressed in terms of cash, they found, would be The Children's Place, which has liquidity to cover 15 weeks of closures, Tailored Brands (14 weeks) and Chico's (14 and a half weeks).

Those with the biggest liquidity cushion included Abercrombie & Fitch, American Eagle and Urban Outfitters, Anderson's team found.

Most retailers under Anderson's coverage "could manage a quarter of store shut down with the current liquidity; however, this would stretch many companies of all their liquidity," she said in a note.

Profits as 'irrelevant'

By their nature, brick-and-mortar retailers have large fixed-cost structures that don't go away when the stores are closed. That is one of the reasons, "you've seen a lot of bankruptcies among retailers with large store networks — they're very sensitive to sales declines," FTI's Hart said.

Retailers will have to review their vendor contracts and other expenses. Even whether to pay rent, another fixed cost, may be up for negotiation as retailers try to weather the shutdowns.

Many retailers have said they are going to pay their store workers through the closures, while others have defined a period of time — for example, two weeks — during which they will continue paying workers. But paying hourly workers, whose schedules can vary week to week, through a closure is not necessarily a straightforward task. And some might well decide to furlough corporate and/or store staff.

Among the first to publicly say it would do so is Pier 1, which is currently in Chapter 11 and seeking to sell itself. On Tuesday it announced it would furlough 65% of its home office and some store associates, after previously announcing it would close its stores temporarily. Staff and executives Pier 1 is retaining will take a pay cut. The home goods and decor retailer's stated aim is to "preserve liquidity and mitigate the financial impact of the COVID-19 pandemic."

One way or another, retailers are in for a major hit to their sales and bottom lines. Chen's team said last week that retailers they cover — which include J.C. Penney, Gap, Macy's and Kohl's, among several others — could see 50% of their earnings for the entire year wiped out from massive sales declines in March and April, as the industry locks up its shops.

As retailers try to maintain cash, the Cowen analysts said that retailers may cut their dividends to shareholders, draw on their revolvers and pull back on investments. The day after the Cowen note was released, Macy's announced that it was doing all of those things.

"[W]e are now operating in an environment with a high degree of uncertainty," Macy's CEO Jeff Gennette said in a statement. "The actions we are announcing today give us additional financial flexibility to address the disruption we are seeing in our business, which we anticipate will continue into the foreseeable future."

Matt Garfield, a managing director with FTI consulting, told Retail Dive that he expects retailers generally to start focusing on cost containment as they move through this period. That could include a pullback on IT projects and capital investment, he said.

But those moves are geared to preserve cash, not profits. "P&L structure, cost structure, are almost irrelevant," Rampoldt said.

All that matters is cash and liquidity. The mindset change, to some degree, could outlast the closures. "A reasonable conjecture is that, coming out of this year, you're going to see liquidity being a much bigger focus for retailers," Rampoldt said.

The era of private equity deals and layering leverage onto retailers could be over, for good, or at least for a while. "I wouldn't be surprised if we swing back to the other pole," with retailers "very focused on paying down debt, reducing leverage, improving their credit and cash reserves," Rampoldt said.

Unlocking the doors

Operationally, there is a lot going on behind the scenes as retailers go through the physical motions of closing their stores.

Garfield said that loss prevention is a key priority as retailers shut down storefronts. Planning and supply chain, which just went through major disruptions and could face more depending on how long the crisis lasts, are also top priorities.

As for stores themselves, the human impact of the shutdowns and the pandemic is front and center. "The first thing on everyone's mind is always going to be safety," Rampoldt said. Retailers have to account for employees and their health and be able to reach them when it's time to re-open.

Hart said that human resource directors and CEOs fill the most important roles at the moment as they engage employees during a shutdown. And those employees may or may not receive full pay for the duration of the shutdown. If those employees are furloughed, they may well seek income anywhere else they can find it in the meantime.

"It's possible you're ready to open the store and you've got no one to turn the key and unlock the door," she said.