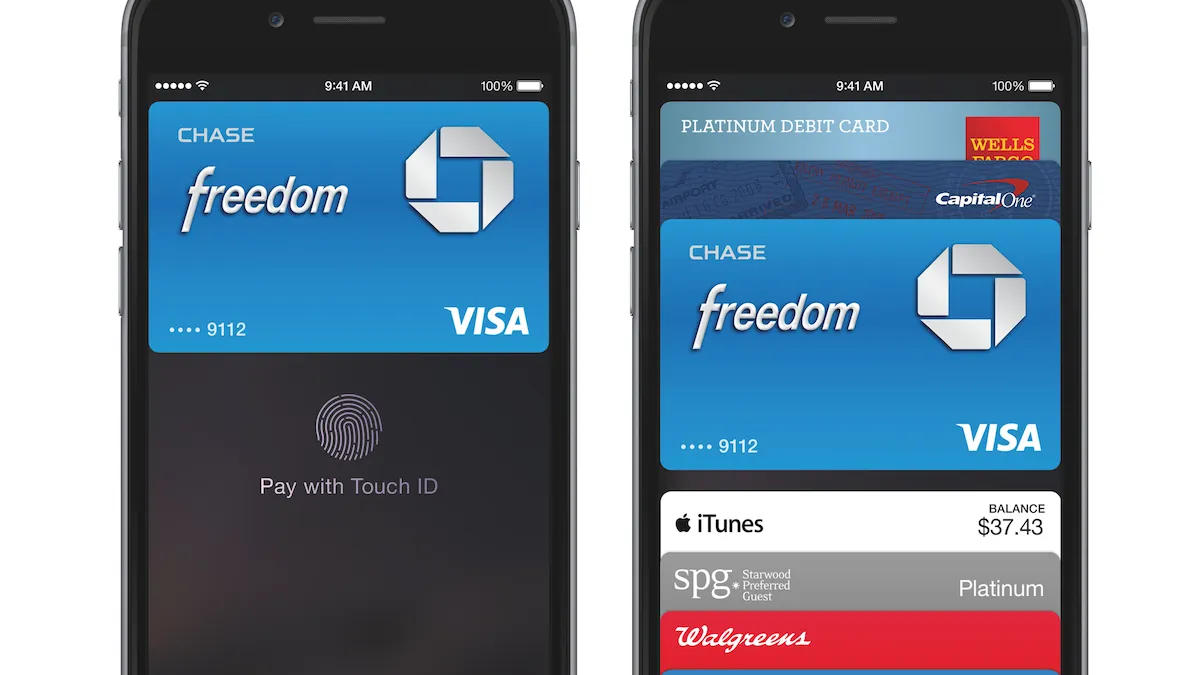

It’s been little more than a year since the world’s biggest smartphone provider debuted its mobile wallet. Consumers registered more than 1 million credit cards on Apple Pay in its first three days of release, fast making it the largest mobile payment system in existence and building awareness of mobile payments among everyday conusmers.

“Without question, any time the company with almost half of all smartphone users in the U.S. promotes a new standard, it has to have an effect,” Srii Srinivasan, founder of Dallas-based Chargeback Gurus, told Retail Dive.

But a year after Apple opened contactless mobile payments to tens of millions of new users, mobile payments have a long way to go. Mobile payments in the U.S. will reach $142 billion by 2019, according to Forrester Research, up from $52 billion in 2014. It’s a healthy pace, but not exactly at the tipping point that industry watchers expected after Apple Pay’s debut last year.

Where Apple Pay stands

Apple Pay does have the biggest slice of the growing mobile payments pie. It will be accepted at 1.5 million locations in the United States by the end of 2015, and it already handles about two-thirds of all contactless payments.

Apple Pay is now used by 14% of households with eligible credit cards, Greg Weed, Phoenix Marketing’s director of Card Performance Research, told the Money 20/20 convention in Las Vegas last month. But adoption rates are slowing: Apple Pay reached 11% of eligible households in its first four months and has only expanded penetration to 14%, in spite of the release of the iPhone 6s.

