Dive Brief:

-

GOAT Group, a sneaker, apparel and accessories marketplace, has raised $195 million in a Series F funding round led by Park West Asset Management, according to a Thursday press release emailed to Retail Dive. The funding round brings the company's valuation to $3.7 billion, more than double its previous $1.8 billion valuation reached during a September 2020 funding round, per the announcement.

-

The company said it would use the funds toward growing its sneaker, accessories and clothing verticals, while also expanding its international footprint. The startup wants to increase its international footprint with new facilities in Chicago, Japan, China and Singapore.

-

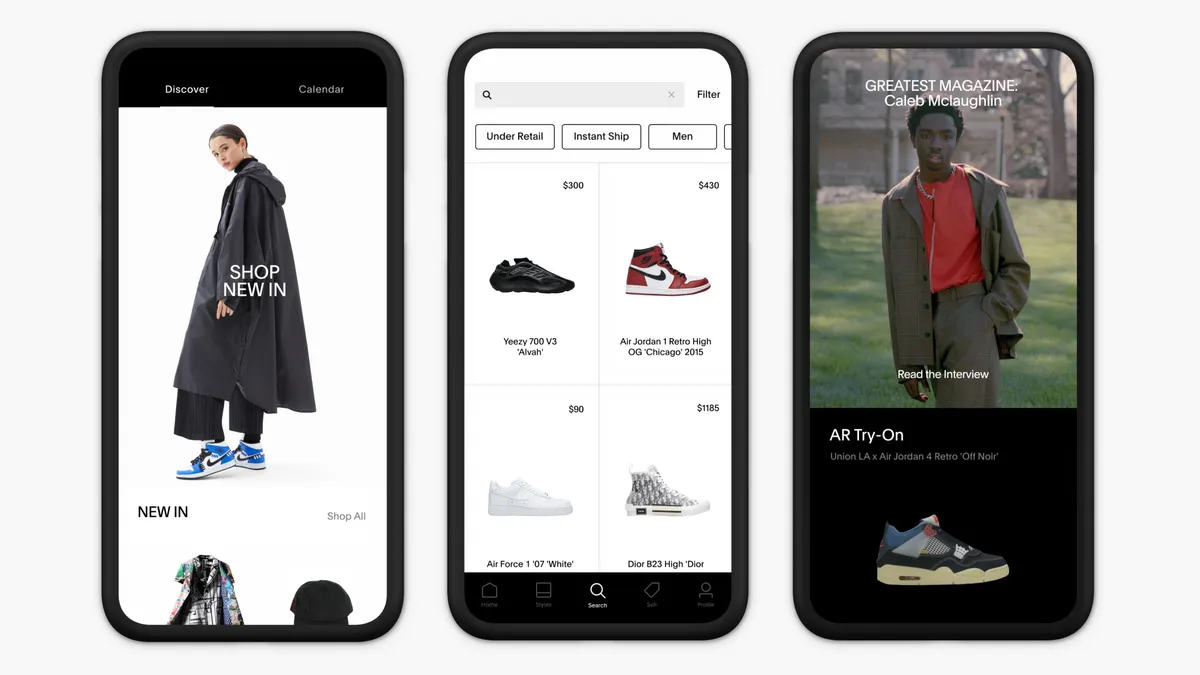

The startup also intends to use the capital to improve its technology and branding to better serve its 600,000 sellers and 30 million members.

Dive Insight:

Since GOAT added clothing and accessories to its selection in 2019, the business has seen sizable growth. The startup noted that the company reached $2 billion in gross merchandise volume in the past 12 months. Its sneakers and apparel verticals have also each grown 100% and 500% year over year, respectively.

"GOAT's growth is accelerating across every channel and category due to the powerful global technology platform we have developed and the premier customer experience we deliver, which resonates with younger consumers around the world," Eddy Lu, co-founder and CEO of GOAT Group, said in a statement.

In early 2019, Foot Locker invested $100 million into GOAT. At that time, a spokesperson for GOAT noted that Foot Locker's investment was the largest to-date in the secondary sneaker market.

As GOAT raises funding to step up its resale platform, eBay has also sought to build trust among sneakerheads. Last October, the online marketplace veteran announced that it would verify sneakers valued at $100 or more as part of its Authenticity Guarantee program. At the time, the platform said it had more than half a million sneaker listings every day.