Department stores have been faltering for some time now — and according to a recent report from Moody's Investor Services, will continue to suffer in the near future. Even when some of these retailers notch positive comps, it's miniscule when compared to others in the industry.

That's not to say retailers haven't made significant efforts to adjust their approach with changing customer needs.

A little over a year ago, Macy's developed a new pop-up store concept called The Market @ Macy's, giving digitally native brands a "turnkey solution" to help break into brick and mortar. And shortly after in May, it acquired Story, an experiential store that reimagines itself every four to eight weeks, which operates a much smaller footprint than the retailer's traditional stores. And to further scale its pop-up concept stores, Macy's partnered and invested in b8ta last June.

Macy's isn't the only player ramping up its game. Nordstrom developed its own concept store, Nordstrom Local, which took a page from showrooming. Barneys New York is looking to modernize its approach and appeal to a broader audience in a more unique way: Last week the department store opened The High End, a concept shop selling cannabis products. And Neighborhood Goods, a newer face in the space, recently raised $8.8 million and announced plans to open a store in New York City.

But will a facelift do the trick to entice shoppers back into department stores, or do the problems run much deeper?

The discussion forum on RetailWire asked its BrainTrust panel of retail experts the following questions:

- Do you think the changes being made by Macy's and Nordstrom indicate a brighter future for department stores or do these retailers and others still have a way to go in establishing relevancy with consumers?

- What do you think department stores will look like in 10 years?

Here are eight of the most insightful comments from the discussion. Comments have been edited by Retail Dive for length and clarity.

1. Department stores will be more specialized in the future

Mark Ryski , Founder, CEO & Author, HeadCount Corporation: Making department stores relevant again is tantamount to changing a jet engine while the plane is flying. These are large enterprises, weighted down by legacy systems and capital constraints. Unfortunately, everything department store operators do seems like incrementalism in the big scheme of things – when disruption is what's needed. I do believe department stores will be around in 10 years, but they will be smaller, more specialized and fewer in number.

2. Focus on multi-channel and mobile shopping

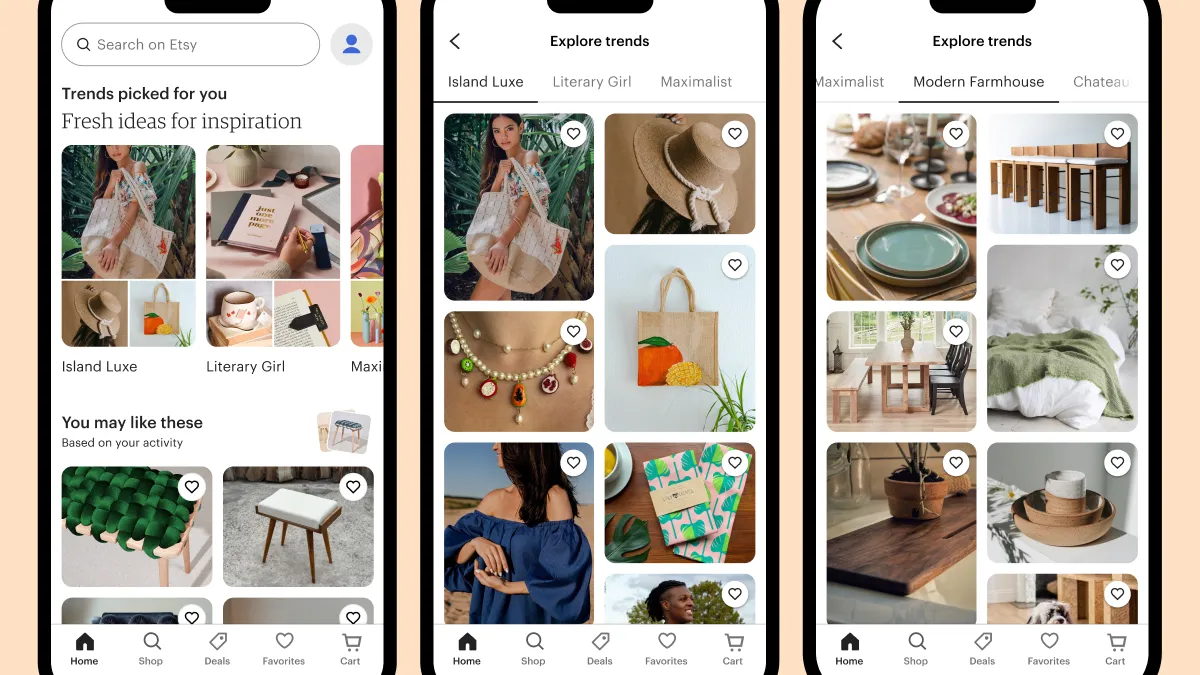

Min-Jee Hwang, Director of Marketing, Wiser Solutions: Much of the conversation around department stores has focused on the customer experience, which aligns with the efforts put forth by Macy's and Nordstrom. If department stores want to remain successful, they need to continue to create engaging, effective, and enjoyable customer experiences and focus on multi-channel, app-centric shopping.

