Dive Brief:

- Amazon made its second appearance at the Interactive Advertising Bureau’s NewFronts Tuesday with a showcase focused on three areas of its video business: ad-supported streamer Freevee, livestreaming platform Twitch and the streaming rights to NFL Thursday Night Football, which go into effect next season.

- Freevee, recently rebranded from IMDb TV, is expanding its content slate and experimenting with new methods of advertiser integration. Both Prime Video and Freevee originals are beta-testing a Virtual Product Placement tool that can drop approved brands into programming on a plug-and-play basis after filming has wrapped.

- Amazon is promising viewers and advertisers additional layers of interactivity for Thursday Night Football as well, such as dynamic stat displays, an X-ray feature, Twitch integrations and a new tool that creates ultra-low latency for live broadcasts. Finally, Twitch is introducing fresh ways to connect with creators through its owned channels and features like Drops, a popular method of rewarding viewers.

Dive Insight:

With its second go at the NewFronts, Amazon emphasized how its video offerings are implementing more advanced technology that could benefit advertisers and content creators seeking an enhanced streaming experience. The showcase for brands and media buyers was in person after being held virtually in 2021 due to COVID-19 precautions.

Virtual Product Placement could be of particular interest, as Prime Video is a major streaming destination but doesn’t support traditional ads. Product placement deals have historically been limited to whatever advertisers had an agreement locked in place prior to shooting. With Virtual Product Placement, brands can insert themselves into shows even after filming ends, opening greater flexibility.

Prime Video and Freevee originals “Reacher,” “Jack Ryan,” “Bosch: Legacy,” “Making the Cut” and “Leverage: Redemption” are already using Virtual Product Placement. A packaged goods brand saw a 6.9% increase in brand favorability and a 14.7% lift in purchase intent for a campaign with Virtual Product Placement, Amazon said. In an example highlighted by the company, a bowl on an office table in a “Bosch” episode has bags of M&Ms in it thanks to Virtual Product Placement.

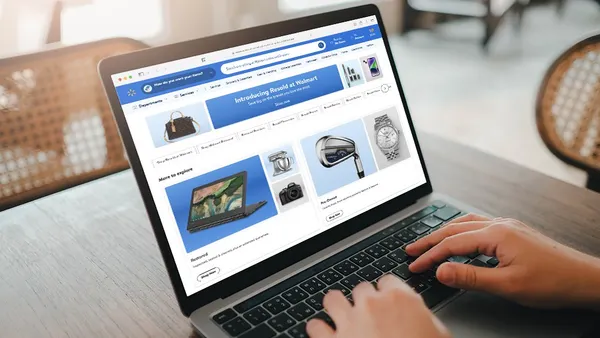

Freevee, which rebranded from IMDb TV earlier this month, remains a dark horse in Amazon’s roster, though an increasingly central part of its pitch to advertisers. The name change is intended to bring more clarity to its positioning around offering free-but-premium streaming content. With the rebranding announcement, Amazon said it planned to grow Freevee’s originals slate by 70%. It’s also pushing for more short-term licensed content, including through a new deal with Disney Media & Entertainment Distribution for a selection of titles such as the “Deadpool” movies, “Hidden Figures” and “Logan.”

Twitch also continues to be a powerful platform driving Amazon’s ad business. Amazon is expanding how brands can capitalize on the connection between influencers and the communities that follow them on the service. Twitch Drops — an existing feature where viewers earn in-game rewards for watching streams — is adding a sponsored element with Co-Op Drops, which allows brands to present those rewards. Adobe tested the product in March through a series of sponsored streams with six Twitch creators.

Twitch is also rolling out a For Twitch, With Twitch program that carries curated creator-driven content aimed at helping brands better connect with Twitch viewers. Content is drawn form Twitch-owned channels like TwitchRivals, TwitchSports and TwitchGaming. One show called out was “POG Picks,” an interactive game show with live shopping elements.

A deeper set of community-building tools for advertisers arrives as Amazon could be planning big changes for creators. Bloomberg recently reported that the platform is weighing policies that would incentivize creators to run more ads and adjust the revenue cut top streamers receive from subscriptions.

Elsewhere, Amazon is attempting to round out its advertising suite. It’s putting out a Streaming TV Media Planner that allows brands to track incremental reach via Amazon Ads and compare their results to linear channels. Another product in beta, Omnichannel Metrics, tries to enable in-flight campaign optimization, while an Amazon Brand Lift capability assesses campaign impact based on metrics like awareness and purchase intent.