Foot Locker unveiled a new loyalty program on Tuesday as it plots a turnaround course under CEO Mary Dillon, who is still relatively young in her tenure at the company.

The refreshed FLX Rewards program comes as the athletics retailer is in the midst of a larger overhaul of its business, including much of its customer experience. That ranges from store revamps for the majority of its fleet and new store concept launches to various website improvements and a new mobile app, which will launch later this year.

“Kind of grounding in Mary's lace-up plan overall for the business is this fundamental idea of being more customer-led as an organization,” Chief Customer Officer Kim Waldmann said, noting that the retailer took an eye to its existing loyalty program through that lens. “What we found was, it was really engaging our sneakerhead-type consumer, who was excited about product heat and launches, but we had an opportunity to really democratize the program and provide value to more consumer segments.”

Key to doing that is the new FLX Cash benefit, which allows shoppers to redeem points for discounts of $5, $10 or $20. Members of the loyalty program earn 100 points for every dollar spent. Foot Locker also introduced free returns as part of the relaunch, in addition to the existing benefit of free shipping with no minimum order. Some of these more value-oriented perks appeal to the average consumer more than the sneakerhead, and lead to higher wallet share, according to Waldmann.

Already, the company is aiming for 50% loyalty penetration by 2026, and in the future, it hopes to hit 70%, per a company press release.

“What we have seen in the pilot is even if they're redeeming cash back, that means that they're spending more frequently and consolidating their share of wallet with us, and so ultimately, it's incremental,” Waldmann said.

She noted that a pilot of the loyalty program in Canada saw customers shopping with Foot Locker more often and buying more when they did. And although a key goal of the program is to bring in more of your average consumer, Foot Locker is also introducing features geared at its sneaker-loving fan base.

