Dive Brief:

-

Harry’s is letting the lease on its "Corner Shop" in New York City’s SoHo neighborhood expire, effectively shuttering the popular barbershop and retail location on March 2, sources told Lean Luxe.

-

The razor startup Feb. 15 collected $112 million in a Series D funding round, according to Pitchbook, bringing its total raised from its 19 investors to $474.5 million.

-

The razor subscription service in 2016 began selling its wares through Target and recently began selling through Walmart too. Harry’s didn’t immediately return Retail Dive’s request for confirmation or comment on the shuttering of its New York City shop.

Dive Insight:

Harry’s move to let go of its quaint barbershop may be more a sign of its success and its ambitions than of any softness in demand for its products, according to speculation from Lean Luxe’s M. Paul Munford.

Setting aside the fact that SoHo rents have skyrocketed, a barbershop is quite a different enterprise than a retail or subscription service, both of which face their own set of challenges. The company has garnered significant backing from investors, but it's still in growth mode and faces steep competition from rivals and the complications of subscription services, which suffer from a high rate of churn.

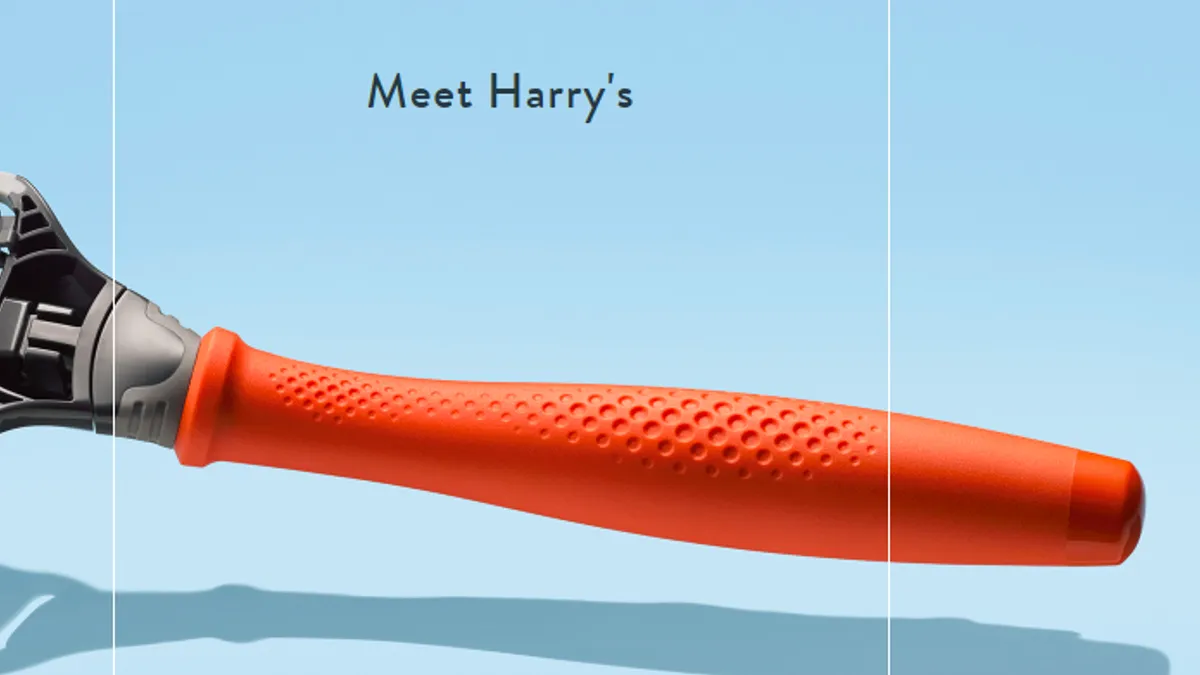

Harry’s was co-founded in 2013 by a Warby Parker founder and, like Dollar Shave Club, took advantage of consumers’ frustration with the expense of drugstore razor offerings to go direct to the consumer, complete with a replenishment program.

But it isn't all smooth sailing. Around the time the startup announced its partnership with Target, for example, consumer products giant Unilever acquired rival grooming startup Dollar Shave Club for a reported $1 billion in cash, meaning that its major competitor has been enjoying the deep pockets of its parent. And Gillette, loathe to be disrupted too easily, has launched its own replenishment service.

"When Dollar Shave Club first launched in 2012, the direct-to-consumer subscription model quickly garnered attention by offering an innovative model that promised a higher level of brand engagement, curated offerings and competitive pricing," Luke Starbuck, vice president of marketing at customer care automation firm Linc, told Retail Dive in an email last year. "When Unilever acquired Dollar Shave Club, it gained access to a large amount of consumer data that not only provided insights on their customers, but it also furthered the CPG’s direct connection to them."