Dive Brief:

-

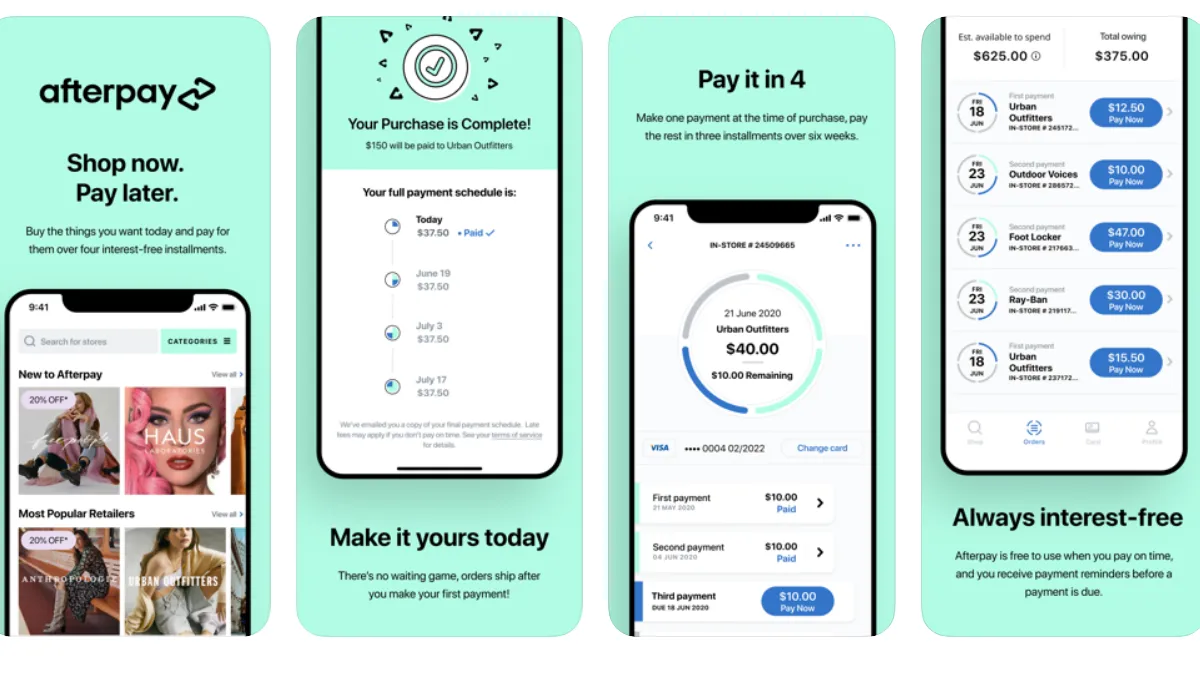

Afterpay's U.S. customers can now make purchases in select retail stores using a virtual, contactless card stored within their digital wallet, according to a company announcement.

-

When completing a transaction, customers can tap the card icon in their Afterpay app to activate the digital wallet card and complete purchases through Google Pay or Apple Pay. From there, customers can pay down their purchases in four installments without paying interest, taking out a loan or incurring other upfront fees, the company said.

-

According to its internal data, merchants who use its technology have seen a three-fold increase in average order values and a two-fold increase in units per transaction.

Dive Insight:

Afterpay's introduction of its mobile wallet feature heats up the installment payment race. Earlier this month, Macy's announced a five-year deal with Klarna to provide Macy's customers with four interest-free installment payments on their purchases. Over the summer, Klarna reached nearly 8 million U.S. customers, debuted a loyalty program and introduced in-store payments through Google Pay.

Other companies have also been partnering with installment payments firms or rolling out the offering themselves. In May, Shopify released an installment payments feature for customers as well as other money management features for merchants. Meanwhile, Mastercard partnered with Splitit to offer installment payments for Mastercard both in stores and online.

Afterpay's CEO and co-founder Nick Molnar noted that the company's new mobile wallet feature lets consumers access its service in stores without requiring retailers to incur additional setup and integration costs. The payments platform is available at retailers like Forever 21, Skechers, Finish Line and some DSW stores, per the company statement. Over the years, the company has added to its roster, including Rebecca Minkoff, Ray-Ban and Tarte Cosmetics, among others.

Venmo recently launched its own credit card and started issuing them to select customers earlier this month. And in early August, Venmo and PayPal entered a deal with CVS to integrate its payment QR codes at the retailer's checkouts across the country.