3. Change is the only constant you can count on

Charles Dimov, Vice President of Marketing, OrderDynamics: Most important is the fact that Macy's and Nordstrom are working on becoming more nimble and driving change. Change is the only constant in retail that you can count on. That means testing new radical ideas, like a fast pop-up store, new app, or other experiential service. Continually adapting, learning and improving is the only way to stay relevant in retail.

First, omnichannel will take on a whole new meaning. It will be about the store that drives to my location (self-driving small stores), showrooms that come to me, high-end AR/VR locations, and back-end systems that track every detail about a customer, their buying journey and their habits.

4. Department stores need to be radical

Neil Saunders, Managing Director, GlobalData: It's good to see Macy's talking a good game, but the reality on the ground in most stores is entirely different: they are dull, uninspiring, uncared for and a mess. That's just not going to cut it. Nordstrom is in a different place. It suffers from the structural change in the sector but, by and large, it still gets the basics right and has successfully moved into off-price and is trying new formats.

In my view, for department stores to survive they need to be radical. They need to completely reinvent the shopping experience, including adding more services alongside their goods, especially in foodservice. They need to develop their own exclusive brands – and these need to be compelling. They need to partner with niche players to create unique experiences. And they need to right-size the amount of space they have, which includes developing a more flexible store format model so they can operate smaller stores in locations that don't justify a full-line outlet. Most of all they need to invest in stores, customer service, and the general proposition.

There is a lot on the to-do list, but all of it is necessary to ensure long-term survival!

5. These things won't help the consumer who visits the department store

Georganne Bender, Consumer Anthropologist, KIZER & BENDER Speaking: Acting smaller and becoming more nimble I get, but an app is not a store window and a place that only offers services is not a store.

I was heavy into a store remodel the week of ShopTalk so I didn't get to hear the speakers, but I do know that a department store is too big when it doesn't have enough salespeople to help shoppers, and that when your store becomes a giant box filled with stale product and uninspired merchandising it's time to change. I applaud the smaller, standalone things Macy's and Nordstrom are doing to move forward, but those things are not helping customers who visit the actual department stores. What's the plan to change the shopper experience in those physical spaces? No one seems to be talking much about that.

6. Be nimble and adaptable

Camille Schuster, PhD., President, Global Collaborations: Being nimble, experimenting, and constantly changing are requirements for today's marketplace. There is no one formula for success. There is no formula that will work for a long time. With experimentation that occurs often and quickly, retailers can identify changing consumer trends, different geographic preferences, technology use, and respond accordingly. Creating pop-up stores to do this is relatively easy. For success across established stores, purchasing, logistics, and marketing departments need to be nimble and adaptable to capitalize and adapt to changes.

7. Department stores have no place in consumers' lives

Doug Garnett, President, Protonik: I'm not hopeful for the broad "department store" model. And although Nordstrom is technically categorized as a department store, in my customer mind they are a large high end clothing store — that's a separate thing.

So why not department stores? Over the past 20 years consumers have voted with their money for one of two alternatives to department stores: Specialty stores (most off-mall) like Old Navy or Melvyn's Or Kohl's or Bed, Bath & Beyond or cooking stores — OR they've shifted to low-touch bulk discount like Costco for vacuums, appliances, and more.

That means the department store has no key place in customer lives. Is Macy's, like Nordstrom, a big clothing store? If so, then they need to radically dash after that model.

Truth is, I do believe the "department store" is dead — but these retailers can find life if they accept that idea and sort out a place they can fit in customers' shopping lives.

8. These stores need a clean slate

Lee Peterson, EVP Brand, Strategy & Design, WD Partners: We just did a study on this and the answer for D stores and retail spaces in general was a complete re-think. Consumers wanted to see grocery stores, food halls, fitness centers, co-work spaces, health centers, beauty mega stores (you know, relevant retail) vs apparel, apparel, apparel. It was pretty clear: the space needs a clean slate and needs to understand that Story alone, is about 1% of the solve.