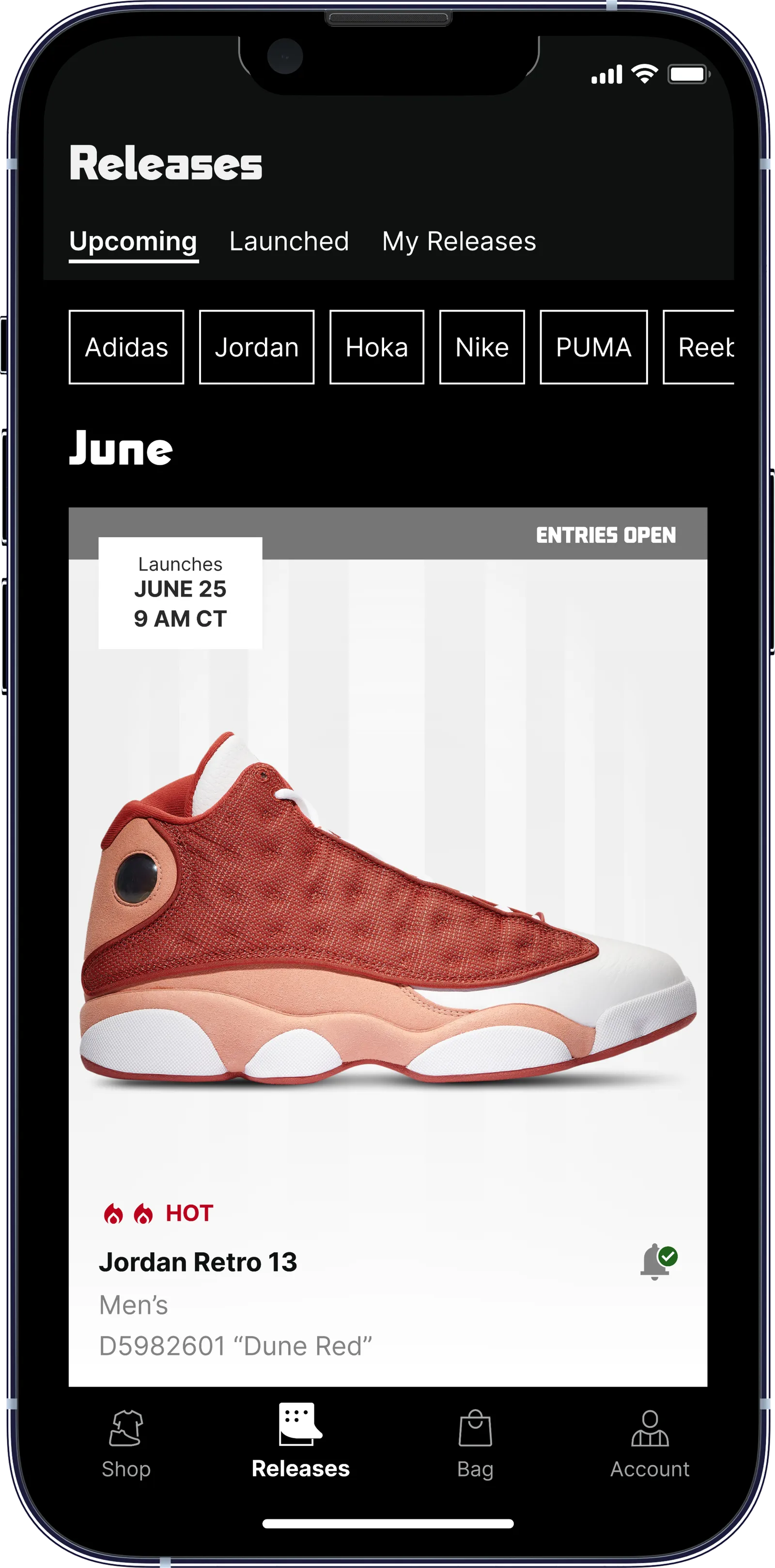

For example, another use of loyalty points is to cash them in for an extra shot at getting access to new sneaker drops. Similar to buying multiple raffle tickets, purchasing an “extra boost,” as Waldmann calls them, ups your chances of getting selected.

“And that obviously matters a ton to get those Jordan Retro 4’s or whatever the high heat product at the moment is,” Waldmann said. “Some are really going to value that, and some are just going to value the ability to get rewarded financially for the more that they spend with us over time.”

The FLX program will also feature members-only sales events and one-off giveaways like the chance to win sneakers for a year.

When Foot Locker’s new mobile app launches later this year, it will be closely tied to the loyalty program, with a hub where shoppers can view points, rewards and scan their loyalty card in stores. The app will also include a “heat monitor” to tell shoppers how hot a product drop is likely to be — for example, just “hot” or “atomic.” The idea behind that is to give customers a sense of how many points they should put toward an upcoming drop, according to Waldmann.

A “Store Mode” feature will allow shoppers to scan products in a given Foot Locker store and see what the retailer has in their size. When asked if a store associate will still have to go retrieve those products for shoppers, Waldmann said they weren’t sharing that information yet.

Looking ahead, Foot Locker plans to invest in personalization based on the data it receives from the loyalty program. That could mean more targeted marketing to different consumer segments, as well as more data insights for brand partners, like Nike. Nike has shown an interest in sharing data with its wholesale partners in the past, including by tying its loyalty program to Dick’s Sporting Goods in 2021 and launching a similar effort with Hibbett two years later.

When asked if that’s in the future for Foot Locker, Waldmann said Nike is “super excited” about Foot Locker’s loyalty program, “in terms of consumer engagement, but also the value that it brings back to them in terms of access and personalization. We're both very focused on getting this out the door and then we obviously always have conversations about what the future looks like and how we can integrate more deeply together.”

For Foot Locker, the loyalty program revamp and soon-to-drop mobile app represent another ticked box on a long list of turnaround priorities, and hopefully — a base to build upon next year.

“We're setting the foundation on all of these pillars this year,” Waldmann said, “and then we'll continue to build on them to deliver a great experience in the future.”