According to PYMNTS.com’s Apple Pay Adoption Tracker, only 16.6% of the 55 million iPhone 6 and 6s users in the United States had tried the mobile wallet as of October 2015, or about 2.8 million people nationwide. Just 5.1% of all eligible mobile transactions were paid using Apple Pay.

Asked why they didn’t use Apple Pay for an eligible purchase, almost a third (30.1%) of customers either forgot to do so or didn’t know the system was available. Those who did use Apple Pay said they appreciated its speed, security, and convenience. For ease of use, the survey respondents said Apple Pay trumps other forms of payment 47% of the time.

Apple Pay is strong among the Gen X demographic, whose members made up nearly half (48%) of users at the start of the fourth quarter, with millennials making up much of the rest. Early adopters are eager to pick a system, too: By September, 79% of Apple Pay users said they used iPhones and Apple Watches for all contactless card payments.

EMV conversion comes first

While its consumers are eager adopters of new gadgets, the United States has historically been slow to implement systems on an institutional level. Mobile wallet functions have been used in Asian countries for several years, including Japan, where people use their phones to pay for subway rides and vending machines.

Many mobile wallet systems including Apple Pay are depending on sellers to update their payment technology. “[A] mobile wallet requires retailers to switch payment terminals to accept the new technology, and customers willing to use it,” Srinivasan says. “It becomes a bit of a chicken-and-egg situation.”

Slow EMV conversion has thwarted next-generation systems. “Though it’s clear that consumers are aware that they can make payments through their phones, continued use of existing payment methods and slow retail adoption of modern card readers have caused usage levels to remain stagnant over the last year,” Robert Flynn, managing director of Accenture Payment Services in North America told PYMNTS.com.

Ironically, EMV conversion may ultimately encourage more customers to store card information in their phones by making in-person payments more difficult. Chip-and-PIN cards are slowing checkout this season as U.S. customers learn to use them, and mobile wallets may help ease the friction.

New wallets on the way

Companies such as PayPal and Softcard explored mobile wallet offerings early on, but weren't successful in presenting consumers with the conveniences they needed to use any system consistently. Apple Pay has inspired other companies to stake claims to the mobile market, however—and competition could go a long way toward finding the one system consumers embrace.

Available on three-quarters of mobile devices shipped in the second quarter, Android Pay will be soon be usable in more places than Apple Pay, and may improve upon security. Google’s system has competitors within its own OS, however, including Samsung Pay and a service rumored to be on the way from handset manufacturer LG.

Launched Sept. 28, 2015, Samsung Pay has one advantage that encourages adoption and use. In addition to enabling contactless transactions with near-field communication (NFC) technology similar to Apple Pay, it also offers Magnetic Secure Transmission (MST) technology to convey magnetic-stripe card information wirelessly to the terminals already in use at the vast majority of U.S. retailers.

Banks get into the game

While Apple has forged partnerships with more than 600 banks and credit unions, its most formidable competition may be the banks themselves. By the end of last year, more than 50% of smartphone users with bank accounts had used a mobile banking app, says a Federal Reserve survey, and 22% had made a payment with their phones.

Capital One launched a tap-to-pay service for Android devices, Capital One Wallet, in September, and quickly racked up more than 1 million downloads. “It’s a race for enrollment between banks and retailers and new entrants like Google,” Richard Crone, chief executive of researcher Crone Consulting, LLC, told Bloomberg. “The sleeping giant here has been the financial institution.”

JPMorgan Chase recently announced it would partner with the Merchant Customer Exchange (MCX) consortium on a mobile wallet that generates QR codes for payments rather than using NFC or other wireless methods. While unlikely to simplify the payment process, the system would help consumers consolidate finances in their smartphones.

Processing 34 million transactions daily, Chase hopes that its position as a repository of money will give it an edge in the market. “Banks are still considered institutions of trust for consumers,” Srinivasan says. “Consumers may be more willing to adopt a mobile wallet backed by one of the big banks than a tech company known for its consumer electronics.”

Ultimately, competition and an expanding array of use cases will help speed adoption, she adds. “Certainly, awareness of mobile wallets has grown. With the promotion of Apple Pay, it acts as a market signal to all the major players: ‘The water is great, jump on in.’ Ultimately, the market will decide who has the best strategy, not the pundits. The market always crowns a winner.”